A historic shift in Bitcoin ownership unfolded during the latest market downturn, while the broader crypto market remained tied to uncertainty over a possible US Federal Reserve rate cut in December.

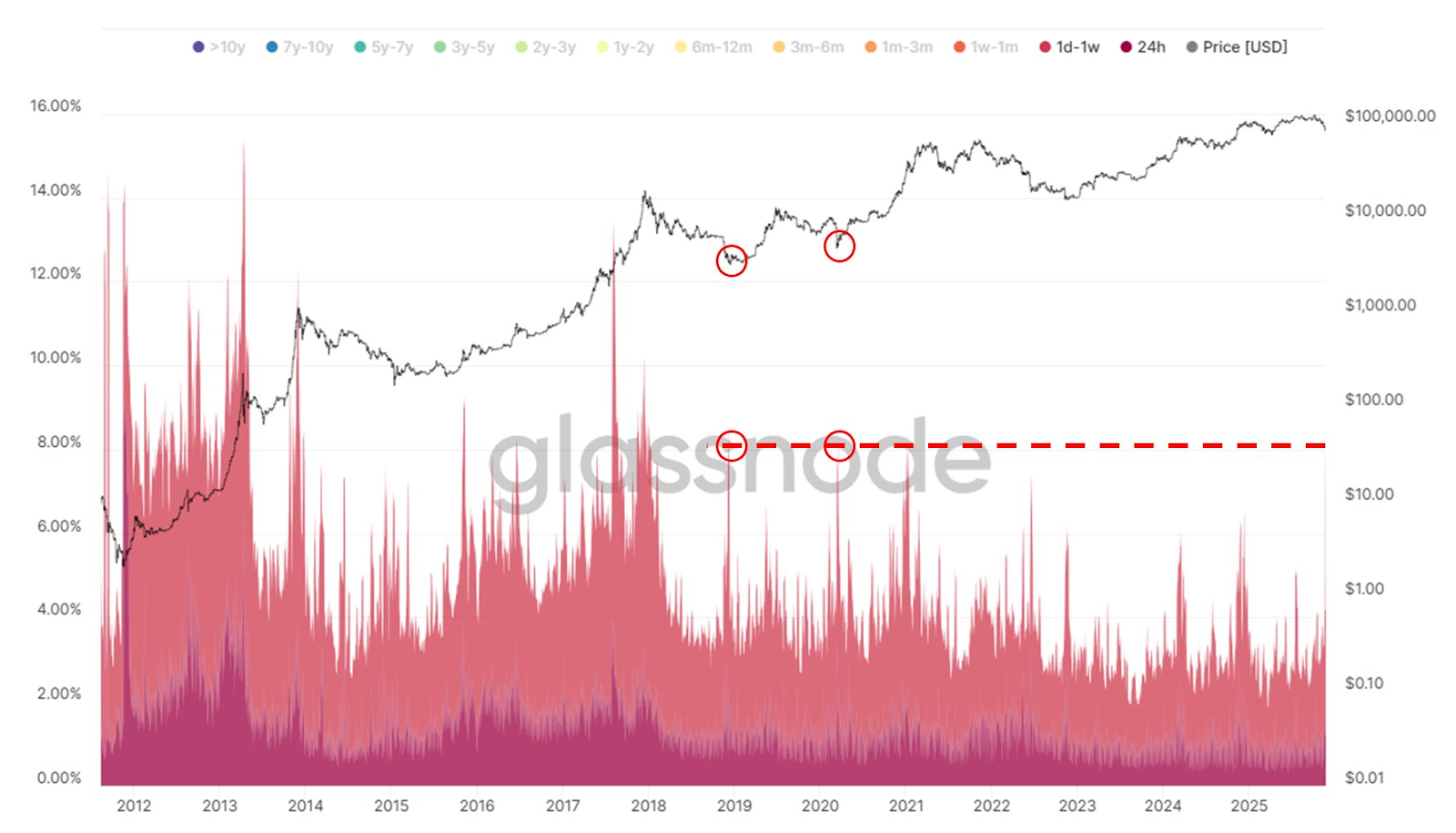

Over 8% of the total Bitcoin (BTC) supply changed hands in the past seven days, making the current market decline “one of the most significant onchain events” in Bitcoin history, according to Joe Burnett, analyst and director of Bitcoin Strategy at Semler Scientific.

During previous significant Bitcoin supply movements, Bitcoin traded at about $5,000 in March 2020 and around $3,500 in December 2018, said Burnett in a Tuesday X post.

Both occasions marked a local bottom ahead of an accumulation phase that ultimately led to new all-time highs.

Still, up to half of the current Bitcoin supply movement may be attributed to a Coinbase Wallet Migration announced on Saturday, added Burnett.

Related: Bitcoin rout continues as crypto treasuries face reckoning: Finance Redefined

Bitcoin, crypto markets on “knife’s edge” ahead of Fed interest rate decision in December

Meanwhile, Bitcoin’s price and investor sentiment remain on a “knife’s edge” due to mixed messages about December’s interest rate cut decisions, according to Nic Puckrin, digital asset analyst and co-founder of educational platform The Coin Bureau.

“What is more certain, though, is that the Fed holds the key to the market’s end-of-year finale, and its next rate decision will determine whether we get a Santa rally or a Santa dump,” he told Cointelegraph.

“As we get closer to Dec. 10, I expect market jitters to continue, and the Fed’s press conference will certainly have traders on the edge of their seats.”

Related: $1.9B exodus and flicker of hope hits crypto investment funds: CoinShares

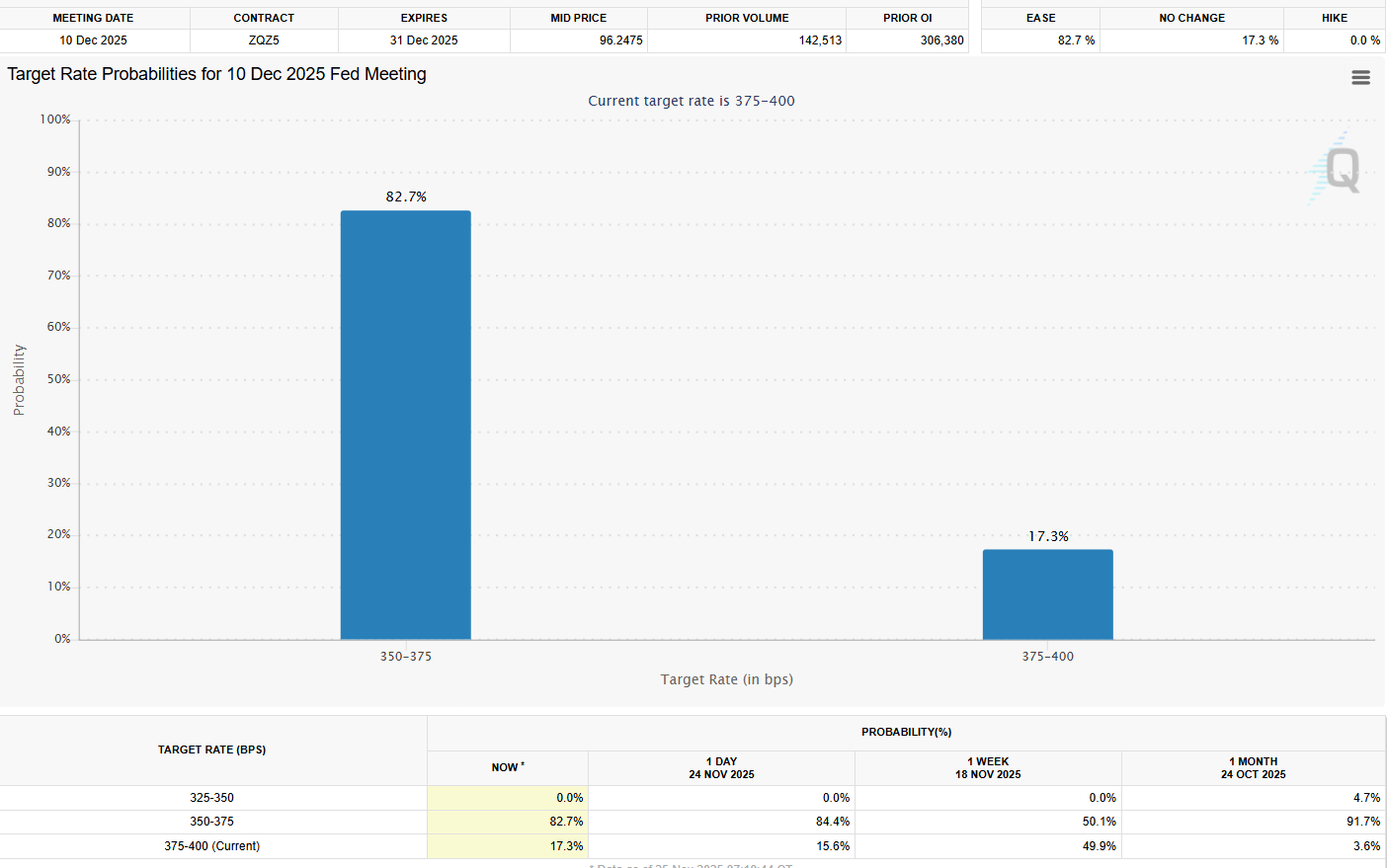

Interest rate cut expectations for the Federal Reserve’s Dec. 10 meeting have changed drastically during the past week

Markets are pricing in an 82% chance of a 25 basis point interest rate cut, up from 50% a week ago, according to the CME Group’s FedWatch tool.

The growing interest rate cut expectations were the main fuel leading to Bitcoin’s recovery from $81,000 to $87,000, according to Puckrin.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder