Fundamental analysis is the process of finding the intrinsic value of an asset, with the goal to determine whether the asset is overvalued or undervalued. That information can then be leveraged along with technical analysis to decide whether to invest in or trade an asset.

Trong phân tích cơ bản tiền điện tử, phương pháp này hơi khác so với phương pháp thường được sử dụng để đánh giá tài sản thị trường di sản. Tài sản Crypto không có dữ liệu lịch sử cần thiết, bởi vì thường không có lịch sử báo cáo thu nhập hoặc báo cáo lợi nhuận và lỗ.

Đối với phân tích tiền điện tử, tất cả các thông tin có sẵn về tài sản cần được tìm kiếm thông qua nghiên cứu bao gồm điều tra các trường hợp sử dụng của nó, mạng lưới của nó, nhóm đằng sau dự án, lịch trình trao quyền, danh sách tiếp tục. Bằng cách xem xét các yếu tố phù hợp, các nhà giao dịch có thể xác định giá trị cơ bản của một dự án cơ bản trước khi đầu tư.

Dưới đây là 10 bước được tìm thấy hữu ích nhất:

1. Đọc trang trắng

Đặc biệt đối với đầu tư mua và giữ dài hạn, điều quan trọng là phải đọc giấy trắng của token. Đây là tài liệu đưa ra một cái nhìn tổng quan có chủ ý và chi tiết về một dự án. Một trang trắng tốt giải thích:

- Mục tiêu của dự án

- Các trường hợp sử dụng và phân phối

- Tầm nhìn của nhóm

- Công nghệ đằng sau mã thông báo

- Kế hoạch nâng cấp và các tính năng mới

- Làm thế nào token cung cấp giá trị cho người dùng

2. Đánh giá các tuyên bố của trang trắng

Be skeptical because the people behind projects can bend, or even break, the truth.

This happens more often than most realize. For example, Michael Alan Stollery, the CEO and founder of Titanium Blockchain Infrastructure Services, raised $21 million in an initial coin offering (ICO).

Sau đó ông thừa nhận đã làm sai lệch các phần của trang trắng của dự án.

Điều quan trọng là đặt ra một số câu hỏi khó khăn và nhận được câu trả lời đầy đủ trước khi đưa tiền vào một dự án.

Một số câu hỏi cần xem xét:

- Are the tokens really distributed the way they promise?

- Are they meeting the road map expectations?

- Are they inventing a problem just to solve it?

- What are other people saying about it?

- Are there any red flags?

- Do the goals seem realistic?

3. Nhìn vào đối thủ cạnh tranh

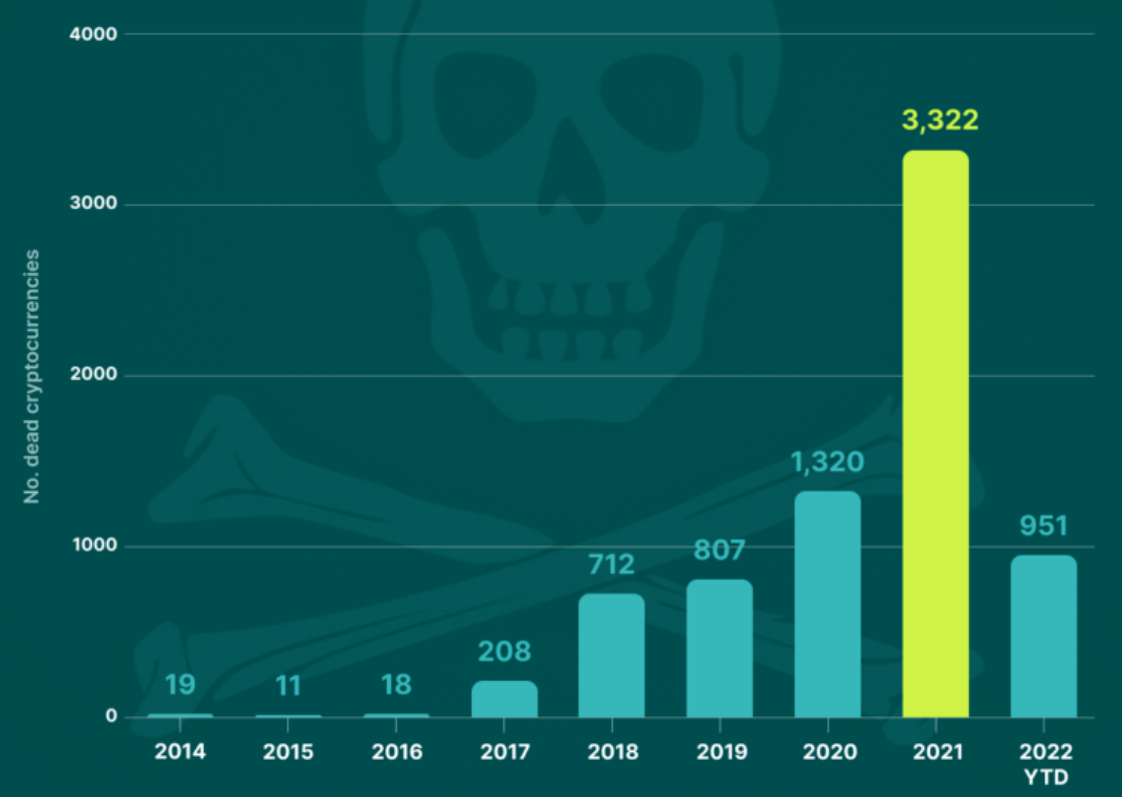

According to some industry sources, nearly 40% of cryptocurrencies that were listed in 2021 no longer exist.

đó phục vụ như một sự thật quan trọng các nhà đầu tư cần phải tính đến; rất nhiều dự án — gần một nửa và nó có thể thậm chí còn nhiều hơn nữa – thất bại, và thất bại thảm hại.

Scrutinizing a project’s white paper reveals the use case the crypto asset is targeting and the problem it is trying to solve. One should then consider whether or not that use case is, in fact, viable and wanted.

Furthermore, it’s important to identify competing projects and examine existing projects this new one might replace, if successful. Bottom line: Smart investors are looking to see if this project is better than others or not.

4. Look at the team behind the project

A project is only as good as the team behind it.

The people offering the project must have precisely the right skills to make their project work. The white paper should have information about each member of the team, but doing some independent research can be helpful too.

Some questions to consider about the people behind any project:

- Have they worked on other reputable, successful projects in the past?

- What are their credentials? Are they experienced?

- Are they reputable members of the crypto community and blockchain ecosystem?

- Have they been involved in any questionable projects or scams?

What if there is no team? Then look to the developer community.

Find out if the project has a public GitHub. Check to see the number of contributors and activity levels. The more consistent development activity on a project the better.

5. Look at on-chain metrics

On-chain metrics are available by looking at data on the blockchain.

The data can be pulled from websites or APIs — such as on-chain analysis, data charts and project reports — specifically designed to inform investment decisions.

Some of the data worth considering:

- Transaction count — a measure of activity taking place on a network. The more activity, the better.

- Transaction value — how much value has been transacted within a period of time. The higher this number is, the better.

- Active addresses — how many blockchain addresses are active at any point in time. Again, the more active addresses, the better.

- Fees paid — how the demand for block space is growing or shrinking for a token based on fees.

- Hash rate — a measure of the network health in proof-of-work cryptocurrencies. The higher the hash rate, the more difficult it is to successfully mount a 51% attack.

- Staking — the amount staked at a given time shows the interest level, or lack of it, in the project.

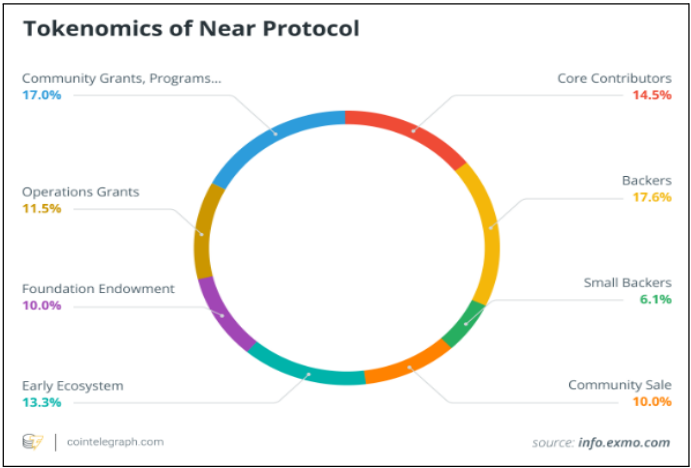

6. Look at the tokenomics

Invest in projects that create useful tokens, otherwise, the token may not have utility in the marketplace.

In addition, if the token is useful, it still needs to be determined how the market will embrace it, thereby making sense of the token’s price movements and allowing investors profit opportunities on an ongoing basis.

Some questions to consider:

- Is the token useful?

- How do people get the token?

- What is the inflation or deflation rate?

- Was it an ICO asset?

7. Market cap, trading volume, liquidity

Some of the most important analysis is about the financial metrics of the token associated with a project, including:

- Market capitalization — the network’s value represented by the hypothetical cost to buy every unit of the asset. The “market cap” gives insight into the growth potential of the network, and it is calculated by multiplying the circulating supply by the current price.

- Trading volume — the amount of value that was traded in a certain amount of time (daily, weekly, monthly). It points to whether a token has enough liquidity.

- Liquidity — an indicator that measures how easily a token can be bought and sold. The more liquid a token is, the easier it is to sell it at its current trading price.

8. Community

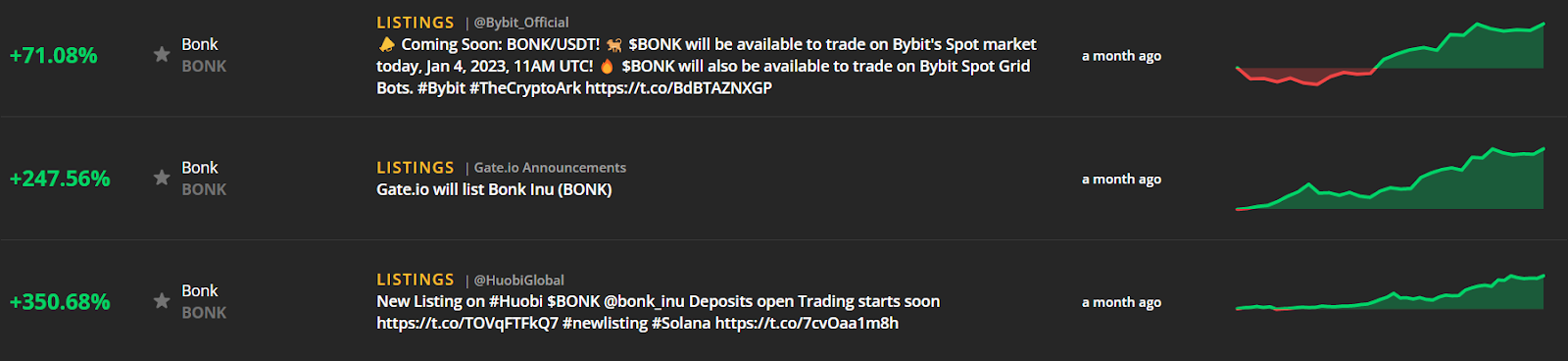

When a community is behind a project, it tends to help the project’s token appreciate in value.

Social media, for instance, can have a significant impact on a crypto asset’s price action. Meme coins such as Dogecoin and Shiba Inu skyrocketed in price, in part, due to social media excitement.

Just recently, Solana’s BONK token got a huge price boost as social media activity pushed interest levels in the asset to new highs.

A community that is backing a coin is a powerful catalyst, so here are a few questions to consider:

- Is the community active and excited?

- Are there a lot of shilling accounts?

- Is sentiment good?

- Are there plenty of developers?

Remember, a token’s price goes up only if there is interest and market action. The more people talk about and invest in a token, the more likely its price will appreciate.

9. Marketing

Currently, there are about 21,910 cryptocurrencies investors can choose from — that’s a lot of competition!

The team behind a project needs to actively market its token in order to differentiate itself from the crowd, and industry insiders are saying that it is now harder than ever to stand out.

In addition, with the continual advent of new tokens on the market, established cryptos are struggling to retain market share.

So, the team behind the project must actively build brand awareness, get customers and retain customers to improve sales and profits.

Some questions to consider before investing in a project:

- Is the core team marketing the product well?

- Do they have a dedicated marketing team?

- Are they increasing market share or not?

10. If the core product is available, test it out

This one might be a little tough for someone who is just looking to invest in the underlying token of a project. However, let’s say one is considering an investment in Ethereum (ETH).

Since Ethereum is a decentralized global software platform, a functional, secured digital network technology would demonstrate for certain how the platform actually works.

Knowing this could definitely help inform a potential investing decision.

After all, if the platform is hard to use, time-consuming or otherwise creates more problems than it solves, it may be wise to steer clear of investing in such a platform until these issues are addressed.

So there it is — 10 steps for sound fundamental analysis to help evaluate the profit potential of any asset before any investing or trading.

See how Cointelegraph Markets Pro delivers market-moving data before this information becomes public knowledge.

Cointelegraph is a publisher of financial information, not an investment adviser. We do not provide personalized or individualized investment advice. Cryptocurrencies are volatile investments and carry significant risk including the risk of permanent and total loss. Past performance is not indicative of future results. Figures and charts are correct at the time of writing or as otherwise specified. Live-tested strategies are not recommendations. Consult your financial adviser before making financial decisions.

All ROIs quoted are accurate as of February 16th, 2023…