Bitcoin (BTC) bắt đầu một tuần mới ở mức cao mới 2023 nhưng vẫn phân chia ý kiến sau một đợt tăng giá phồng rộp.

Trong những gì đang định hình để trở thành thuốc giải độc cho sự chảy máu chậm của năm ngoái, tháng Giêng đã đưa ra sự biến động của những con bò đực Bitcoin đã hy vọng – nhưng họ có thể duy trì nó?

Đây là câu hỏi chính cho những người tham gia thị trường đi vào tuần thứ ba của tháng.

Ý kiến vẫn chia rẽ về sức mạnh cơ bản của Bitcoin; một số người tin rằng cuộc diễu hành đến mức cao nhất trong hai tháng là một “tăng điểm của sucker”, trong khi những người khác đang hy vọng rằng thời điểm tốt sẽ tiếp tục – ít nhất là trong thời gian này.

Ngoài động lực thị trường, không thiếu các chất xúc tác tiềm năng đang chờ đợi để khẳng định mình trên tâm lý.

Dữ liệu kinh tế Hoa Kỳ sẽ tiếp tục đến, trong khi thu nhập của công ty có thể mang lại một số biến động mới cho thị trường chứng khoán trong tuần này.

Cointelegraph takes a look at five potential BTC price movers as all eyes focus on new support levels and the fate of the Bitcoin bear market.

Giá BTC do củng cố, các nhà phân tích đồng ý

Bitcoin đã phải đối mặt với sự hoài nghi ngày càng tăng sau khi vượt qua một số mức kháng cự quan trọng trong suốt tuần qua.

As Cointelegraph reported, consensus remains skewed to the bearish side long term, with few believing that current momentum will end up any more than a bear market rally.

Với những cảnh báo về mức thấp vĩ mô mới là $12.000 vẫn còn hiệu lực, Bitcoin đang được theo dõi mạnh để có dấu hiệu của sự sụp đổ. Cho đến nay, tuy nhiên, điều này đã không được thực hiện.

Mức đóng cửa hàng tuần gắn liền với những giá từ trước khi FTX sụp đổ, và tại thời điểm viết bài viết, BTC/USD vẫn ở trên $20,000, đã chạm mức cao mới trong vùng 21,411 qua đêm, dữ liệu từ Cointelegraph Markets Pro và TradingView cho thấy.

Volatility remained in action, with moves of several hundred dollars commonplace on hourly timeframes. A flash dip below the $21,000 mark at the time of writing was described by commentator Tedtalksmacro as a “liquidity hunt.”

Analyzing levels to hold in the event of a broader retracement, on-chain analytics resource Material Indicators identified the 21-week moving average (MA) at $18,600.

“Một bức tường giá thầu $11M được đặt để bảo vệ Bitcoin 2017 Top”, nó ghi nhận cùng với một biểu đồ bổ sung của sổ đặt hàng Binance.

“Việc giữ trên mức đó là biểu tượng và làm tăng khả năng mở rộng đà tăng điểm, nhưng IMO giữ đường MA 21 tuần là rất quan trọng cho một đợt tăng duy trì. TradFi đóng cửa vào thứ Hai trong ngày MLK. Biến động vẫn tiếp tục.”

Một bài viết trước đó nói thêm rằng hoạt động cá voi thực sự đã giúp phao thị trường trên sàn giao dịch.

Nhằm mục đích đảo chiều các khoản lỗ FTX, trong khi đó, tài khoản giao dịch Stockmoney Lizards kêu gọi “củng cố một chút (ngang)” ở mức hiện tại.

Michaël van de Poppe, người sáng lập và Giám đốc điều hành của công ty thương mại Eight, nói rằng Bitcoin thực sự có thể củng cố như là kết quả của những thay đổi trong việc đánh dấu sức mạnh đồng đô la Mỹ.

Chỉ số đô la Mỹ (DXY) vẫn giao dịch gần mức thấp nhất kể từ đầu tháng Sáu năm 2022 vào ngày, chạm mức 107.77.

Focus shifts to earnings as stocks catalyst

This week will get off to a brisk start in terms of macro data, with producer price inflation (PPI) data coming on Jan. 18.

This will come amid various speeches from Federal Reserve officials, while stocks will likely be swayed by another phenomenon in the form of corporate earnings reporting through the week.

As noted by Bank of America strategists in a note last week, the S&P 500 has become particularly sensitive to earnings, these even overtaking classic data releases such as the consumer price index (CPI) in terms of impact.

“We see this as a narrative shift in the market from the Fed and inflation to earnings: reactions to earnings have been increasing, while reactions to inflation data and FOMC meetings have been getting smaller,” they wrote, quoted by media outlets including CNBC.

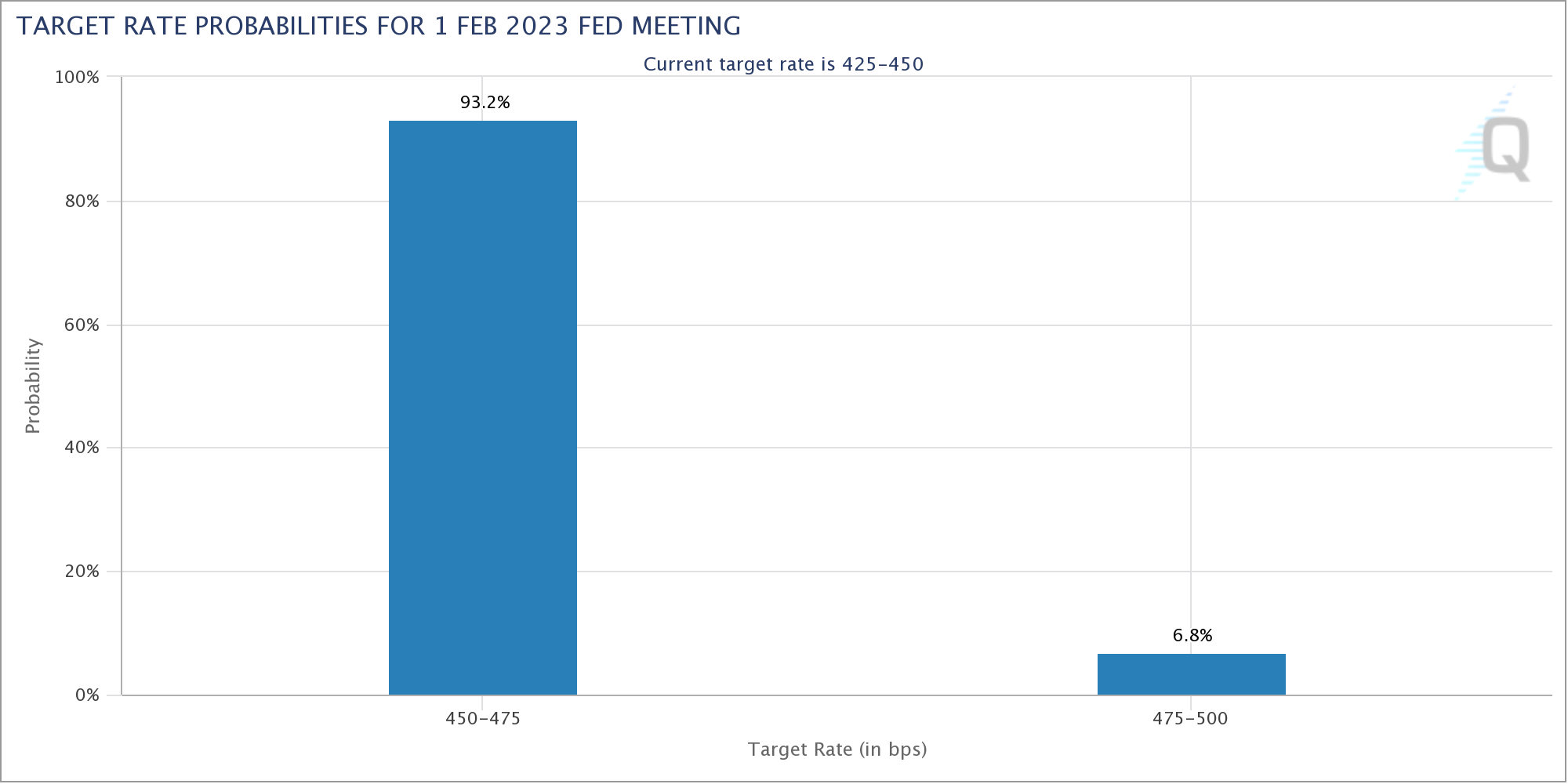

The strategists referred to the upcoming meeting of the Fed’s Federal Open Market Committee (FOMC), which on Feb. 1 will decide on interest rate hikes.

These are currently expected to be lower than any since early 2022, with sentiment favoring a 0.25% increase, according to CME Group’s FedWatch Tool.

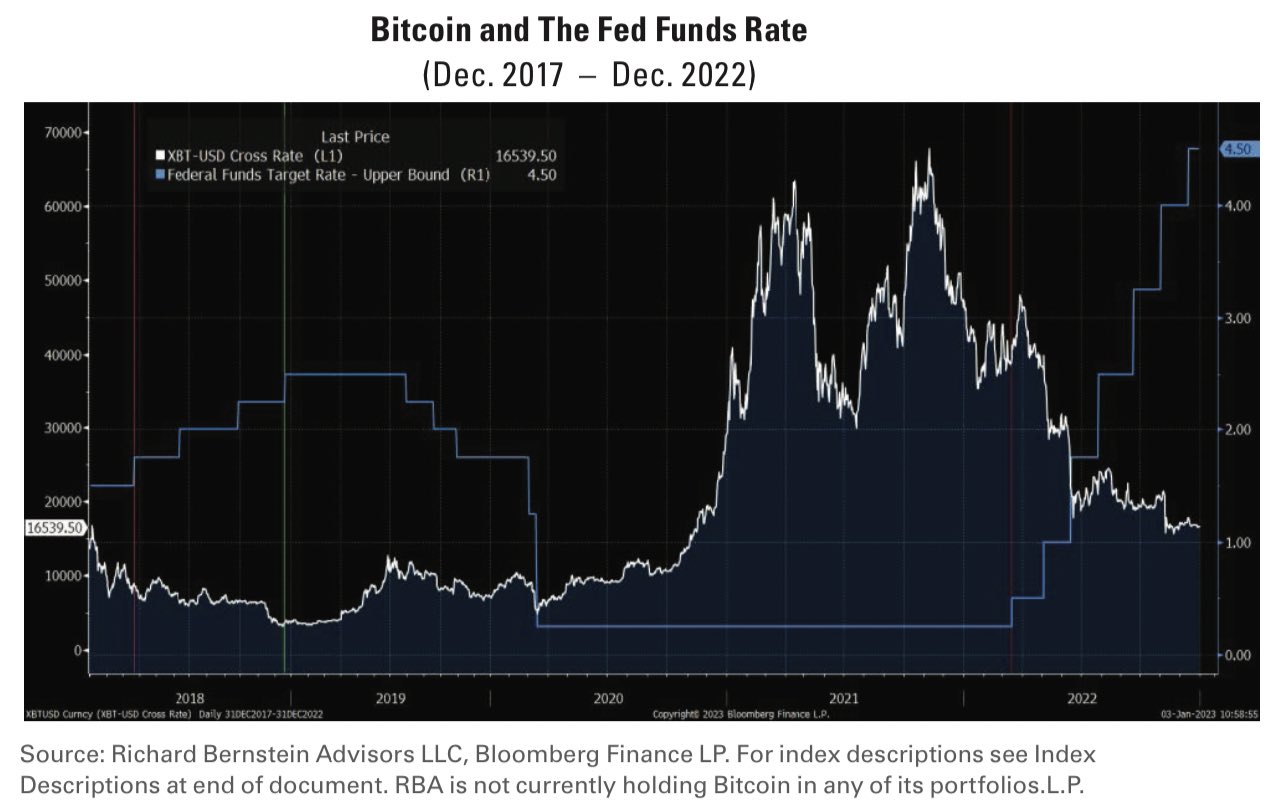

“The lower the Fed Funds, the more liquidity there is in the system,” Ram Ahluwalia, CEO of digital asset investment advisor Lumida Wealth Management, wrote in part of research last week.

An accompanying chart showed what Ahluwalia suggested was a beneficial relationship between lower Fed funds rates and Bitcoin liquidity.

He continued by referencing an appearance on mainstream media by veteran economist Larry Summers on Jan. 13, in which the latter made positive noises about inflation abating.

“Larry made a statement saying the Fed’s fight against inflation is ‘much, much closer to being done.’ This is a ‘positive surprise’ to risk assets and supports the Fed pivot camp,” he argued.

“BTC benefits from QE Hypothesis: One of the big macro desks listened and went long bitcoin.”

GBTC winning streak continues

On the topic of institutional interest recovery, another chart retracing the entirety of its FTX losses is the largest Bitcoin institutional investment vehicle, the Grayscale Bitcoin Trust (GBTC).

Data from Coinglass shows that as of Jan. 13, the latest date for which data is available, GBTC shares traded at a discount to net asset value (NAV) of 36.26%.

This discount, formerly positive and known as the “GBTC premium,” has been ticking higher since the end of December, and is now higher than at any point since the FTX meltdown.

Its largest ever reading came just before that, when it hit 48.62% as Grayscale suffered as part of parent company Digital Currency Group’s (DCG) own FTX troubles.

That controversy continues to rage, often publicly, but GBTC is delivering its most encouraging results in months.

Behind the scenes, meanwhile, Grayscale continues to battle U.S. regulators over their refusal to allow it to convert GBTC to an exchange-traded fund (ETF) based on the Bitcoin spot price.

In an extensive Twitter update on Jan. 13, Craig Salm, Grayscale’s chief legal officer, made multiple references to the firm’s “commitment” to win its case and bring the first spot Bitcoin ETF to the market in the U.S.

“To reiterate, converting GBTC to a spot bitcoin ETF is the best long-term way for it to track the value of its BTC,” he summarized.

“Our case is moving forward swiftly, we have strong, common sense and compelling legal arguments and we’re optimistic that the Court should rule in our favor.”

Difficulty hits new all-time high

If Bitcoin’s price recovery were not enough to get bulls excited, its network fundamentals tell a similarly encouraging story.

Roughly in step with the weekly close, network mining difficulty increased by over 10%, marking its biggest uptick since last October.

The move has obvious implications for Bitcoin miners, and suggests that the ecosystem is already benefiting from higher prices.

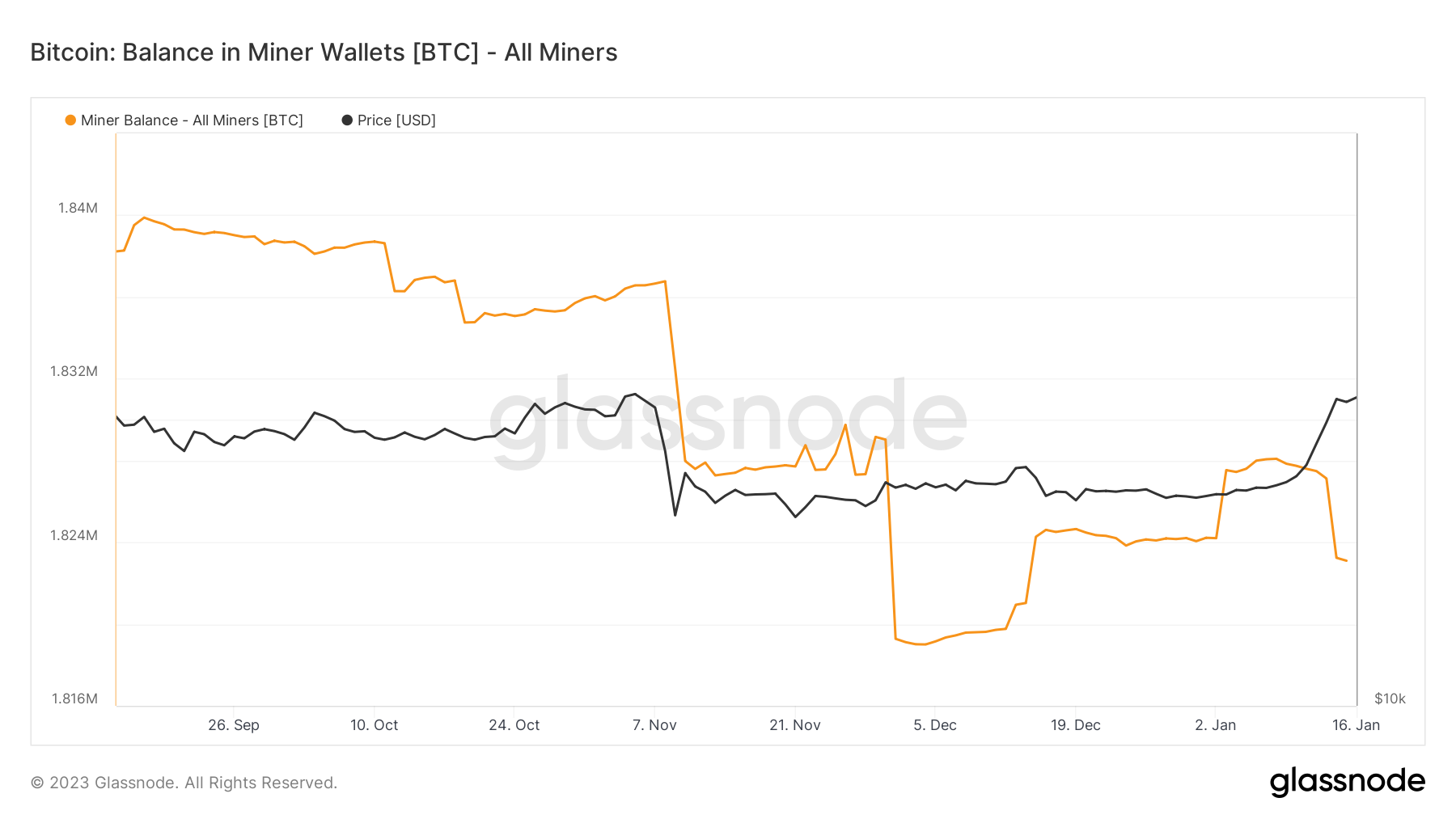

As Cointelegraph reported, miners had already been slowing the pace of their BTC reserve sales in recent weeks, while the difficulty increase reflects competition for block subsidies returning to the sector.

Over the past week, however, miners’ balances have decreased in response to Bitcoin’s rapid price rise. They stood at 1,823,097 BTC as of Jan. 16, data from on-chain analytics firm Glassnode shows, marking one-month lows.

Despite this, difficulty has now erased its FTX reactions, and set a new all-time high in the process.

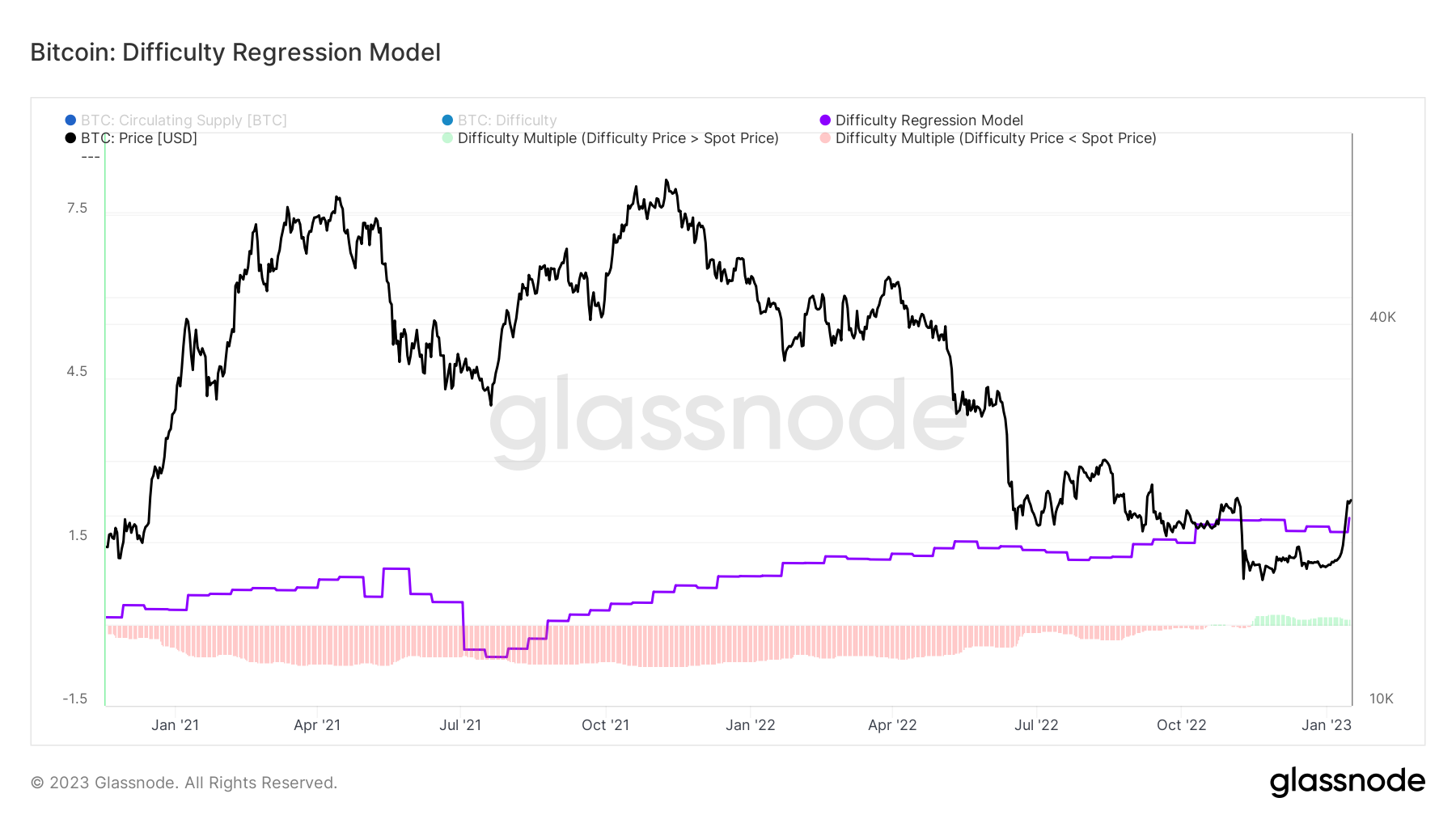

“Bitcoin is in the process of retesting the estimated average cost of production price for Miners,” Glassnode additionally noted last week, before the majority of the gains came.

It added that “breaking above this level like offers much needed relief to miner incomes.”

An accompanying chart showed its proprietary “difficulty regression model,” which it describes as “an estimated all-in-sustaining cost of production for Bitcoin.”

Sentiment exits “fear” as whales buy big

It is no secret that the average Bitcoin hodler is experiencing some much needed relief this month, but is it a case of unchecked euphoria?

Related: 5 altcoins that could breakout if Bitcoin price stays bullish

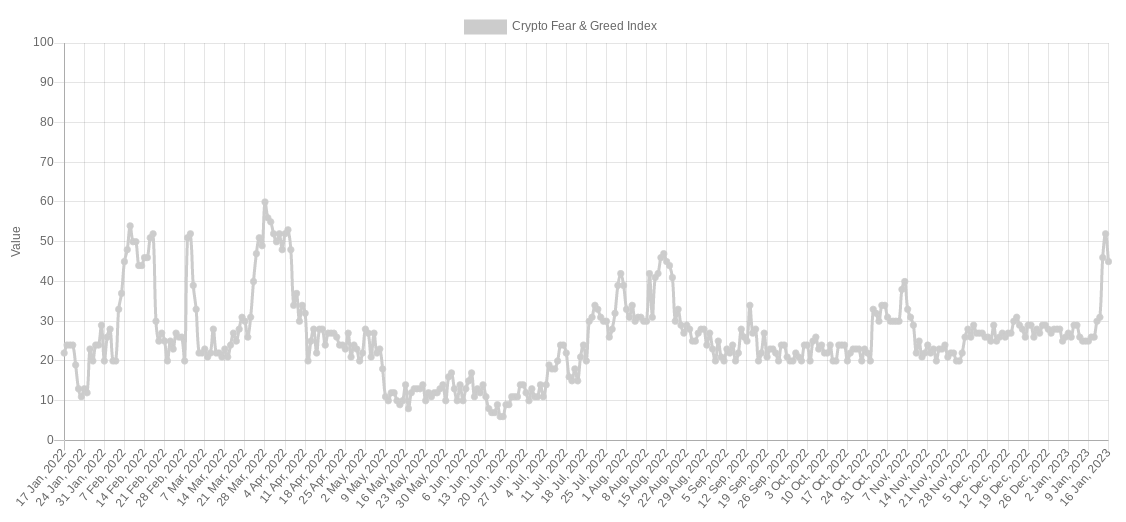

According to time-honored yardstick, The Crypto Fear & Greed Index, it could well be “too much, too soon” when it comes to changes in the mood over Bitcoin price strength.

On Jan. 15, the Index hit its highest levels since last April, and while not “greedy” yet, the move marks a big change from just weeks prior.

As Cointelegraph reported, the crypto market spent a large swathe of 2022 in its lowest “extreme fear” bracket, something not helped by FTX.

Now, it is scoring above 50/100, dropping slightly into the new week to stick in “neutral” territory.

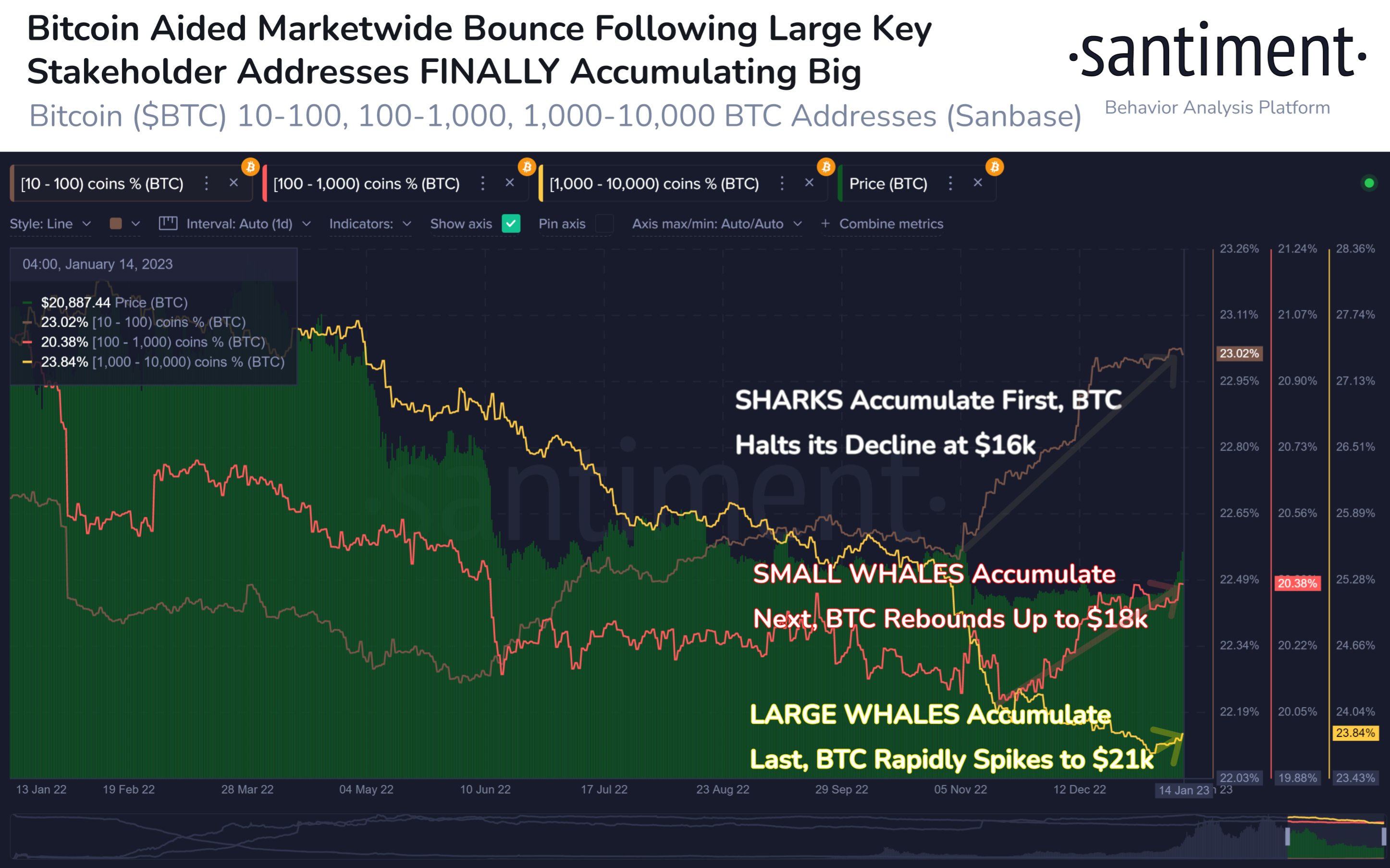

For research firm Santiment, which specializes in gauging the atmosphere around crypto markets, there is nonetheless one overriding factor influencing Bitcoin’s newfound strength.

The answer, it wrote in a Twitter post at the weekend, lies firmly in whale activity.

Over the ten days to Jan. 15, whales big and small added to their positions, sparking a chain reaction of supply and demand in the process. In total over that period, they purchased 209,700 BTC.

Santiment called the data “a definitive explanation on why crypto prices have bounced.”

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.