Banking giant JPMorgan Chase’s decision to cut ties with the CEO of Bitcoin payments company Strike is reigniting concerns about a renewed wave of US “debanking,” an issue that haunted the crypto industry during the 2023 banking turmoil.

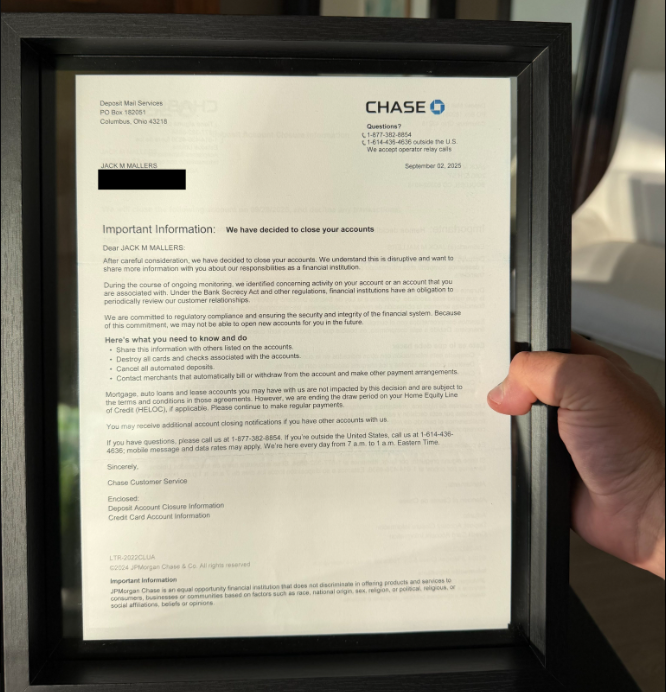

Jack Mallers, CEO of the Bitcoin (BTC) Lightning Network payments company Strike, said Sunday on X that JPMorgan closed his personal accounts without explanation.

“Last month, J.P. Morgan Chase threw me out of the bank,” Mallers wrote. “Every time I asked them why, they said the same thing: We aren’t allowed to tell you.”

Cointelegraph has contacted JPMorgan Chase for comment.

The decision has stirred fears of Operation Chokepoint 2.0, a term critics use to describe alleged government pressure on banks to sever relationships with crypto companies.

“Operation Chokepoint 2.0 regrettably lives on,” said US Senator Cynthia Lummis in a Monday X post. Actions like JP Morgan’s “undermine the confidence in traditional banking” while sending the digital asset industry overseas, she said, adding:

“It’s past time we put Operation Chokepoint 2.0 to rest to make America the digital asset capital of the world.”

Other crypto founders, including Caitlin Long of Custodia Bank, said the debanking efforts targeting crypto may persist until January 2026, pending the appointment of a new Federal Reserve governor.

Related: Fed mulls ‘skinny’ payment accounts to open rails for fintech, crypto companies

“Trump won’t have the ability to appoint a new Fed governor until January. So, therefore, you can see the breadcrumbs leading up to a potentially big fight,” Long said during Cointelegraph’s Chainreaction daily X show on March 21.

Long’s Custodia Bank was repeatedly targeted by US debanking efforts, which cost the company months of work and “a couple of million dollars,” she said.

The collapse of crypto-friendly banks in early 2023 sparked the first allegations of Operation Chokepoint 2.0, during which at least 30 technology and cryptocurrency founders were reportedly denied access to banking services under the administration of former President Joe Biden.

In August 2025, President Donald Trump signed an executive order related to debanking, aiming to prevent banks from cutting off services to politically unfavorable industries, including the cryptocurrency sector.

Related: $1.9B exodus and flicker of hope hits crypto investment funds: CoinShares

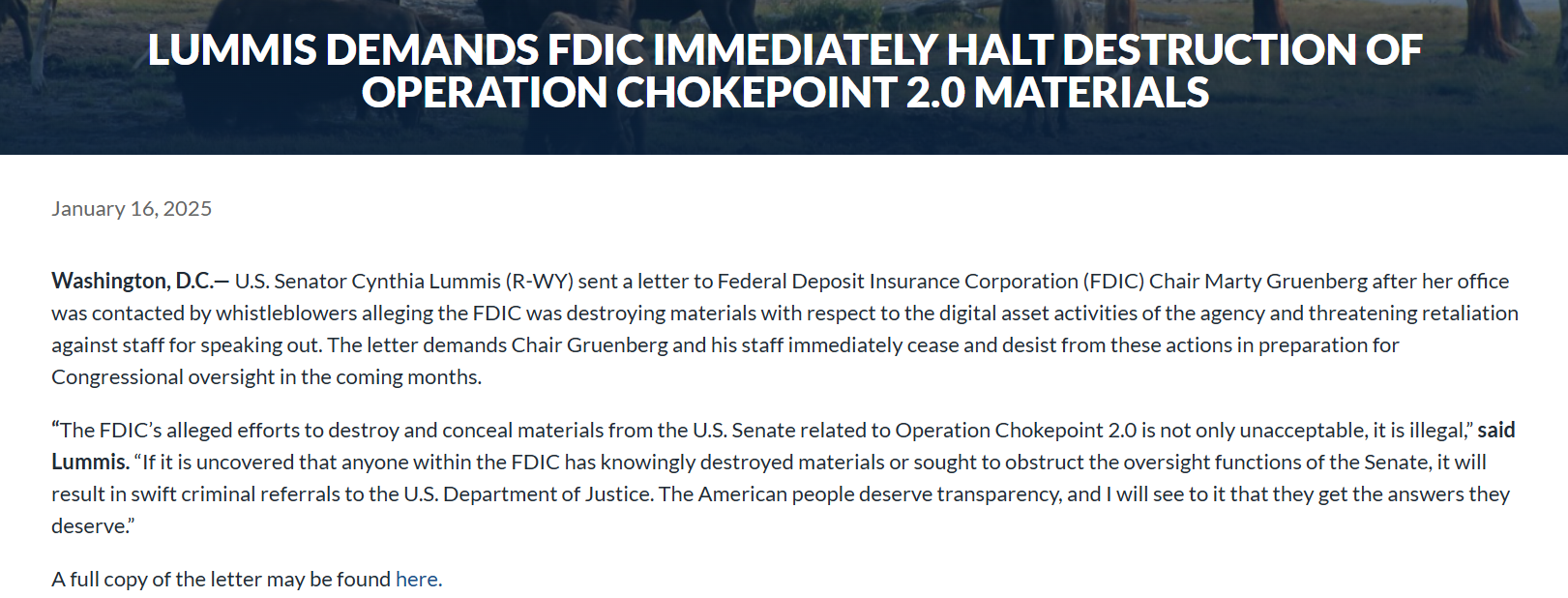

Lummis accuses FDIC of destroying records

Debanking concerns took another turn in January, when Lummis’s office was contacted by an anonymous whistleblower, alleging that the Federal Deposit Insurance Corporation (FDIC) was “destroying material” related to Operation Chokepoint 2.0.

“The FDIC’s alleged efforts to destroy and conceal materials from the U.S. Senate related to Operation Chokepoint 2.0 is not only unacceptable, it is illegal,” said Lummis in a letter published on Jan. 16, threatening “swift criminal referrals” if the wrongdoing was uncovered.

Traditional financial institutions have long criticized crypto firms for enabling illicit finance. But US banks have themselves paid more than $200 billion in fines over the past two decades for compliance failures, according to data compiled by Better Markets and the Financial Times.

Bank of America reportedly accounted for about $82.9 billion of those penalties, while JPMorgan Chase paid more than $40 billion.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight