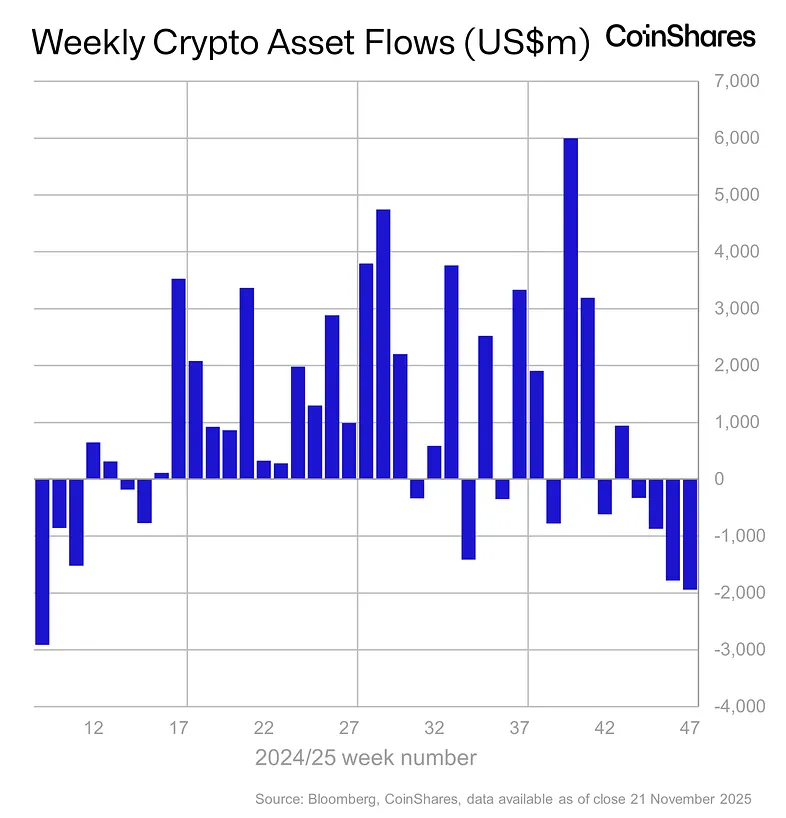

Cryptocurrency investment products have hit almost $5 billion in outflows over the past four weeks, but inflows during the final days of last week offered a small sign of improving sentiment.

Crypto exchange-traded products (ETPs) saw $1.94 billion in outflows last week, a small decline from the $2 billion exodus the previous week, according to a Monday research report from CoinShares.

The four-week total now stands at $4.9 billion, marking the third-largest outflow run on record. Only the March tariff-driven sell-off and the February 2018 downturn were bigger.

Still, CoinShares noted “tentative signs of a turnaround,” citing $258 million in inflows during the last trading days of the week following seven straight days of redemptions.

Related: Pump.fun’s massive $436M cash-out turns heads as memecoin mania fades

XRP funds buck the broader slump

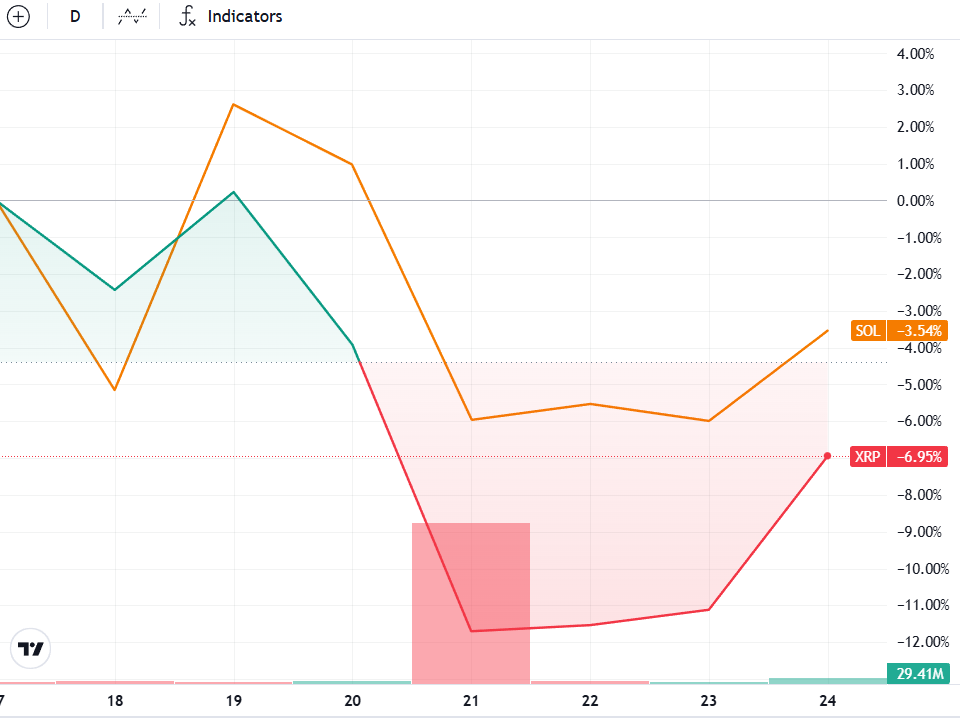

XRP (XRP) investment products were a rare bright spot. XRP exchange-traded products (ETPs) recorded $89.3 million in inflows last week, defying the broader downturn even as the token fell 6.9%.

Solana (SOL) ETPs were in the red with $156 million in outflows and SOL falling 3.5%, according to Cointelegraph data.

Bitcoin (BTC) saw the majority of outflows, at $1.27 billion, while Ether (ETH) funds followed with $589 million in weekly outflows.

Related: BitMine sits on $3.7B loss as DAT ‘Hotel California’ meets BlackRock’s staked ETH ETF

Meanwhile, the industry’s most successful traders, who are tracked as “smart money” traders on Nansen’s blockchain intelligence platform, are betting on the short-term appreciation of the XRP token.

Smart money traders added $10.4 million worth of cumulative leveraged long positions in the past 24 hours, as the cohort was net long with $74 million, according to Nansen.

However, smart money was still betting on a further decline in Bitcoin, with $325 million in cumulative net short Bitcoin positions.

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari — Crypto Kid