Inflation does not have a major impact on Bitcoin’s price, as many believe, but a weakening US dollar does help push up the cryptocurrency alongside gold, according to NYDIG.

“The community likes to pitch Bitcoin as an inflation hedge, but unfortunately, here, the data is just not strongly supportive of that argument,” NYDIG global head of research Greg Cipolaro said in a note on Friday.

“The correlations with inflationary measures are neither consistent nor are they extremely high,” he added. Cipolaro said that expectations of inflation are a “better indicator” for Bitcoin (BTC) but are still not closely correlated.

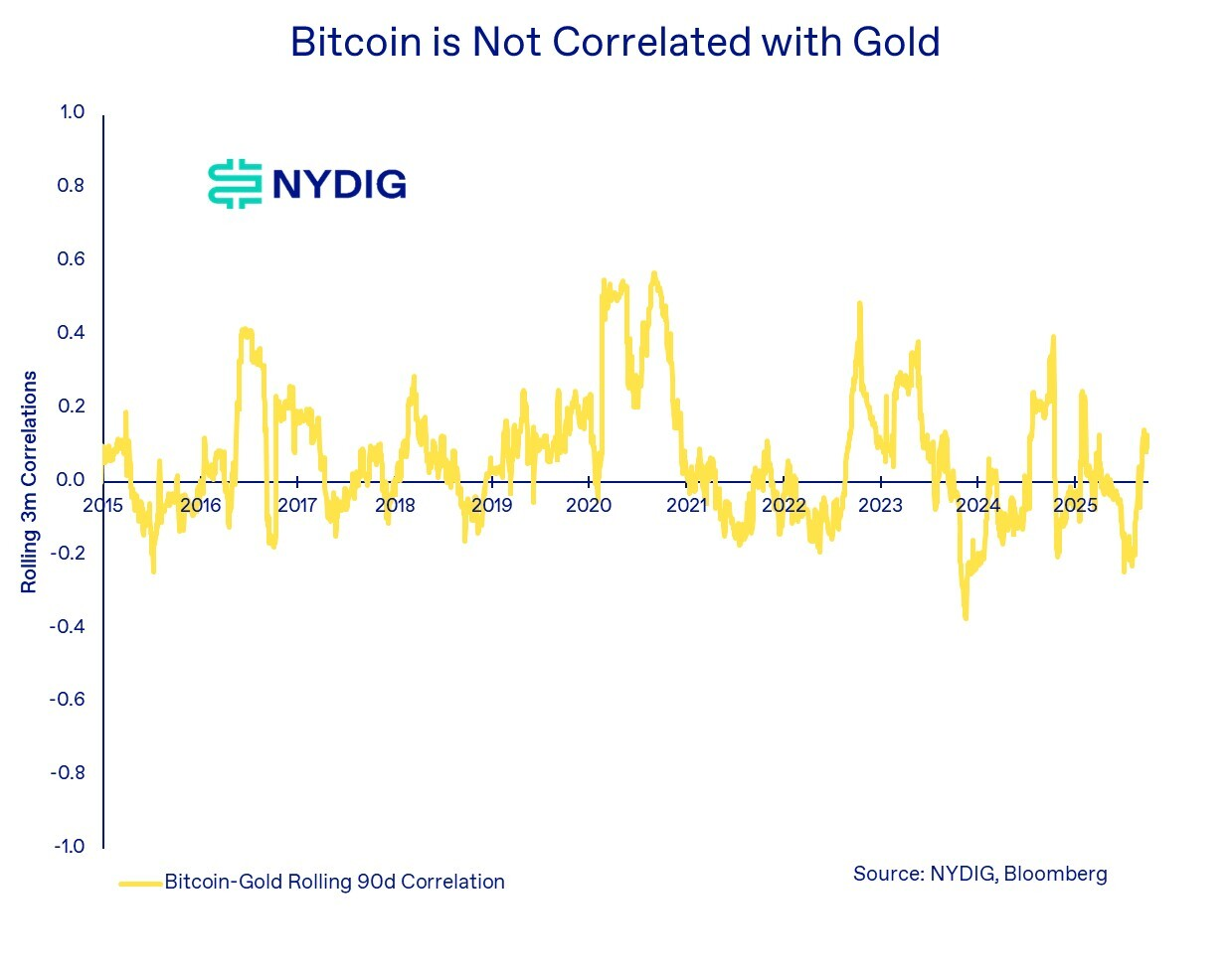

Bitcoin proponents have long lauded that Bitcoin is “digital gold” and a hedge against inflation due to its hard fixed supply and being a decentralized asset. However, it has recently become more ingrained and correlated with the traditional finance system.

Cipolaro added that real gold isn’t much better as an inflation hedge, as it has an inverse correlation with inflation and has been inconsistent across periods, which he said was “surprising for an inflation protection hedge.”

Weakening dollar a boon to Bitcoin, gold

Cipolaro said that gold has typically risen as the US dollar has fallen, as measured against other currencies using the US Dollar Index.

“Bitcoin also has an inverse correlation to the US dollar,” he added. “While the relationship is a bit less consistent and newer than gold’s, the trend is there.”

Cipolaro said NYDIG expects Bitcoin’s inverse correlation with the dollar to strengthen as the asset becomes “more embedded in the traditional financial market ecosystem.”

Interest rates, money supply the real Bitcoin mover

Interest rates and the money supply were the two major macroeconomic factors that Cipolaro said impacted the movements of Bitcoin and gold.

Related: Gold’s worst dip in years wipes $2.5T: How does Bitcoin match up?

Gold has typically risen on falling interest rates and fallen when interest rates have risen. That same relationship, Cipolaro said, “has emerged and strengthened over time” for Bitcoin too.

He added the relation between global monetary policy and Bitcoin has also been “persistently positive” and strong over the years, with looser monetary policies typically being a boon to Bitcoin.

Cipolaro said that Bitcoin’s similar price movements to gold, relative to macroeconomic conditions, show its “growing integration into the global monetary and financial landscape.”

“If we were to summarize how to think about each asset from a macro factor perspective, it is that gold serves as a real-rate hedge, whereas Bitcoin has evolved into a liquidity barometer,” he added.

Magazine: 7 reasons why Bitcoin mining is a terrible business idea