Key takeaways:

-

Bitcoin must hold support at $114,000 to confirm the recovery.

-

Spot volume and trading activity must recover to ensure a sustained breakout in BTC price.

Bitcoin’s (BTC) 10% rally from its Oct. 17 lows of $103,500 appears to have stalled at $115,000, amid diminishing demand and low onchain activity.

Several analysts revealed what must happen to increase Bitcoin’s potential to break above $115,000 in the following days or weeks.

Bitcoin must hold $114,000 support

BTC price’s 5% climb over the last seven days saw it reclaim key levels, including the 200-day simple moving average (SMA), the $110,000 psychological level and $114,000, where it has found support, per data from Cointelegraph Markets Pro and TradingView.

Related: BTC price eyes record monthly close: 5 things to know in Bitcoin this week

Bitcoin’s bullish case hinges on bulls defending the support at $114,000, according to Swissblock.

“This week is about confirmation — proving that Bitcoin is forming a bottom and can hold the $114K support,” the private wealth manager said in a Tuesday X post.

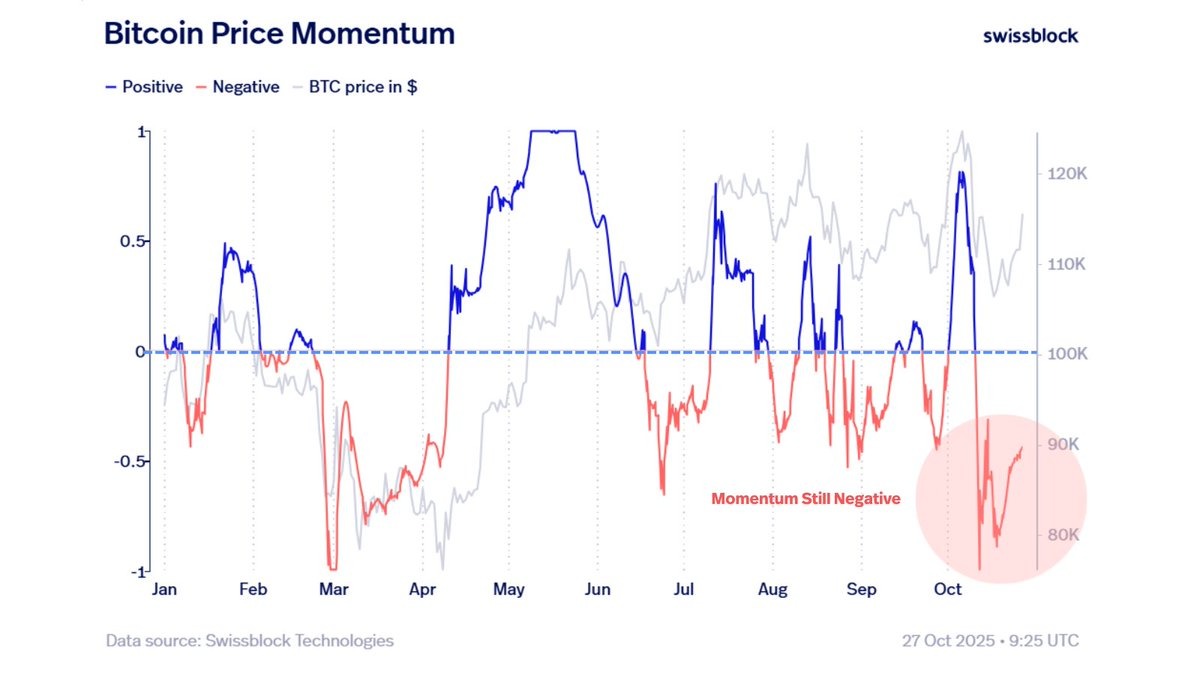

Swissblock explained that as price momentum has remained negative since the Oct. 11 flash crash, the key now lies in “momentum ignition,” adding:

“For BTC to sustain upside continuation, it must generate fresh buying pressure to defend $114K and begin constructing a new bullish structure from that base.”

Crypto analyst Rekt Capital said that Bitcoin bulls needed to turn the weekly close at $114,500 into support through a retest to confirm the breakout.

Bitcoin has successfully Weekly Closed above both the 21-week EMA (green) and $114.5k (black)

Both $114.5k & EMA could get retested to confirm a reclaim to support$BTC could achieve this via a volatile retest of $114.5k, wicking into the EMA below#Crypto #Bitcoin https://t.co/T7WJgk9mIY pic.twitter.com/hw1chWDSdx

— Rekt Capital (@rektcapital) October 27, 2025

Fellow analyst Daan Crypto Trades said holding the 200-day exponential moving average (EMA) at $114,000 is crucial going forward.

As Cointelegraph reported, the bulls aimed to defend the $112,300-$114,500 demand zone, with their eyes set on all-time highs above $126,000.

New demand, onchain activity will push BTC higher

Bitcoin’s ability to push above $115,000 appears limited due to the absence of buyers and low network activity.

The chart below shows that Bitcoin’s spot cumulative volume delta (CVD) and perpetual CVD remain negative, but have been flattening out over the last two weeks.

This indicates that “aggressive selling pressure has subsided over the last several days,” onchain data provider Glassnode said in a post on X.

Meanwhile, spot trading volume has declined by 17.5% to $12.5 billion from $15.2 billion over the last week, suggesting a lack of speculative activity.

The decline suggests that Bitcoin’s recent recovery to $116,000 was “not supported by broad participation,” Glassnode wrote in its latest Weekly Market Impulse report, adding:

“The pullback suggests cooling participation and a potential consolidation phase, with rising prices yet to be confirmed by stronger inflows.”

A rise in spot volume would align with a broader accumulation phase, triggering a strong rally.

Additionally, onchain activity remains muted, with a “dip in active addresses, transfer volume, and fees, pointing to a quieter network environment and a consolidating user base,” Glassnode said, adding:

“Until conviction deepens and demand broadens, Bitcoin is likely to remain in a rangebound consolidation, with cautious optimism beginning to replace defensive positioning.”

As Cointelegraph reported, consolidation amid favorable RSI signals, combined with an expected Federal Reserve interest-rate cut, could be the trigger for the next rally in the next few days.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.