Bitcoin (BTC) bắt đầu tuần thứ hai của tháng Hai trong tâm lý mới giảm khi mức cao trong nhiều tháng không giữ được.

Trong những gì có thể mang lại sự chứng thực cho những người dự đoán giá BTC tăng mạnh, BTC/USD đã trở lại dưới $23,000 và làm cho mức thấp hơn trên khung thời gian 1 giờ.

Feb. 6 trading may not yet be underway in Europe or the United States, but Asian markets are already falling and the U.S. dollar gaining — potential further hurdles for Bitcoin bulls to overcome.

Với một số dữ liệu kinh tế vĩ mô đến từ Cục Dự trữ Liên bang trong tuần này, sự chú ý chủ yếu tập trung vào kiểm tra lạm phát trong tuần tới dưới dạng Chỉ số Giá tiêu dùng (CPI) cho tháng Một.

Trong quá trình xây dựng cho sự kiện này, kết quả của nó đã được tranh cãi nóng bỏng, biến động có thể đạt được một chỗ đứng mới trên các tài sản rủi ro.

Thêm vào đó những lo ngại nói trên rằng Bitcoin đã quá hạn một sự rút lui đáng kể hơn so với những tuần gần đây, và công thức là có cho các điều kiện giao dịch khó khăn, nhưng có khả năng sinh lợi.

Cointelegraph xem xét tình trạng chơi trên Bitcoin tuần này và xem xét các yếu tố đang diễn ra trong việc di chuyển thị trường.

Giá BTC thất vọng khi đóng cửa hàng tuần

Nó là rất nhiều một câu chuyện về hai Bitcoins khi nói đến việc phân tích hành động giá BTC trong tuần này.

BTC/USD has managed to retain the majority of its stunning January gains, these totaling almost 40%. At the same time, signs of a comedown on the cards are increasingly making themselves known.

The weekly close, while comparatively strong at just under $23,000, still failed to beat the previous one, and also represented a rejection at a key resistance level from mid-2022.

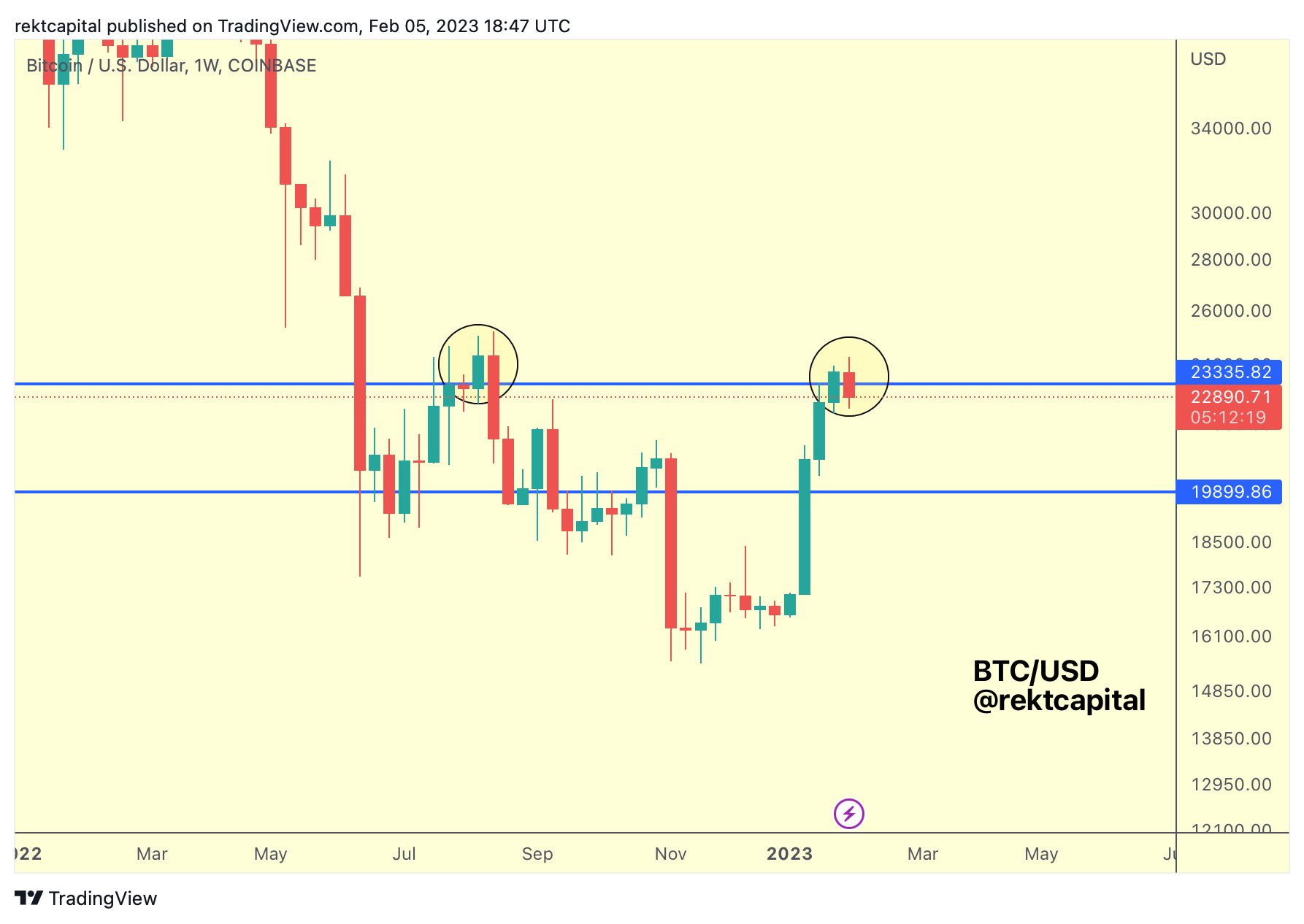

“BTC is failing its retest of ~$23400 for the time being,” popular trader and analyst Rekt Capital summarized about the topic on Feb. 5.

Một biểu đồ tuần đi kèm nhấn mạnh vùng hỗ trợ và kháng cự đang diễn ra.

“Important BTC can Weekly Close above this level for a chance at upside. August 2022 shows that a failed retest could see BTC drop deeper in the blue-blue range,” he continued.

“Technically, retest still in progress.”

Như Cointelegraph báo cáo vào cuối tuần, các nhà giao dịch đã đặt cược vào nơi mà một pullback tiềm năng có thể kết thúc – và mức nào có thể đóng vai trò hỗ trợ dứt khoát cho đà tăng mới của Bitcoin tiếp tục.

Những điểm này hiện đang tập trung khoảng $20,000, một con số đáng kể về mặt tâm lý và cũng là vị trí cao nhất mọi thời đại của Bitcoin từ năm 2017.

BTC/USD giao dịch ở mức khoảng $22,700 vào thời điểm viết bài, dữ liệu từ Cointelegraph Markets Pro và TradingView cho thấy, tiếp tục đẩy thấp hơn trong giờ giao dịch Châu Á.

“Some bids were filled on this recent push down (green box) but most of the remaining bids below have been pulled (red box),” trader Credible Crypto wrote about order book activity on Feb. 5.

“Nếu chúng ta tiếp tục thấp hơn ở đây, mắt vẫn còn trên khu vực 19-21k như một vùng phản hồi hợp lý.”

For a quietly confident Il Capo of Crypto, meanwhile, it is already crunch time when it comes to the trend reversal. A supporter of new macro lows throughout the January gains, the trader and social media pundit argued that breaking below $22,500 would be “bearish confirmation.”

“Current bear market rally has created the perfect environment for people to keep buying all the dips when the current trend reverses,” he wrote during a Twitter debate.

“Perfect scenario for a capitulation event in the next few weeks.”

Fed officials to speak as market eyes CPI

The week in macro looks decidedly calm compared to the start of February, with less in the way of data and more by way of commentary set to define the mood.

That commentary will come courtesy of Fed officials, including Chair Jerome Powell, and any hint of policy change contained within their language has the potential to shift markets.

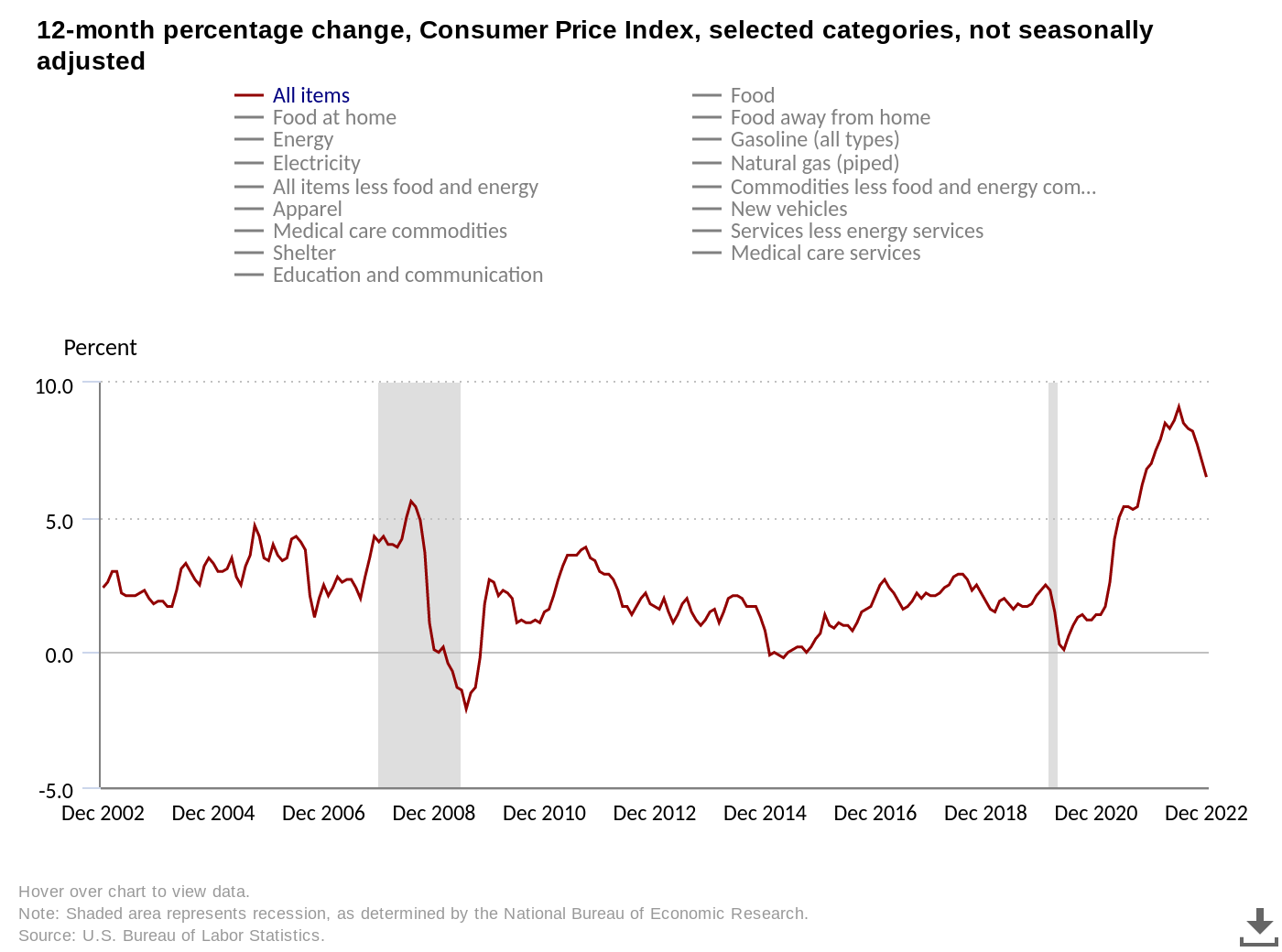

The week prior saw just such a phenomenon play out, as Powell used the word “disinflation” no fewer than fifteen times during a speech and Q&A session accompanying the Fed’s move to enact a 0.25% interest rate hike.

Ahead of fresh key data next week, talk in analytics circles is on how the Fed might transition from a restrictive to accommodative economic policy and when.

As Cointelegraph reported, not everyone believes that the U.S. will pull off the “soft landing” when it comes to lowering inflation and will instead experience a recession.

“DON’t be surprised if the term “soft-landing” remains around for a while before the rug being pulled in Q3 or Q4 this year,” investor Andy West, co-founder of Longlead Capital Partners and HedgQuarters, concluded in a dedicated Twitter thread at the weekend.

In the meantime, it may be a case of business as usual, however, with smaller rate hikes after Powell’s “mini victory lap” over declining inflation, further analysis argues.

“Personally, my belief is that the Fed will most likely raise by +0.25% in the upcoming two meetings (March & May),” Caleb Franzen, senior market analyst at CubicAnalytics, wrote in a blog post on Feb. 4.

“Of course, all future actions by the Fed will be dependent on the continued evolution of inflation data & broader macroeconomic conditions.”

Franzen acknowledged that while recession was not currently an apt description of the U.S. economy, conditions could still worsen going forward, referencing three such cases in past years.

Closer to home, next week’s CPI release is already on the radar for many. The extent to which January’s data supports the waning inflation narrative should be key.

“Post-FOMC, we have a heap of 2nd tier data releases including the important ISM services and NFP,” trading firm QCP Capital wrote in forward guidance mailed to Telegram channel subscribers last week.

“However the decider will be the Valentine’s Day CPI – and we think there are upside risks to that release.”

Miner “relief” contrasts with BTC sales

Turning to Bitcoin, it is network fundamentals currently offering some stability amid a turbulent environment.

According to current estimates from BTC.com, difficulty is stable at all-time highs, with only a modest negative readjustment forecast in six days’ time.

This could well end up positive depending on Bitcoin price action, however, and a look at hash rate data suggests that miners remain in fierce competition.

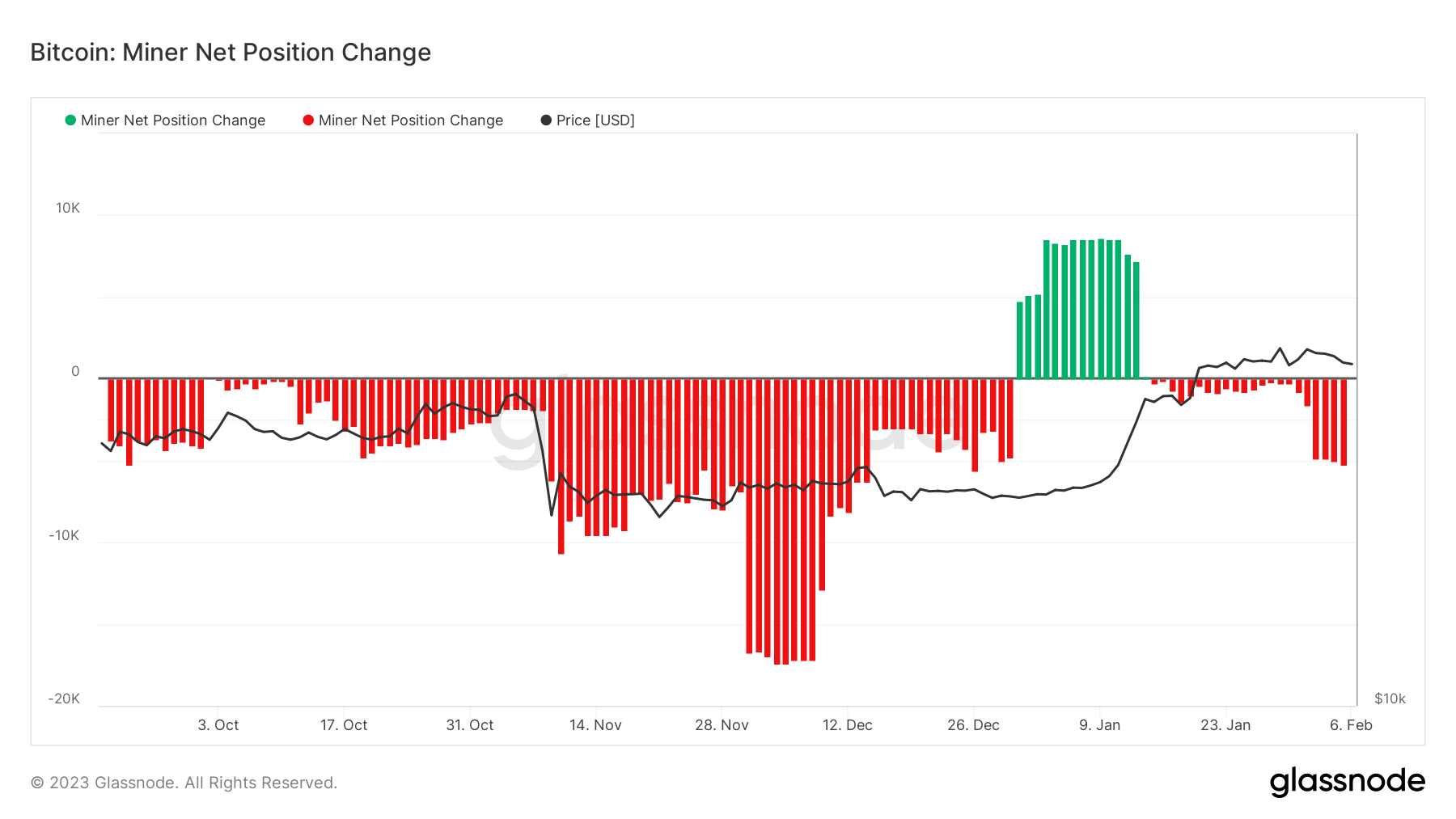

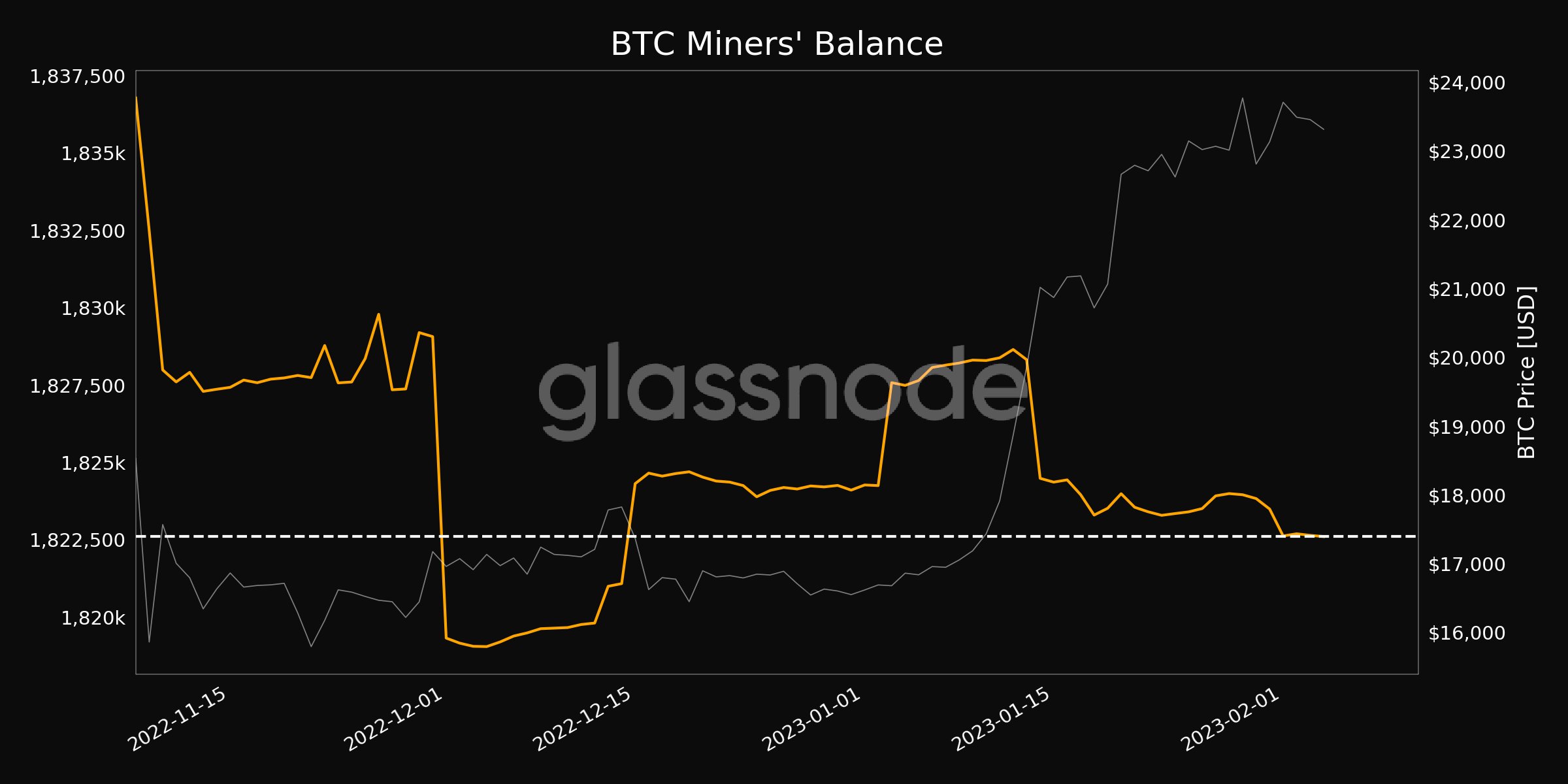

A countertrend comes in the form of miners’ economic behavior. The latest data from on-chain analytics firm Glassnode shows that sales of BTC by miners continue to increase, with their reserves dropping faster over 30-day periods.

Reserves correspondingly totaled their lowest in a month on Feb. 6, with miners’ balance at 1,822,605.594 BTC.

Overall, however, current price action has provided “relief” for miners, Philip Swift, co-founder of trading suite Decentrader says.

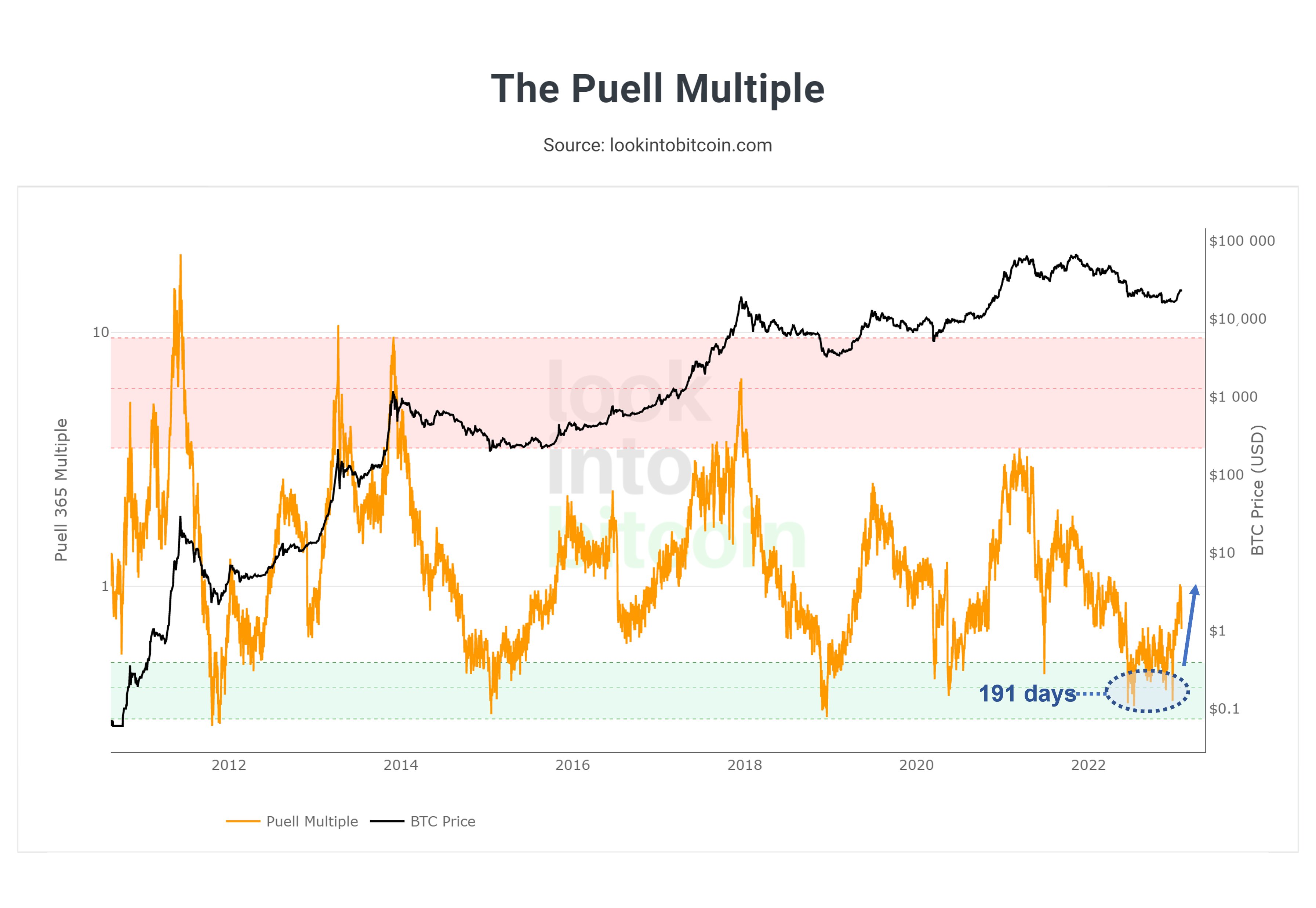

In a tweet last week, Swift referenced the Puell Multiple, a measure of relative value of BTC mined, which has left its “capitulation zone” to reflect better profitability.

“After 191 days in capitulation zone, the Puell Multiple has rallied. Showing relief for miners via increased revenue and likely reduced sell pressure,” he commented.

NVT suggests volatility will kick in

Some on-chain data is still surging ahead despite the slowdown in BTC price gains.

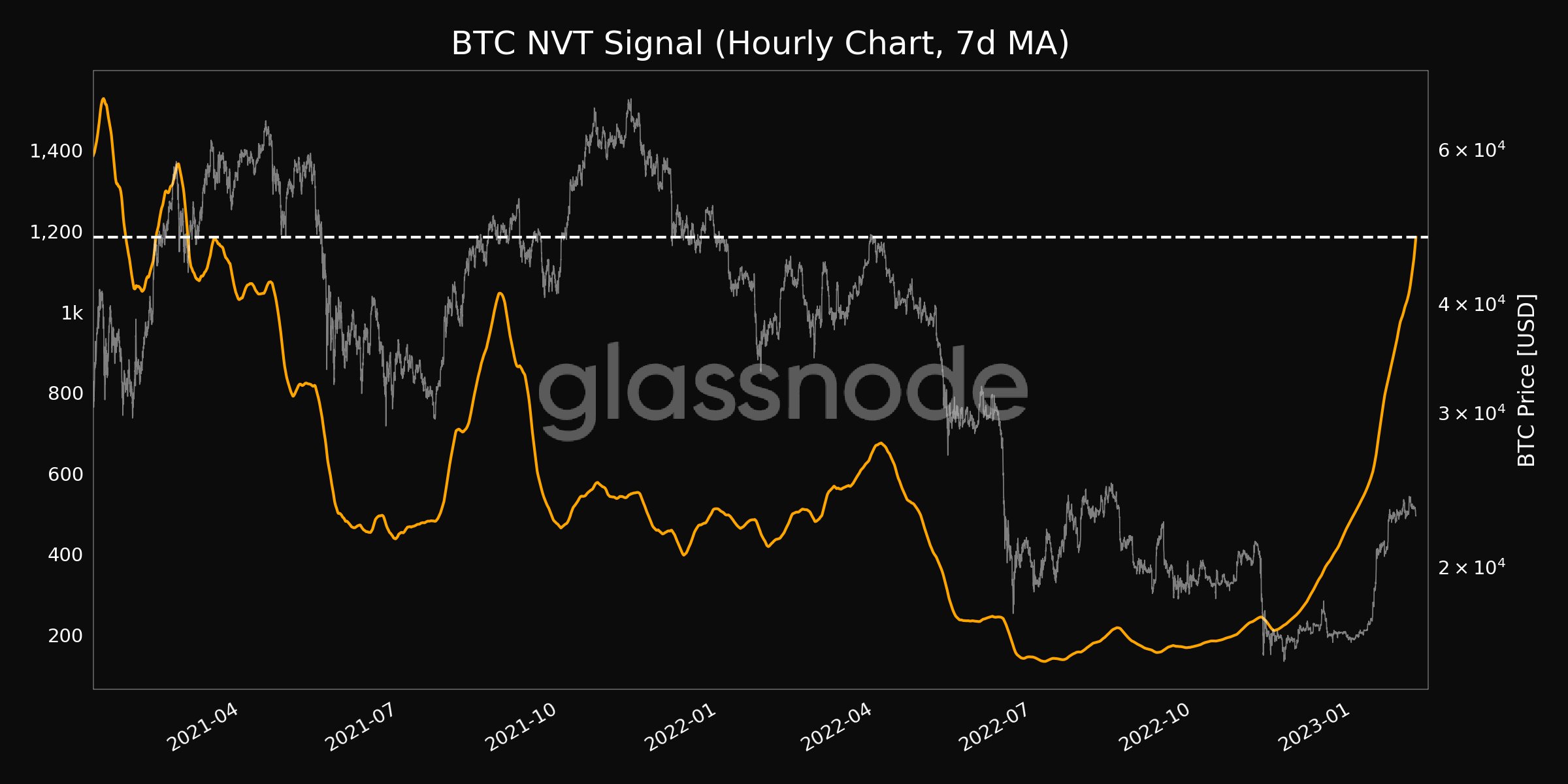

Of interest this week is Bitcoin’s network value to transaction (NVT) signal, which is now at levels not seen in nearly two years.

NVT signal measures the value of BTC transferred on-chain against the Bitcoin market cap. It is an adaption of the NVT ratio indicator, but uses a 90-day moving average of transaction volume instead of raw data.

NVT at multi-year highs may be cause for concern — network valuation is relatively high compared to value transferred, a scenario which may prove “unsustainable,” in the words of its creator, Willy Woo.

As Cointelegraph reported late last year, however, there are multiple nuances to NVT which make its various incarnations diverge from one another to provide a complex picture of on-chain value at a given price.

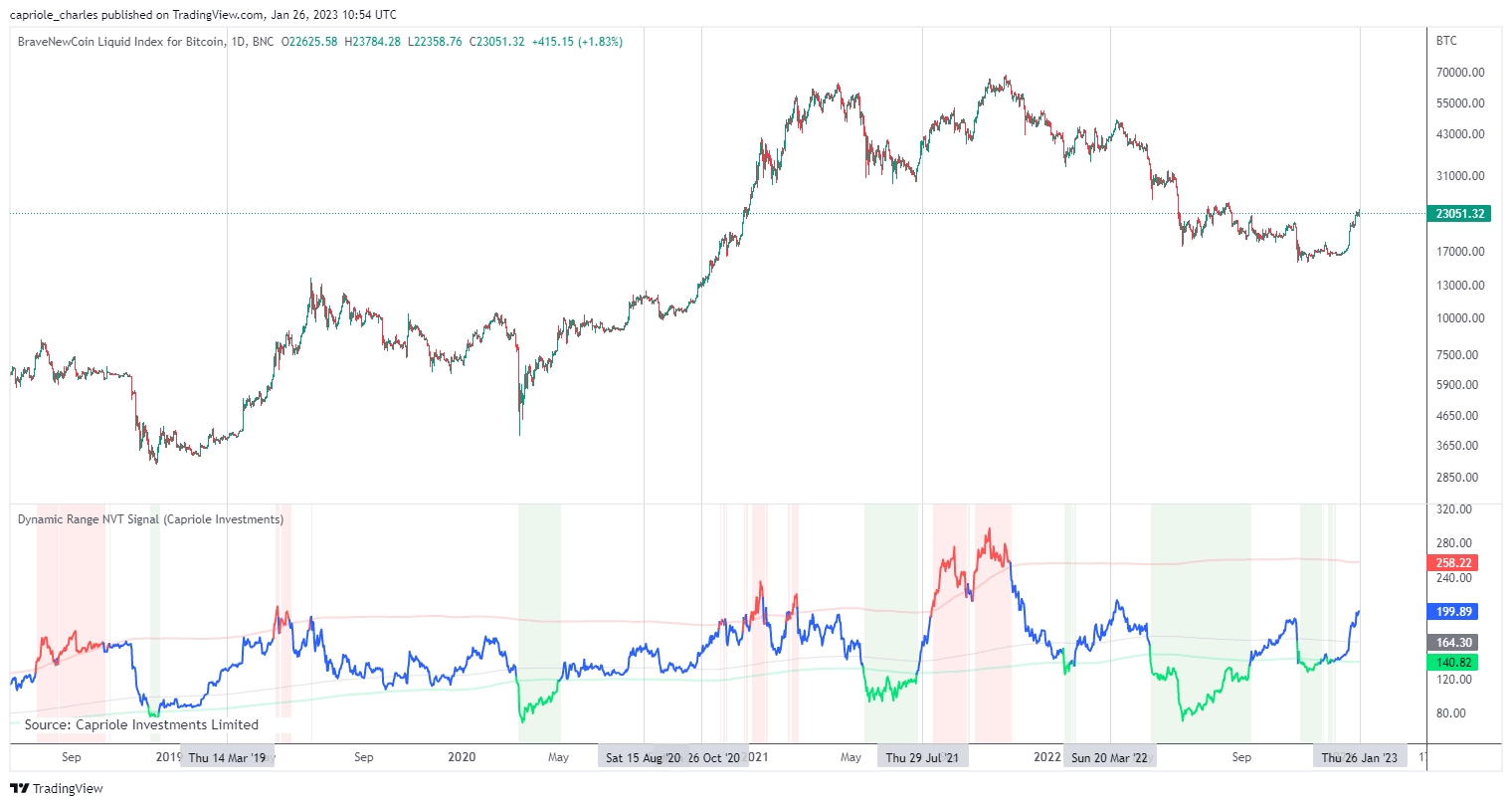

“Bitcoin’s NVT is showing indications of value normalization and the start of a new market regime,” Charles Edwards, CEO of crypto investment firm Capriole, commented about a further tweak of NVT, dubbed dynamic range NVT, on Feb. 6.

“The message is the same further through history and more often than not it is good news in the mid- to long-term. In the short-term, this is a place we typically see volatility.”

Small Bitcoin wallet show “trader optimism”

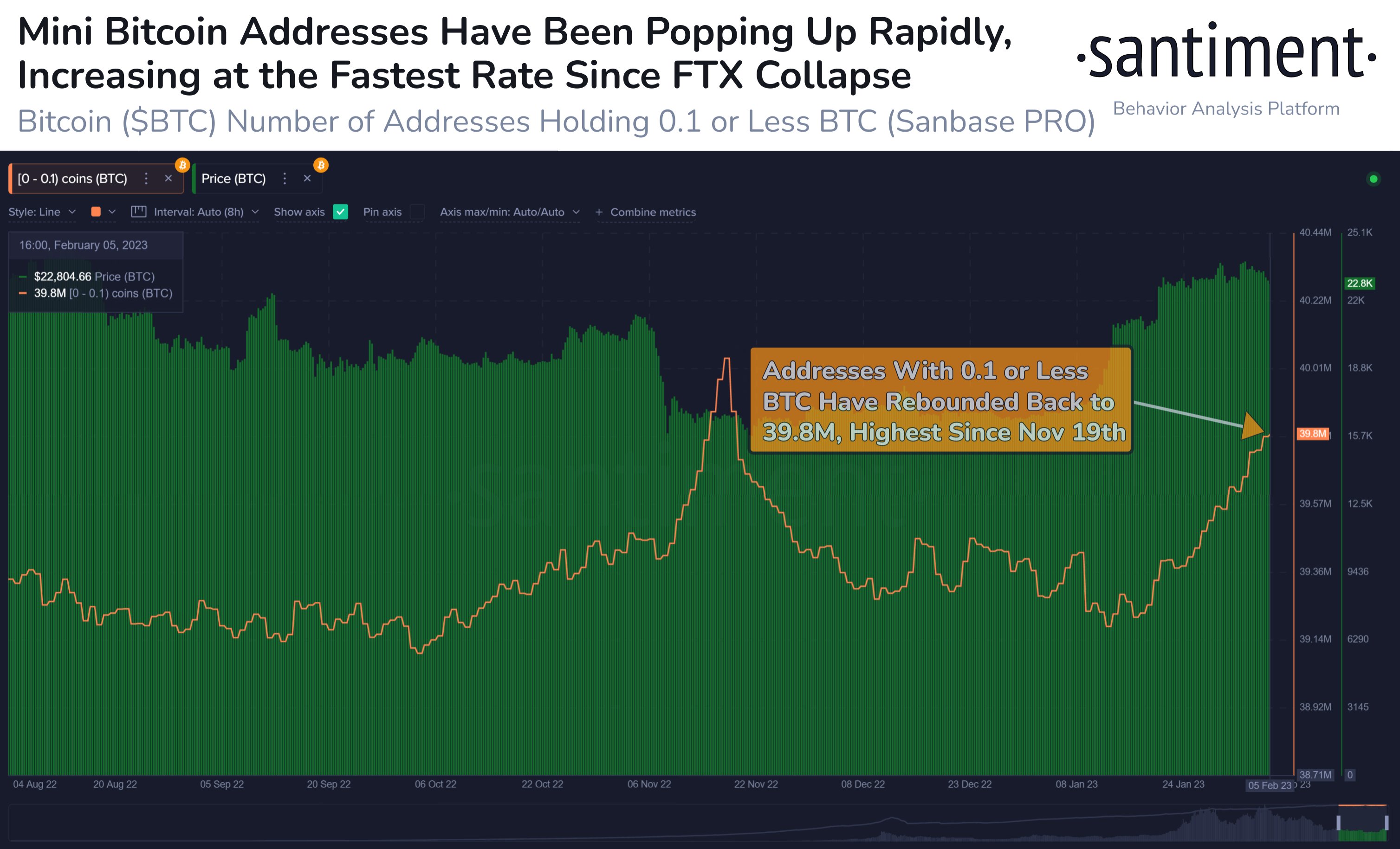

In a glimmer of hope, on-chain research firm Santiment notes that the number of smaller Bitcoin wallets has ballooned this year.

Related: Bitcoin, Ethereum and select altcoins set to resume rally despite February slump

Since BTC/USD crossed the $20,000 mark once more on Jan. 13, 620,000 wallets with a maximum of 0.1 BTC have reappeared.

That event, Santiment says, marks the moment when “FOMO returned” to the market, and the subsequent growth in wallet numbers means that these are at their highest since Nov. 19.

“There have been ~620k small Bitcoin addresses that have popped back up on the network since FOMO returned on January 13th when price regained $20k,” Twitter commentary confirmed on Feb. 6.

“These 0.1 BTC or less addresses grew slowly in 2022, but 2023 is showing a return of trader optimism.”

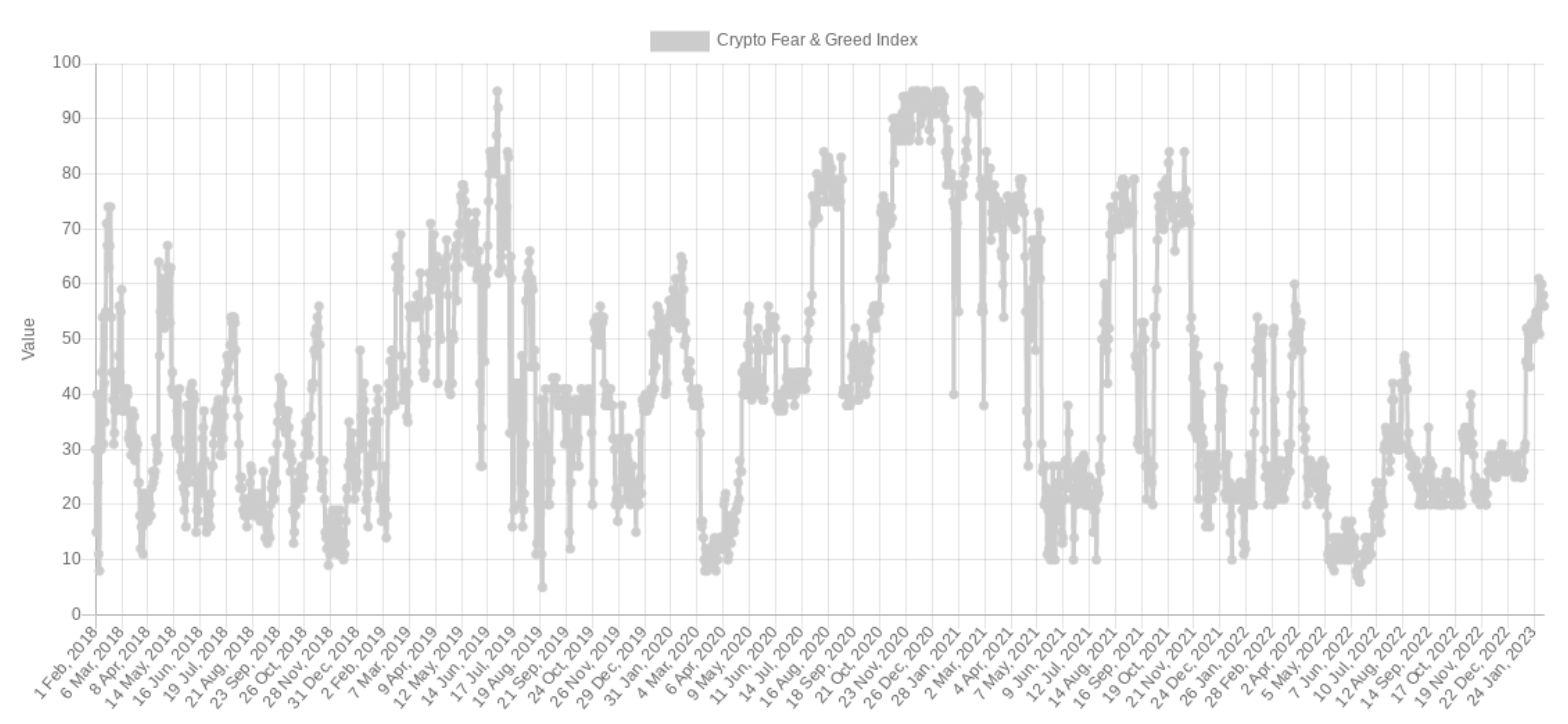

A look at the Crypto Fear & Greed Index meanwhile shows “greed” still being the primary description of market sentiment.

On Jan. 30, the Index hit its “greediest” since Bitcoin’s November 2021 all-time highs.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.