Bitcoin (BTC) bắt đầu một tuần mới với sự củng cố trong không khí trong bối cảnh một số điều kiện ít biến động nhất từ trước đến nay.

Mặc dù mất 5% trong một giờ tuần trước, sự thiếu biến động tiếp theo của Bitcoin là trong tâm trí của mỗi nhà giao dịch.

Câu hỏi đặt ra là liệu điều đó sẽ thay đổi trong những ngày tới.

Có rất nhiều chất xúc tác tiềm năng, từ dữ liệu kinh tế vĩ mô để trao đổi thiết lập và nhiều hơn nữa, nhưng sẽ giành chiến thắng – và theo hướng nào nó sẽ gửi giá BTC – vẫn còn được nhìn thấy.

Đằng sau hậu trường, nó vẫn hoạt động như bình thường đối với các nguyên tắc cơ bản của mạng Bitcoin, với các thợ mỏ giữ được độ nổi mới của họ và sẵn sàng cho mức cao mới mọi thời đại trong khó khăn.

Cointelegraph xem xét các yếu tố di chuyển thị trường chính và tóm tắt ý kiến về cách họ có thể định hình hành động giá BTC trong tuần này.

Giá Bitcoin vẫn bị tê liệt sau khi đóng cửa hàng tuần

Trong khi bất cứ điều gì có thể và không xảy ra trong Bitcoin, cuối tuần đã được đánh dấu bằng một từ chỉ khi nói đến hành động giá BTC — nhàm chán.

After flash volatility on March 3 due to a combination of Silvergate bank concerns and exchange margin calls, BTC/USD has remained eerily quiet.

Dữ liệu từ Cointelegraph Markets Pro và TradingView chứng minh quan điểm này, với giá giao ngay di chuyển trong phạm vi gần như không thể nhận thấy kể từ đó.

Bulls nonetheless failed to recover much of the lost ground, leading Bitcoin to finish the week down around 5.1% on Bitstamp.

Đối với người đóng góp Cointelegraph Michaël van de Poppe, người sáng lập và Giám đốc điều hành của công ty thương mại Eight, vẫn có lý do để tin rằng thị trường sẽ sớm vạch ra một đường theo xu hướng ngắn hạn hiện tại.

“Boring price action on Bitcoin since the correction, but still acting in support here,” he told Twitter followers on March 6.

“Indices bounced already and seem to continue to do so. Might have another sweep of the lows and then reverse up, losing $21.5K = trouble time.”

Một bài viết tiếp theo đã nhắm mục tiêu bật lên tiềm năng cho $23,000 nếu những con bò đực lấy lại một số hình thức sức mạnh.

“Tôi chỉ muốn thấy một số biến động giá hôm nay nếu tôi trung thực”, nhà giao dịch nổi tiếng Crypto Tony tiếp tục.

“I remain short as of few days ago with my stop loss at $23,200 to remain transparent. I would like to see a move up to $22,800 before any downside.”

Fellow trading account Daan Crypto Trades meanwhile noted that BTC/USD had already closed the modest CME futures gap from the weekend.

$22,000 or $22,650 needs to be crossed in order for Bitcoin to provide “clear direction,” he acknowledged.

$BTC Quickly closed the gap for the most part. There is a tiny gap open of about $20 but we see that quite often. Would not value it too much personally.

Anyways, still in chop/range mode so no clear direction until a clean break of 22000 or 22650 in my opinion. https://t.co/tOigpLO71q pic.twitter.com/Wu1J7Bjxdg

— Daan Crypto Trades (@DaanCrypto) March 6, 2023

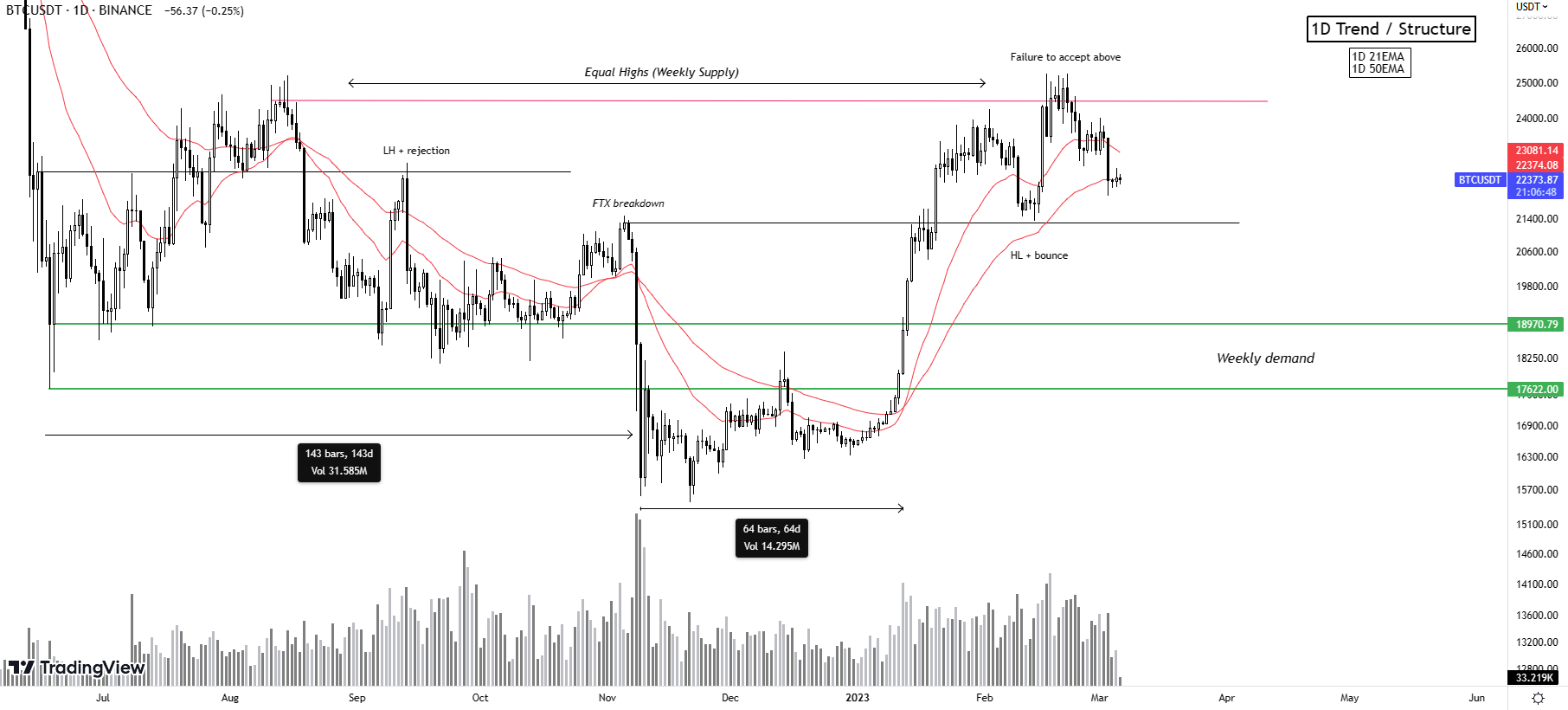

For trading resource Skew, the weekly open at around $22,300 should function as a “pivot” for near-term price performance.

“Probable that this weekly open price will trade as a pivot for 1D breakdown towards weekly demand ($19K) else HL with confirmation above $23K,” a tweet about the daily chart stated.

“We’re in the chop zone currently. (weakness or strength in coming day will be leading of momentum/direction).”

All eyes on Fed’s Powell as macro signals return

The macroeconomic scene begins to heat up in the coming days after a cool week, with Jerome Powell, Chair of the United States Federal Reserve, due for two rounds of testimony.

Một nguồn biến động kinh điển của thị trường, lời nói của Powell với Ủy ban Dịch vụ Tài chính Hạ viện Hoa Kỳ có thể lật tâm trạng tổng thể – ít nhất là một thời gian ngắn – tùy thuộc vào ngôn ngữ ông sử dụng khi nói đến chính sách kinh tế trong tương lai.

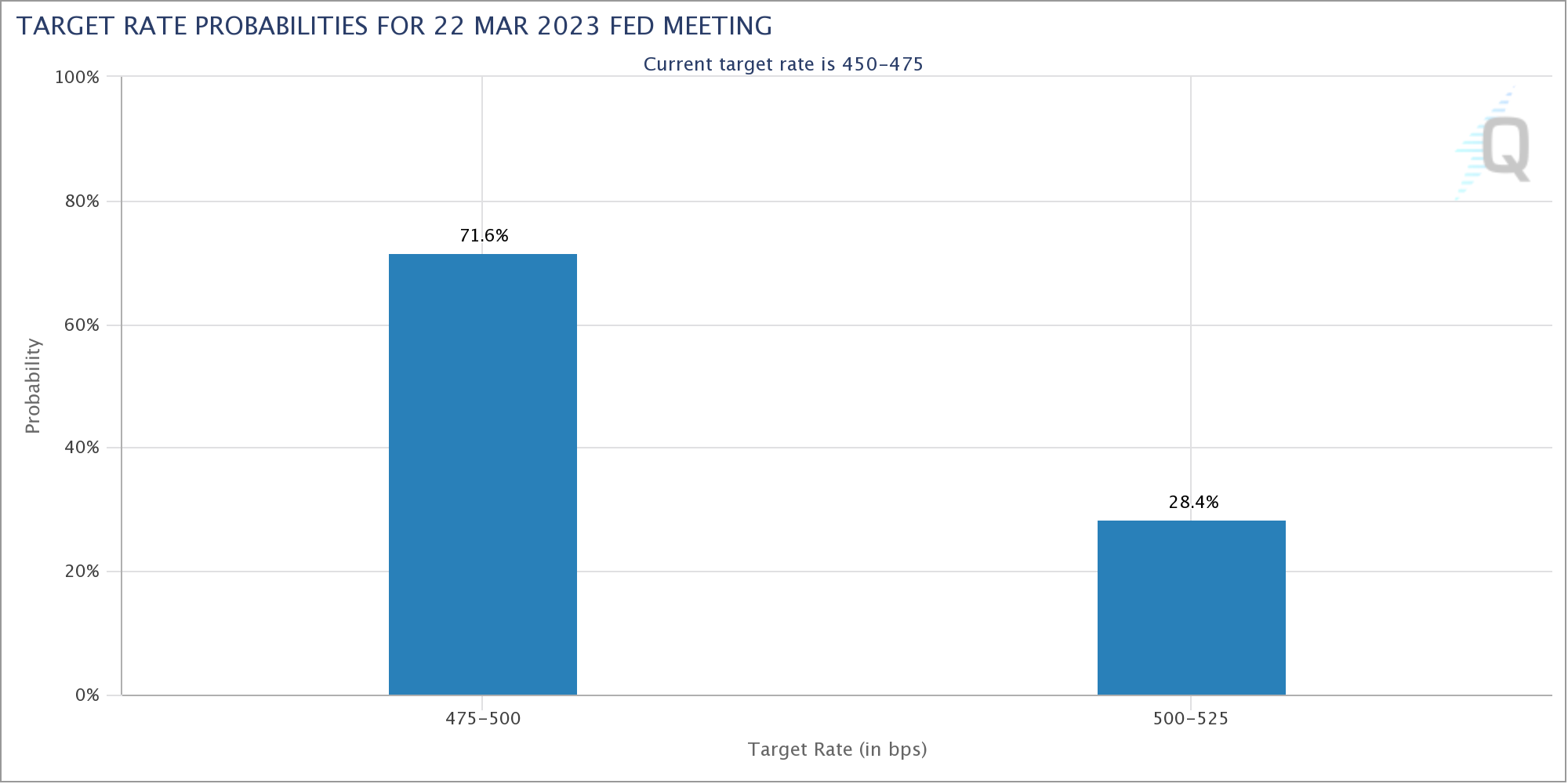

At stake in particular are interest rates, with the next decision on a benchmark Fed rate hike still two weeks away.

“Expecting Bitcoin volatility to pick up during midweek next week during Powell’s testimony,” trader, analyst and angel investor Crypto Santa confirmed in part of weekend Twitter posts.

Popular analytics account Tedtalksmacro also flagged nonfarm payrolls data and a statement and press conference from the Bank of Japan toward the end of the week as crunch points.

Key events for the week ahead

Tuesday – RBA statement/presser + Powell testifies to the Senate Banking Committee.

Wednesday – ECB’s Lagarde + Fed’s Powell speak

Friday – Bank of Japan statement/presser

Friday – US NFP employment data— tedtalksmacro (@tedtalksmacro) March 5, 2023

As Cointelegraph reported, the liquidity decisions of central banks outside the U.S. is being increasingly considered as an important influence on Bitcoin markets.

“US dollar liquidity is on the rise so far in March (~+100bn inflows),” Tedtalksmacro added.

“Liquidity leads, price lags!”

According to CME Group’s FedWatch Tool, the odds of the Fed’s March rate hike coming in at 50 basis points versus the previous 25 basis points stood at 28.6% as of March 6.

Fundamentals set for yet more all-time highs

Another adjustment, another all-time high — when it comes to Bitcoin difficulty, the only way is up.

The latest data from BTC.com confirms that later this week, difficulty will inch 1% higher to new record levels of 43.5 trillion.

This is no mean feat, coming at a time when BTC/USD has been consolidating for several weeks and miner profit margins continue to be slender.

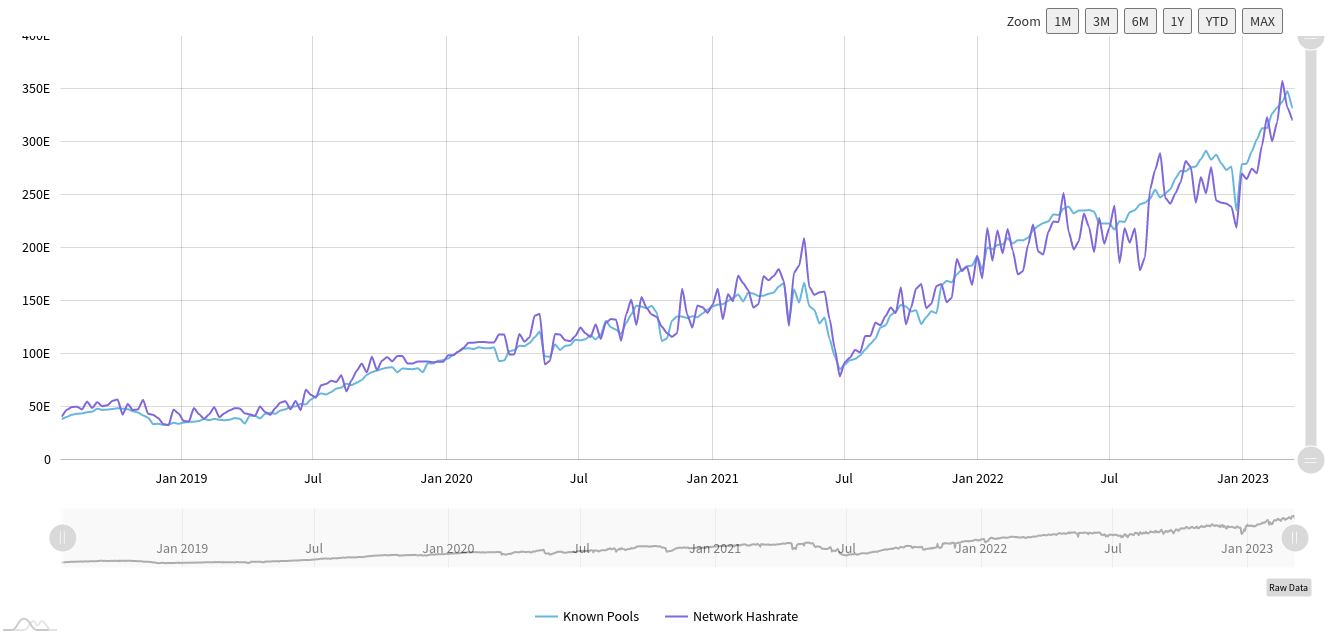

Nonetheless, hash rate shows that commitment from mining participants is also in a firm uptrend. Raw data estimates from MiningPoolStats put hash rate at 320 exahashes per second (EH/s) as of March 6.

On-chain analytics firm Glassnode meanwhile shared profitability statistics for Bitcoin miners, this having recovered markedly versus the second half of 2022.

We can use a similar methods to assess a suite of #Bitcoin mining metrics for the ASIC fleet:

– Estimate global power consumption

– Revenue per rig per day (BTC and USD)

– Break-even Operational costsFind out more in our #Bitcoin ASIC fleet dashboard

https://t.co/L56fbrsENa pic.twitter.com/uNuyOFAI5h— glassnode (@glassnode) March 5, 2023

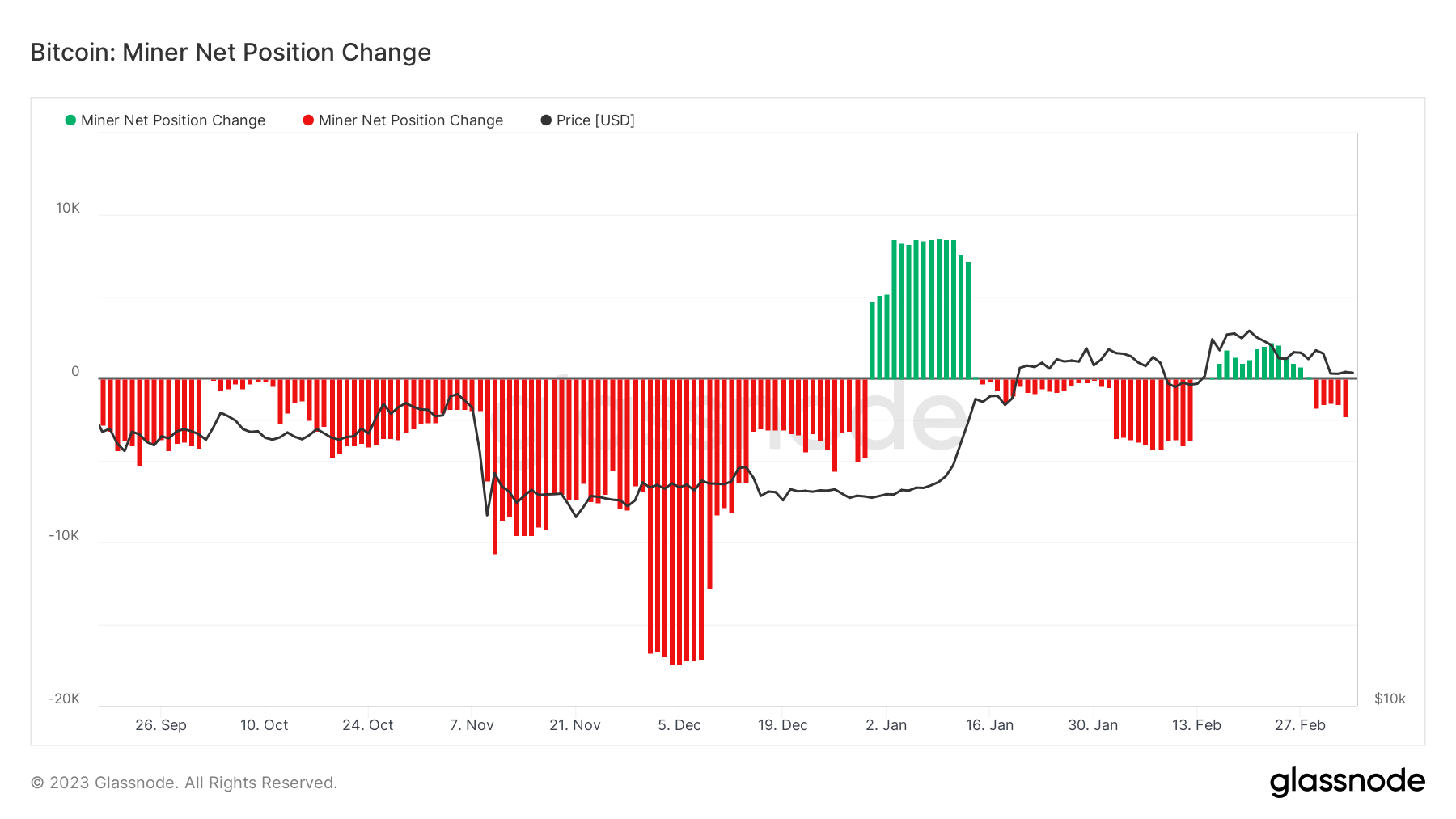

Additional data nonetheless shows that miners have yet to begin a firm accumulation trend at current prices, despite these being 40% up versus the start of the year.

On a rolling 30-day basis, miners’ BTC balances were lower in March.

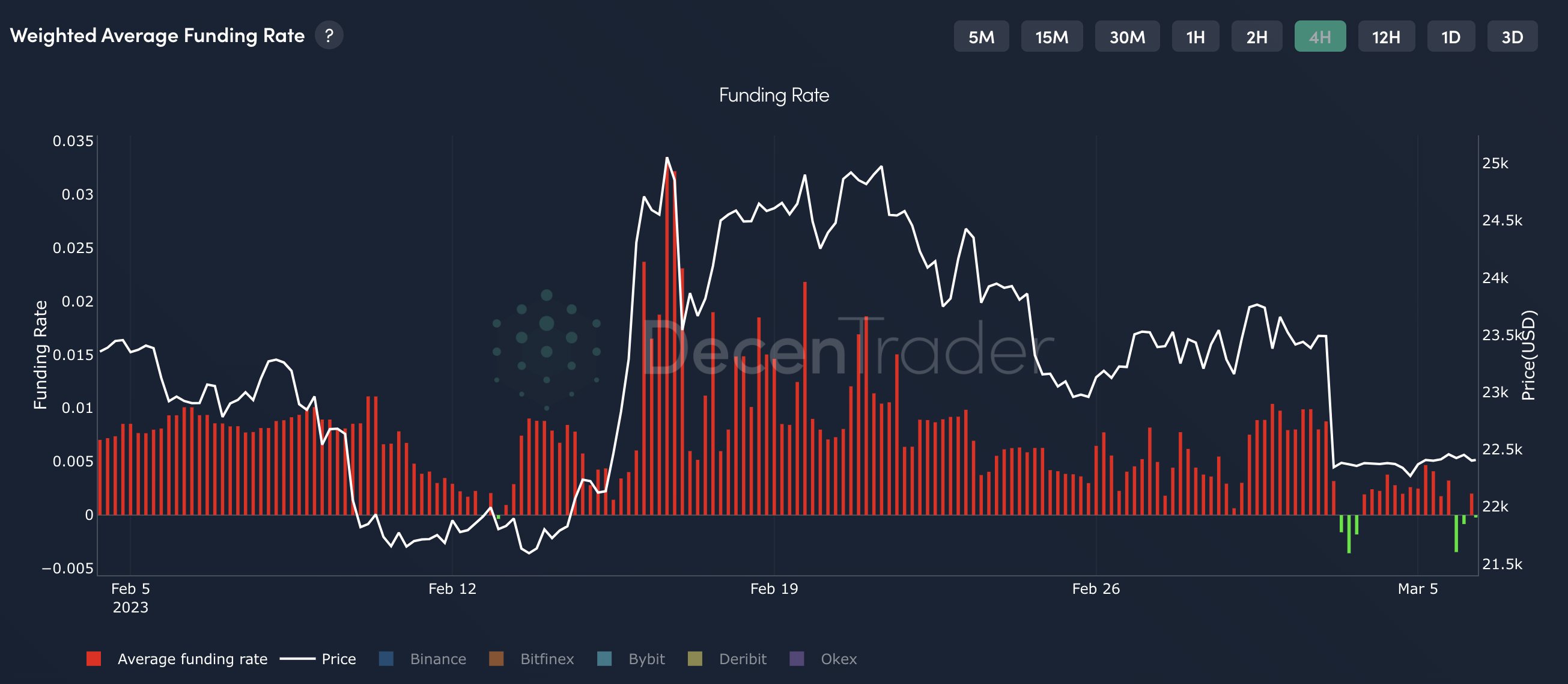

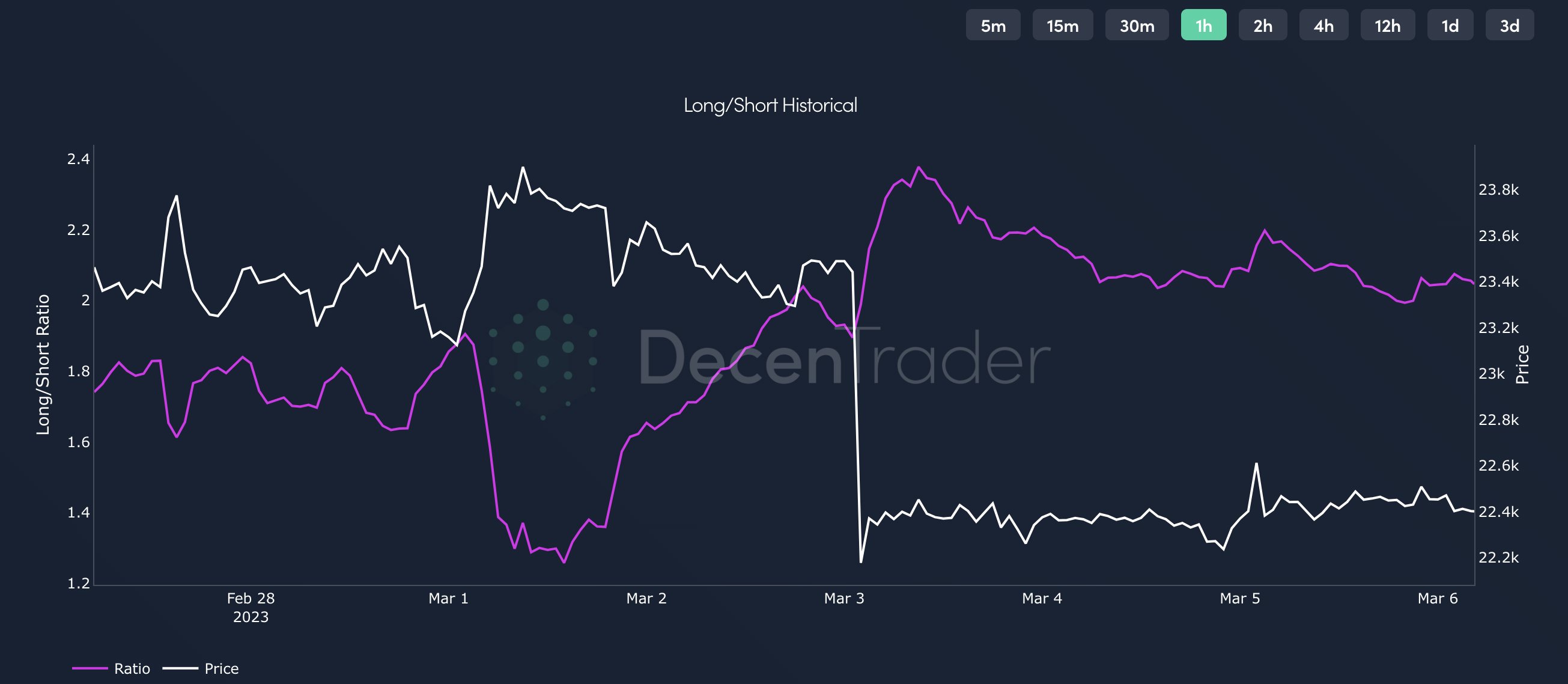

Funding rates give cause for optimism

On derivatives markets, analysts are eyeing a potential rerun of conditions that sent BTC/USD to its February highs above $25,000.

This is principally thanks to funding rates, which since last week’s 5% BTC price dip have flashed negative twice.

“Bitcoin Funding Rate doing similar to Ethereum now, turned negative a couple times after the nuke a few days ago,” trading suite Decentrader noted on March 6.

“Prior to this, Funding Rates were last negative before the pump to $25k on the 12th of Feb.”

In the way, however, the ratio of longs to shorts remains “stubborn,” Decentrader added, with two longs for every short “typically higher than usual for Bitcoin.”

Cointelegraph has published a guide which offers a full explanation of funding rates and how they work.

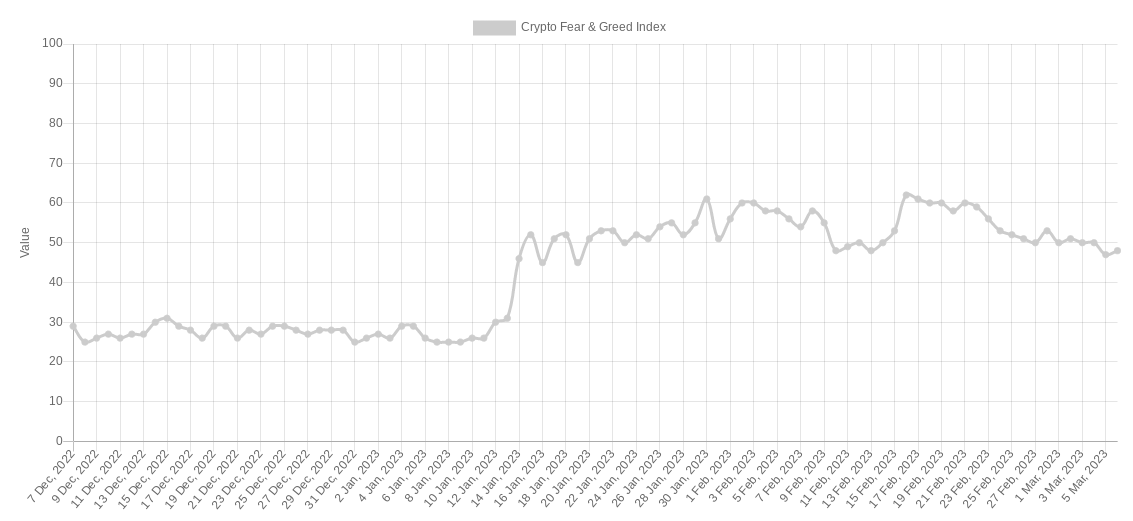

Sentiment index hits 6-week lows

In a more pronounced turnaround that price action would suggest, crypto market sentiment is increasingly shedding any trace of bullishness this month.

Related: EOS, STX, IMX and MKR show bullish signs as Bitcoin searches for direction

According to the Crypto Fear & Greed Index, the mood on the ground is now “neutral,” while the return of “fear” is getting ever nearer.

At 47/100, in fact, the Index hit its lowest levels since mid-January over the weekend.

As Cointelegraph reported, research is even querying the extent of crypto’s newfound cold feet, arguing that the market’s reaction to the Silvergate episode was out of proportion.

“Traders are more of a mixed bag when it comes to shorting or longing the markets right now,” research firm Santiment, which published the findings, stated.

Santiment added that sentiment might not necessarily form an accurate reflection of market strength given the aforementioned state of funding rates.

“So there could be something funky going on with an inflated amount of negative comments, even though perpetual contract funding rates on exchanges aren’t necessarily matching the sentiment,” it concluded.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.