Bitcoin (BTC) bắt đầu vào tuần cuối cùng của tháng Hai trong tâm trạng biến động như một vùng kháng cự quan trọng không phá vỡ.

Sau một “giả mạo” cổ điển trong phiên giao dịch cuối tuần khối lượng thấp, BTC/USD quay trở lại dưới $25,000 với những con bò vẫn còn thiếu đà.

Đồng tiền điện tử lớn nhất đã thấy giai đoạn tiếp theo của sự phục hồi 2023 tuần trước, tăng nhanh và thậm chí chạm mức cao mới trong sáu tháng.

Tuy nhiên, thời điểm tốt đẹp không được tiếp tục, và tiến độ của tháng Hai đã chậm hơn nhiều và khó khăn hơn so với mức tăng 40% của tháng 1. Làm thế nào phần còn lại của tháng sẽ được an toàn?

Một đóng cửa hàng tháng quan trọng là do, cùng với một kích hoạt giá bên ngoài tiềm năng dưới dạng phút từ Cục Dự trữ Liên bang Hoa Kỳ.

Trong khi đó, các nguyên tắc cơ bản của mạng Bitcoin là do bước nhảy vọt lên một mức cao khác mọi thời đại, và các thợ mỏ đang trong chế độ phục hồi hoàn toàn.

Cointelegraph xem xét các yếu tố này và nhiều hơn nữa trong tổng quan về quan điểm giá BTC trong tuần cuối cùng của tháng Hai.

RSI “phân kỳ giảm” gây ra báo động

Sau một khởi đầu gần như bình tĩnh vào cuối tuần sau những ngày phản ứng dữ liệu kinh tế vĩ mô, Bitcoin thức dậy vào cuối Chủ Nhật để tăng trở lại trên $25,000.

This was not to last, however, and as Cointelegraph reported, signs on exchange order books pointed to manipulative moves by large-volume traders.

A subsequent comedown after the weekly close took BTC/USD below $24,000 before a bounce back to the same levels as Saturday, where the pair still traded at the time of writing, according to data from Cointelegraph Markets Pro and TradingView.

Đối với các thương nhân, có nguyên nhân tự nhiên để cảnh giác.

“Không chú ý nhiều đến cuối tuần PA.. BTC thường tiết kiệm những động thái có ý nghĩa cho giờ thị trường chứng khoán Mỹ,” Crypto Chase viết trong một phần tóm tắt Twitter.

Monitoring resource Material Indicators, which originally flagged the order book activity, meanwhile queried how long the phenomenon might continue with bulls powerless to make inroads higher.

Bạn có nghĩ rằng hỗ trợ sẽ giữ tại bức tường giá thầu khét tiếng để chơi phạm vi một lần nữa hoặc sẽ nó giả mạo và đổ?

Hãy nhớ rằng #TradFi Markets đóng cửa vào thứ Hai. Nếu bạn đang chơi trò chơi với Notorious B.I.D., hãy quản lý rủi ro của bạn cho phù hợp. Pic.twitter.com/ZyzlhtmFWM

— Chỉ số vật liệu (@MI_Algos) Tháng hai 19, 2023

Một biểu đồ bổ sung của cuốn sách lệnh Binance xác nhận rằng hỗ trợ giá thầu lớn, được gọi là “bức tường giá thầu”, đã di chuyển xuống mức $23,460, cho phép giá giao ngay thấp hơn bên cạnh.

Fellow trader and analyst Matthew Hyland meanwhile admitted that it was “really hard to tell” whether Bitcoin could break higher on short timeframes.

Holding the area around $22,800 in the event of a pullback, followed by the key breakout, however, “wouldn’t surprise me,” he said on the day.

More concerned about the strength of the rally was Venturefounder, a contributor to on-chain analytics platform CryptoQuant.

In a Twitter thread, he warned that even external factors such as “macro weakness” could have an immediate bearish impact on crypto markets.

“Bitcoin bearish RSI divergence continues… Almost the exact opposite way of May-July 2021 period. I think any macro weakness can have BTC snap back to $19-20k real quick,” part of comments stated.

Venturefounder referenced the Relative Strength Index (RSI) metric, which measures how overbought or oversold an asset is at a given price point. In 2021, RSI was increasing versus a BTC price correction, this subsequently ending in current all-time highs of $69,000 in November that year.

All eyes on FOMC minutes and U.S. dollar

What form that “weakness” on macro markets might take remains to be seen.

The upcoming week holds considerably fewer potential macro triggers than the last, with a sprinkling of U.S. data releases including personal spending in the form of the Personal Consumption Expenditures (PCE) Index.

The event on most crypto pundits’ radar, however, is the release of the minutes from February’s Federal Open Market Committee (FOMC) meeting at the Fed.

This was where the latest benchmark interest rate hike was decided, and expectations now are for Fed Chair Jerome Powell to have included talk of a moratorium on rate hike policy — if only theoretically.

“We also have FOMC minutes releasing on Wednesday where Powell will describe what a rate hike ‘pause’ could look like,” Crypto Chase mentioned about the event.

“Middle of upcoming week is where I start considering swing entries.”

Not everyone is convinced that the FOMC minutes will be plain sailing, however. Among them is financial market research resource Capital Hungry, which this week warned that “sneaky hawkish revisions” may be revealed.

“Feds sneak in hawkish revisions out of the spotlight (not an active FOMC) with market already adjusted to CPI revisions and Jan report. PCE data feeds into elevated inflation sentiment,” it argued in part of Twitter commentary.

Any return of inflationary tendencies would be a boost to U.S. dollar strength, which spent the last macro trading day of last week erasing prior gains.

Matthew Dixon, founder and CEO of crypto rating platform Evai, spelled out the bearish scenario for the U.S. dollar index (DXY), in what would be a bullish tailwind for risk assets including crypto.

Looking the look of #DXY so far. If we are already on the way down to complete the Y wave then this will be positive for #Btc #Eth #Crypto and risk assets in general #Evai pic.twitter.com/9OEHTG1d1v

— Matthew Dixon – CEO Evai (@mdtrade) February 20, 2023

Analyst: moving average “cloud” is there to be broken

As Cointelegraph continues to report, Bitcoin bulls have a problem which is becoming increasingly obvious on short timeframes — the 200-week moving average (WMA).

A classic “bear market” trend line, the 200WMA has acted as resistance since the middle of 2022, and BTC/USD has spent more time below than ever before.

Reclaiming the level would mark a conspicuous achievement, but so far, all attempts have met with flat rejection.

“If Bitcoin manages to break above the 200-week MA cloud, which is becoming increasingly likely, we’re going to see a lot more TradFi coverage of crypto again,” Caleb Franzen, senior market analyst at Cubic Analytics, summarized at the weekend.

Franzen additionally showed the levels at stake in the short term, with $25,200 the ceiling in need of a breakout.

Short-term levels that #Bitcoin keeps wrestling with… pic.twitter.com/Qmx9UBKyht

— Caleb Franzen (@CalebFranzen) February 19, 2023

The “cloud” he referred to involves more than just the 200WMA, however — Bitcoin’s 50WMA is currently at $24,462, coinciding exactly with current spot price focus.

Additionally, asks on exchange order books are stacked around the 200WMA, increasing the challenges present in flipping it from resistance to support.

In research published on Feb. 18, Franzen described the WMA cloud as one of “two major signals to add more bullish fuel to the fire” alongside realized price.

“BTC was rejected on this dynamic range for the first time in August 2022 and was briefly rejected on this level earlier in the week. While it be able to break above on this second attempt?” he queried.

Hash rate, difficulty in line for fresh record highs

In a familiar silver lining, Bitcoin’s network fundamentals are keeping the bullish vibe firmly intact as the month draws to a close.

The next automated readjustment will see difficulty add an estimated 10% to its existing tally. This will cancel out the previous readjustment’s modest decline to send difficulty to new all-time highs.

This is a key yardstick for gauging Bitcoin miner sentiment, as such large increases suggest corresponding advances in competition for block subsidies.

It comes on the back of increasing coverage of so-called “ordinals” fees, with miner profitability clearly recovering after months of pressure.

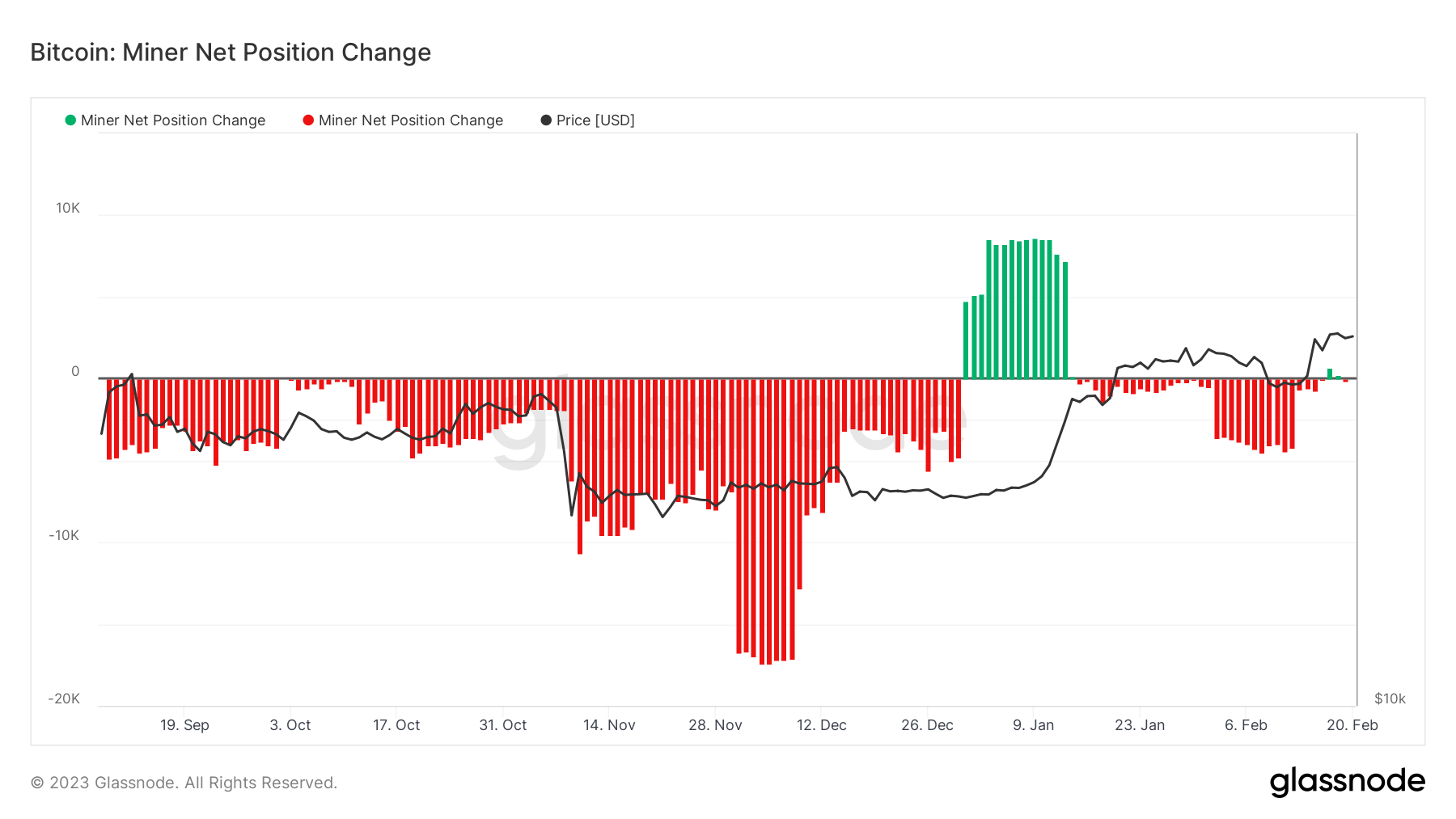

Data from on-chain analytics firm Glassnode bears this out. Miners have begun retaining more BTC than they sell on rolling monthly timeframes, it shows, reversing a trend of net sales in place from mid-January.

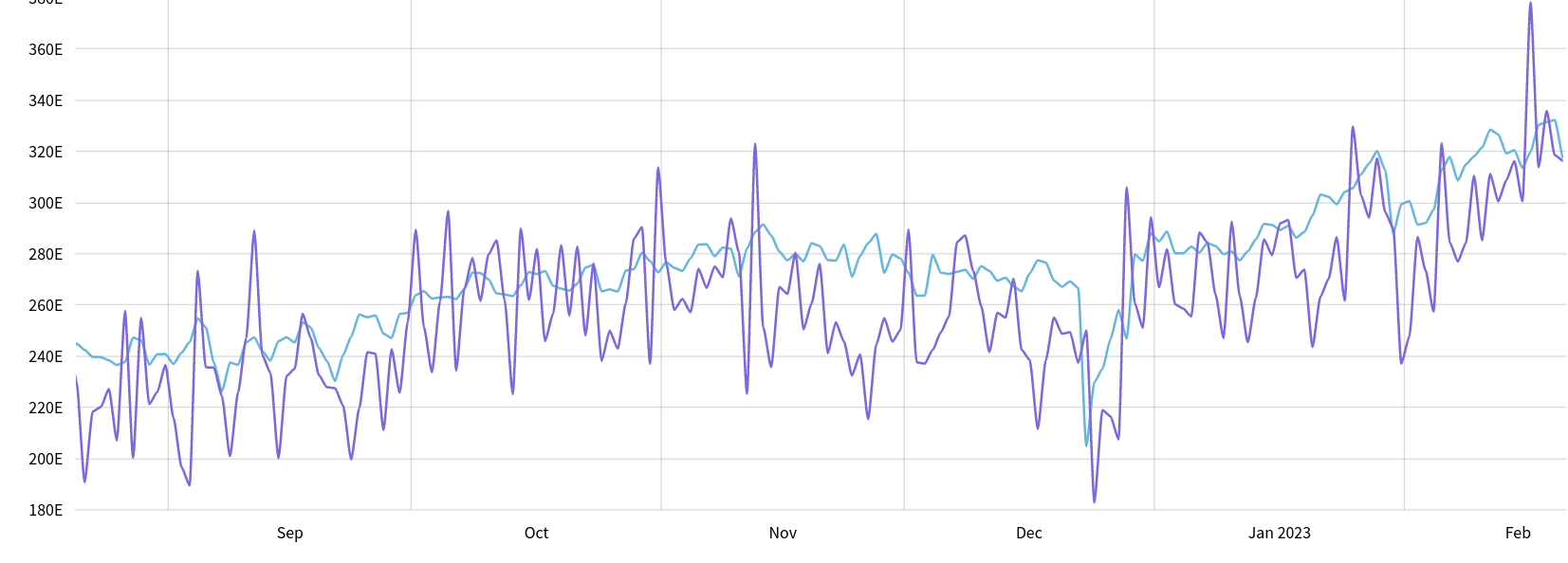

Raw data from MiningPoolStats meanwhile shows Bitcoin network hash rate also preserving its upward trend, remaining at over 300 exahashes per second (EH/s).

“Unstoppable!” economist and analyst Jan Wuestenfeld commented about the phenomenon as its 30-day moving average climbed to new all-time highs of its own last week.

Joe Burnett, head analyst at Blockware, described hash rate growth as “truly relentless.”

“The 14 day moving average of total global hashrate now sits at ~ 290 EH/s. Bitcoin miners are scavenging the Earth for cheap, wasted, excess energy,” he added alongside Glassnode figures.

Longtime Bitcoin market participants will recall the once popular phrase, “price follows hash rate,” which postulates that a large enough hash rate uptrend has inevitable bullish implications for BTC price action.

Most “greed” since Bitcoin all-time highs

$25,000 is a headache for reasons beyond solid resistance — breaking above it could be an unsustainable move for Bitcoin.

Related: Bitcoin’s bullish price action continues to bolster rallies in FIL, OKB, VET and RPL

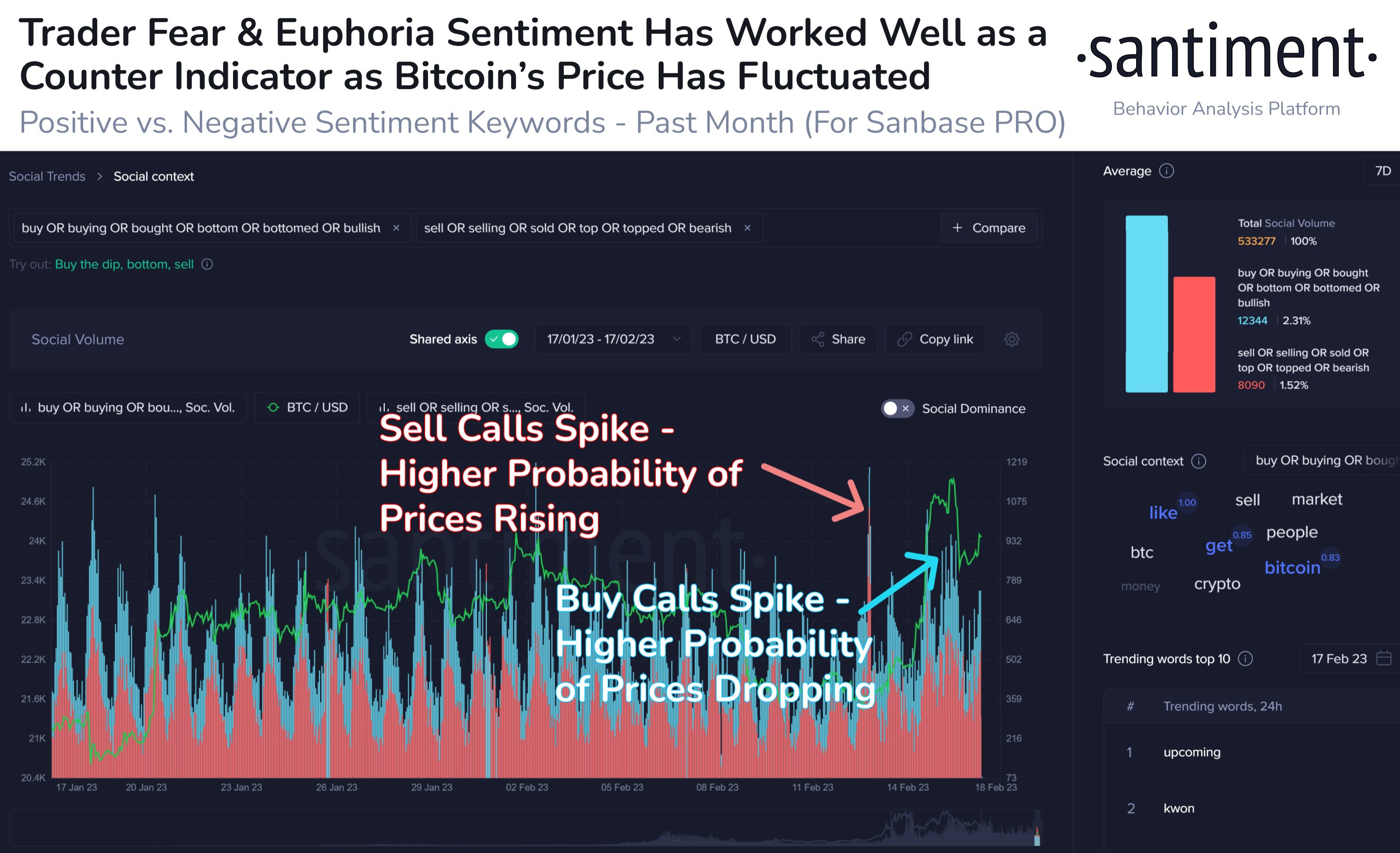

The latest findings from research firm Santiment suggest that at around those multi-month highs, crypto market sentiment simply becomes too greedy.

“Bitcoin’s 8-month high yesterday came with a great amount of euphoria,” it commented on a chart showing social media activity.

“Perhaps a bit too much, as the positive commentary on social platforms may have created a local top. Just as the negative commentary on Feb. 13th likely contributed to the bottom.”

The phenomenon is also visible on altcoins, with Santiment singling out Dogecoin (DOGE) as a key example this month.

“This pattern of social volume and highly positive sentiment toward Dogecoin perfectly illustrates how euphoria creates price tops. Regardless of your opinion on DOGE, hype on this asset in particular historically foreshadows market corrections,” it concluded.

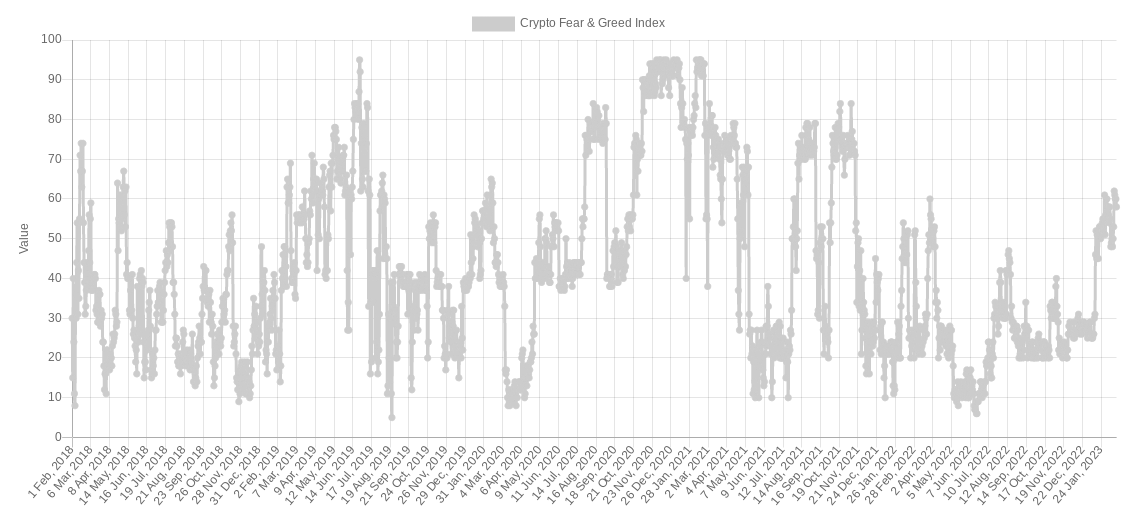

The ever-popular Crypto Fear & Greed Index meanwhile shows “greed” as the overriding sentiment flavor across crypto this week.

The push to the highs for Bitcoin coincided in a reading of 62/100 for the Index, marking new highs in the period since the November 2021 push to $69,000 on BTC/USD.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.