Bitcoin (BTC) bắt đầu một tuần mới trong phạm vi giá làm các nhà giao dịch thất vọng và để lại ít cho trí tưởng tượng – điều gì tiếp theo?

Sau khi hoạt động ít quý giá vào cuối tuần, tiền điện tử lớn nhất thiếu định hướng, và thậm chí kích hoạt kinh tế vĩ mô đã không thể thay đổi hiện trạng.

Ở khoảng 10% dưới mức $30,000, BTC/USD đang bước vào nước, và bất chấp lời kêu gọi điều chỉnh thêm, những người tham gia thị trường đang đối phó với một phạm vi giao dịch hoạt động nhỏ.

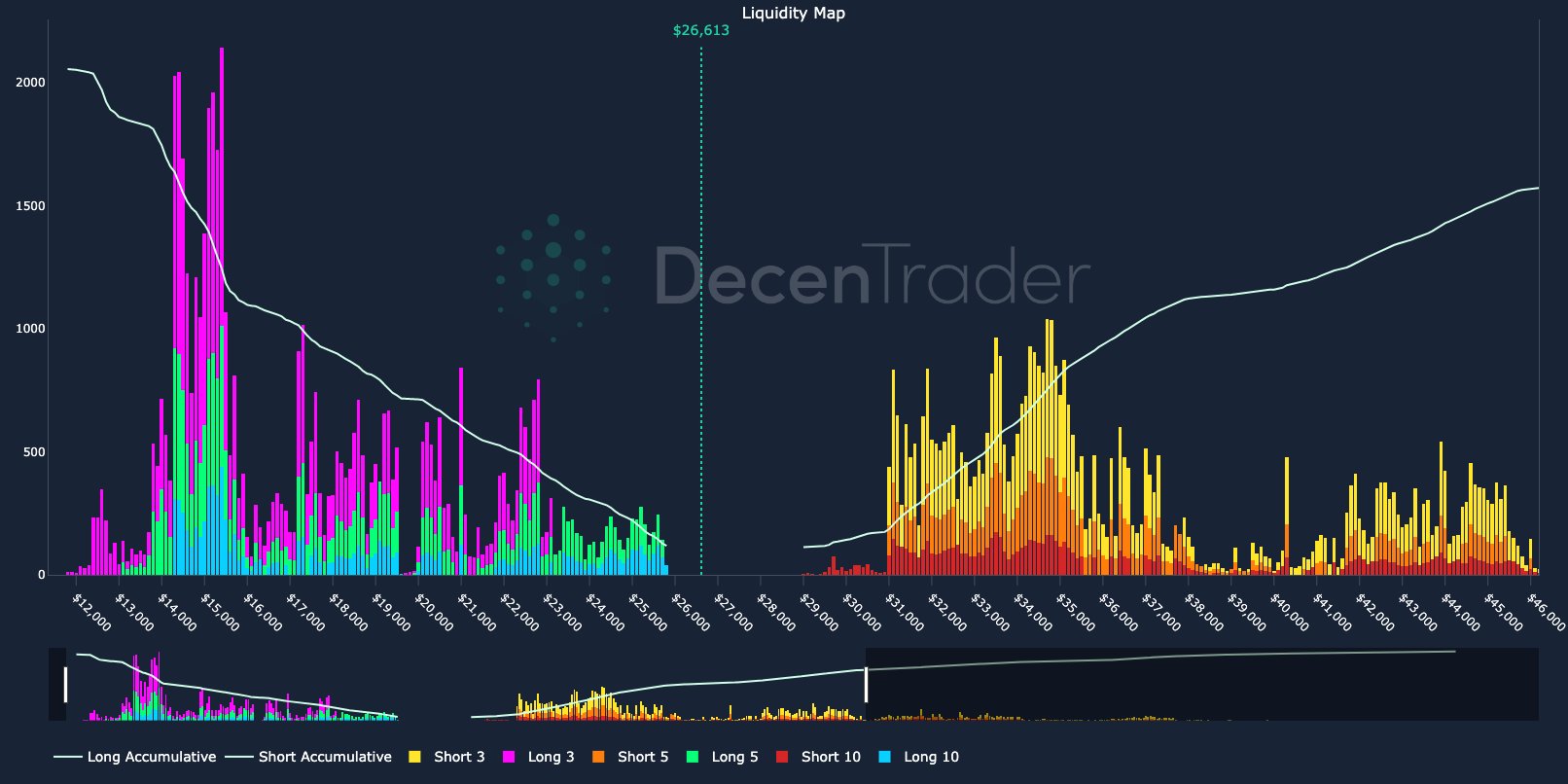

Thanh khoản là có để được thực hiện ở trên và dưới, nhưng cho đến nay, chỉ có một trêu chọc của một cuộc quét thanh khoản đã được thực hiện.

Những ngày tới có một số bất ngờ vĩ mô tiềm năng trong cửa hàng, nhưng các nhà phân tích đồng ý sẽ mất một sự thay đổi đáng kể trong dữ liệu để crack một Bitcoin bướng bỉnh.

Ở những nơi khác, tín hiệu trên chuỗi cũng là đặc trưng của một giai đoạn củng cố sau khi tăng nhanh chóng được thấy trong quý 1.

Cointelegraph xem xét cảnh quan về hành động giá BTC để xem những gì có thể phá vỡ xu hướng – hoặc thiếu nó – trong tuần này.

Thanh khoản ở đâu?

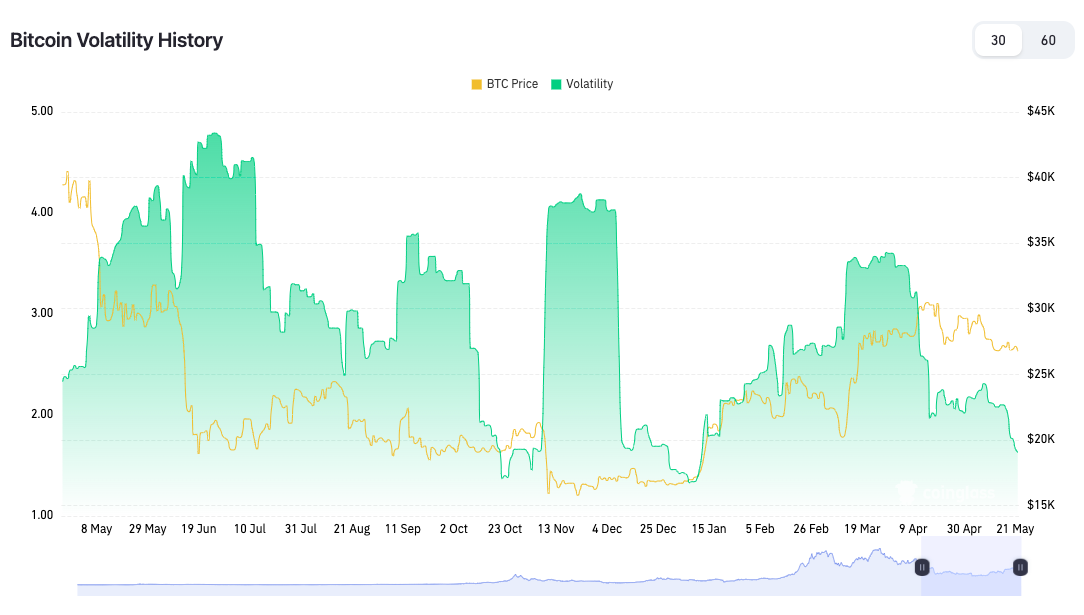

Hiệu suất giá giao ngay Bitcoin đang làm cho các nhà giao dịch đau đầu – không phải vì sự biến động mà là thiếu nó.

Trong những gì cảm thấy như một trạng thái bất thường của các sự kiện, BTC/USD đang hoạt động trong phạm vi chỉ vài trăm đô la, mà không có gì có thể thay đổi tâm trạng.

Ngay cả những nhận xét của tuần trước từ Jerome Powell, chủ tịch Cục Dự trữ Liên bang Hoa Kỳ, cũng không đủ để đưa Bitcoin cao hơn hoặc thấp hơn một cách dứt khoát.

Do đó, các nhà giao dịch đang ngày càng ở bên lề chờ đợi tín hiệu.

“Nếu chúng ta mất $26,600 và đóng cửa trên 4 giờ nến đóng cửa tôi sẽ xem xét ngắn. Bears đưa chúng tôi đến hỗ trợ, nhưng bây giờ họ có thể đưa chúng tôi và đóng cửa dưới đây,” Crypto Tony tóm tắt cho những người theo Twitter vào ngày.

Phạm vi nhỏ chỉ dưới $27.000 đã là nhà của Bitcoin kể từ ngày 13 tháng 5. Bên ngoài, cả thanh khoản dài và ngắn nằm trong chờ đợi.

Theo dữ liệu từ bộ giao dịch DecentTrader, việc di chuyển đến $25,800 là tất cả những gì cần thiết để tạo ra một số hình thức thác.

“Dips keeping being aggressively longed on Binance, as shown by the Long/Short ratio,” it revealed.

“Thông thường chúng ta thấy loại hành động giá này tuôn ra rất nhiều các nhà giao dịch này khi giá chênh lệch về. Thanh khoản dài bắt đầu từ $25,800.

Những người khác chú ý đến các mô hình lịch sử, với Thằn lằn Stockmoney rút ra so sánh với hành vi của Bitcoin sau thị trường gấu năm 2015.

post bear market similarities pic.twitter.com/vWseKsPlki

— Stockmoney Lizards (@StockmoneyL) May 22, 2023

“This year is the boring year,” Michaël van de Poppe, founder and CEO of trading firm Eight, continued in part of his own thoughts on Bitcoin in 2023.

“No price acceleration, no fundamental growth, while the preparations for the next bull cycle are made during this year.”

Short-timeframe analysis over the weekend highlighted $27,200 as a level to break through in order for “sustained momentum” to return.

Classic choppy pattern on #Bitcoin.

Rejects at $27,200 and consolidates, as CME gap is also around $26,900.#Bitcoin needs to break and flip $27,200 if we want to see any sustained momentum.

Beneath us, at around $26,000-26,500 -> 200-Week MA. pic.twitter.com/4rvuHLyjxe

— Michaël van de Poppe (@CryptoMichNL) May 21, 2023

As Cointelegraph reported, some still believe the current price action is a prelude to a deeper correction toward $24,000.

In terms of volatility, however, Bitcoin is now at its quietest since the start of the year, data from monitoring resource CoinGlass shows.

PCE data forms week’s macro highlight

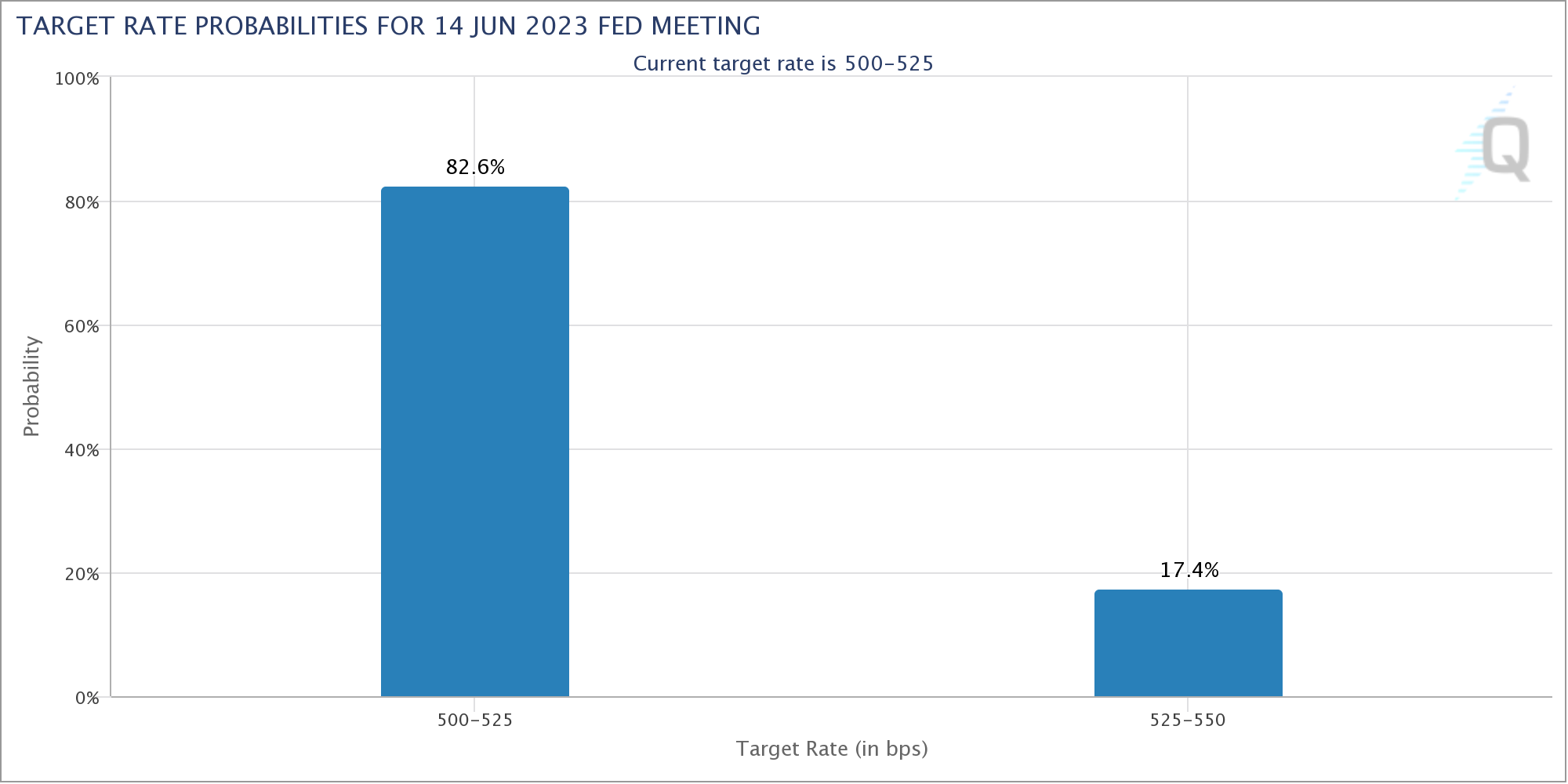

Macro triggers are set to increase somewhat this week, as May 26 sees a slew of economic data, including the Personal Consumption Expenditures (PCE) Index.

This is a key component for the Fed regarding interest rate policy, and its readings can instantly reshape market expectations for rate changes.

That was the case during Powell’s speech last week, with the odds of a rate hike pause increasing from 60% to 80%.

As of May 22, those odds remain high at around 86%, according to CME Group’s FedWatch Tool, with the next decision on policy not due for another three weeks.

The disparity between market expectations and the conservative language of the Fed thus remains a key phenomenon, one which Powell himself addressed last week.

The phenomenon, he said, “appears to reflect simply a different forecast, one in which inflation comes down much more quickly,” adding that there was no such guarantee of this.

“While we do not have a report on PCE inflation for April yet, another inflation measure, the core component of the Consumer Price Index (CPI), showed little further improvement in April,” comments from Fed board member Philip Jefferson at the 2023 International Insurance Forum in Washington, D.C. on May 18 stated in a similarly risk-off tone.

Beyond that, May 24 will see the release of the minutes from this month’s Federal Open Market Committee (FOMC) meeting, at which the most recent rate hike was decided. Markets will scrutinize the exact language employed by Fed members during that event.

A separate debate concerns the U.S. debt ceiling debacle, with talks remaining deadlocked last week.

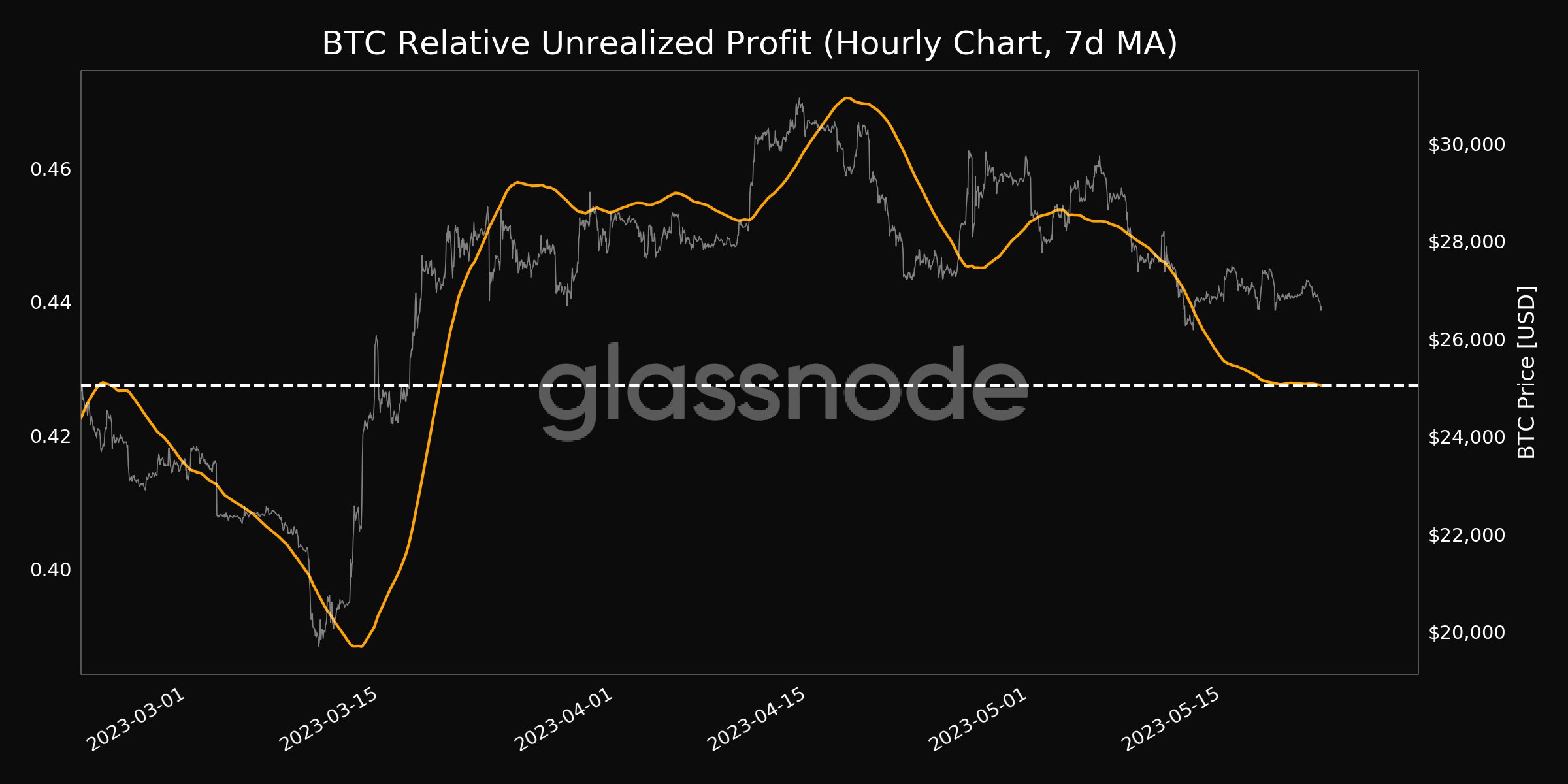

Short-term BTC holder profits trend toward reset

It’s consolidation time for the BTC supply, with on-chain data showing a lack of movement compared to recent months.

According to the figures from on-chain analytics firm Glassnode, the portion of the supply last active within the previous three to six months is now at three-month lows.

Corresponding to the period from December 2022 to February 2023, this suggests hodlers sitting on their hands as last year’s bear market fizzled to produce the start of Bitcoin’s 70% Q1 gains.

Contrasting that is the supply last active one to three months ago, now at three-month highs and covering the portion of price action, which includes the $31,000 local highs from April.

At the same time, the effects of the subsequent comedown can be seen in hodlers’ unrealized profit, now at its lowest levels in a month.

That latter figure could yet preclude a reset in expectations of Bitcoin speculators, classified as short-term holders (STHs) with positions three months old or less. Drifting downward, BTC/USD is slowly approaching their current average cost basis.

Earlier in May, Glassnode noted that such a “reset” in profitability tends to offer significant price support.

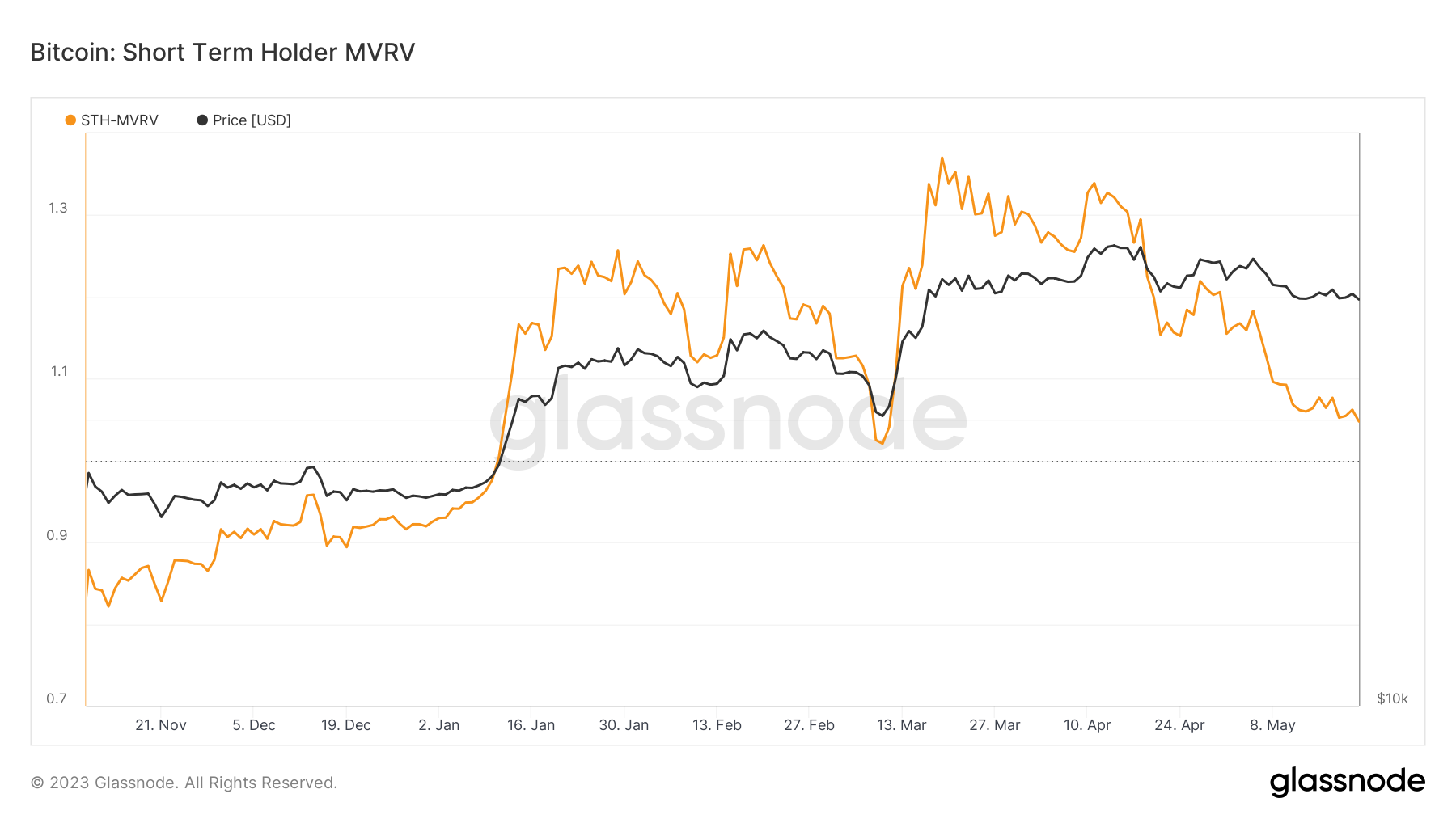

Research into the STH market value to realized value (MVRV) metric, then at 1.15, nonetheless warned a reset might require a dip below $25,000.

“Should a deeper market correction develop, a price of $24.4K level would bring a STH-MVRV back to a break-even value of 1.0, which has shown to be a point of support in up-trending markets,” it stated.

STH-MVRV measured 1.047 as of May 21, the latest date for which data is currently available.

Whale BTC price influence “lessening”

Probing the May correction, on-chain analytics platform CryptoQuant drew some specific conclusions about the forces driving markets.

In one of its Quicktake market updates on May 17, researchers flagged profit-taking and whale activity as key phenomena pertaining to recent BTC price action.

“The latest Bitcoin price dip followed Long-Term Holders (LTHs) capitalizing on the year’s highest profit ratio, over 34%. Furthermore, on a broader scale, all market players managed to realize profits exceeding 7% on average,” it commented on market participants as a whole.

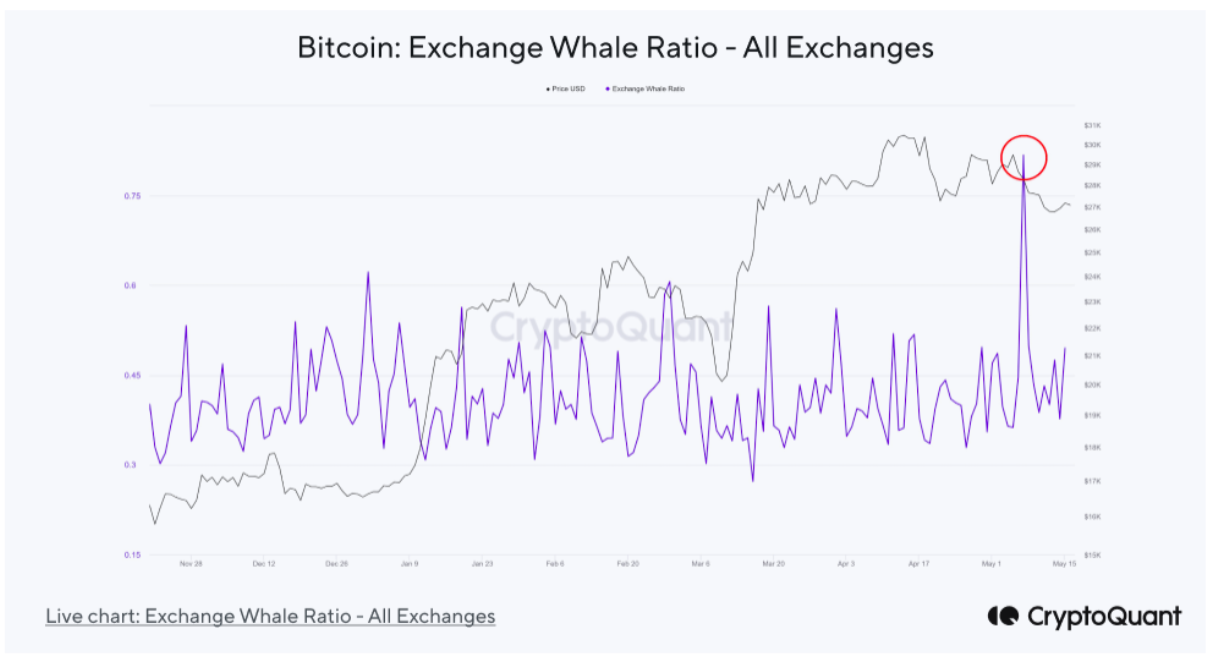

On whales, CryptoQuant referenced the exchange whale ratio metric, which tracks the size ratio of the top ten exchange inflow transactions relative to the total.

“This downturn is also influenced by whales taking the lead in depositing Bitcoin into exchanges, as evidenced by the early May surge in the Exchange Whale Ratio. Without a doubt, Bitcoin transactions by these whales escalated to fairly high levels, with transfers involving more than 40% of the coins,” it continued.

In terms of support, the research nonetheless acknowledged that whales’ overall impact on the market is “lessening” as time goes by.

STHs, on the other hand, were responsible for protecting the $26,500, which was subsequently held as support over the weekend.

“Investors who have held Bitcoin for 1 to 3 months show a significant support level in their cost basis ($26.5K), indicating that this was a key point during the recent price correction,” it added.

Crypto market fear on the up

Aside from on-chain data, social signals suggest that the average crypto market participant is becoming afraid.

Related: These four altcoins could be ready for an up-move if Bitcoin rallies above $27,500

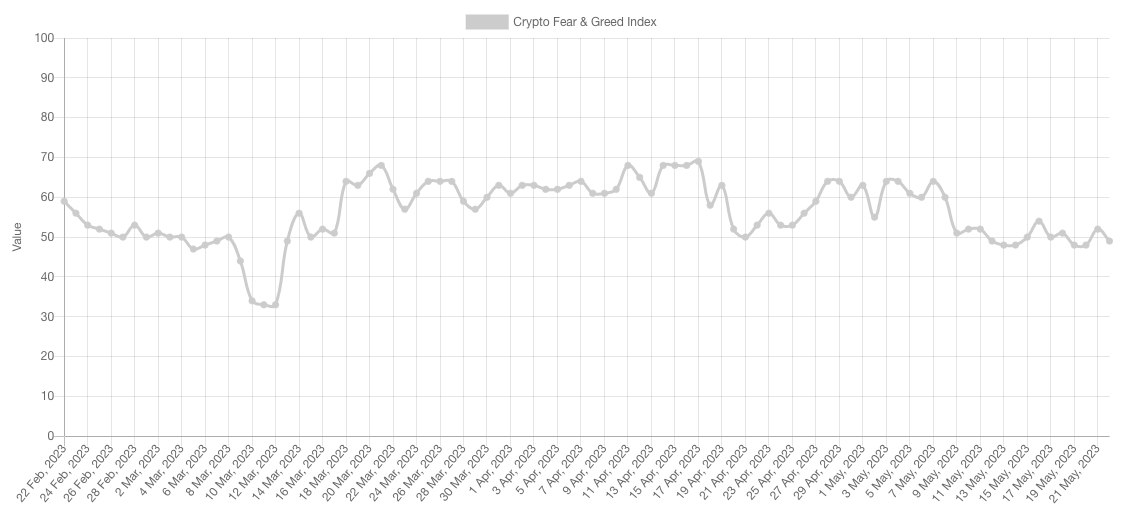

The Crypto Fear & Greed Index matched two-month lows at the end of last week, now below the 50 midpoint and markedly unlike its composition at April’s $31,000 local BTC price highs.

Expectations thus seem skewed toward conditions worsening for markets; and while broadly “neutral,” Fear & Greed is not the only source showing traders’ doom and gloom.

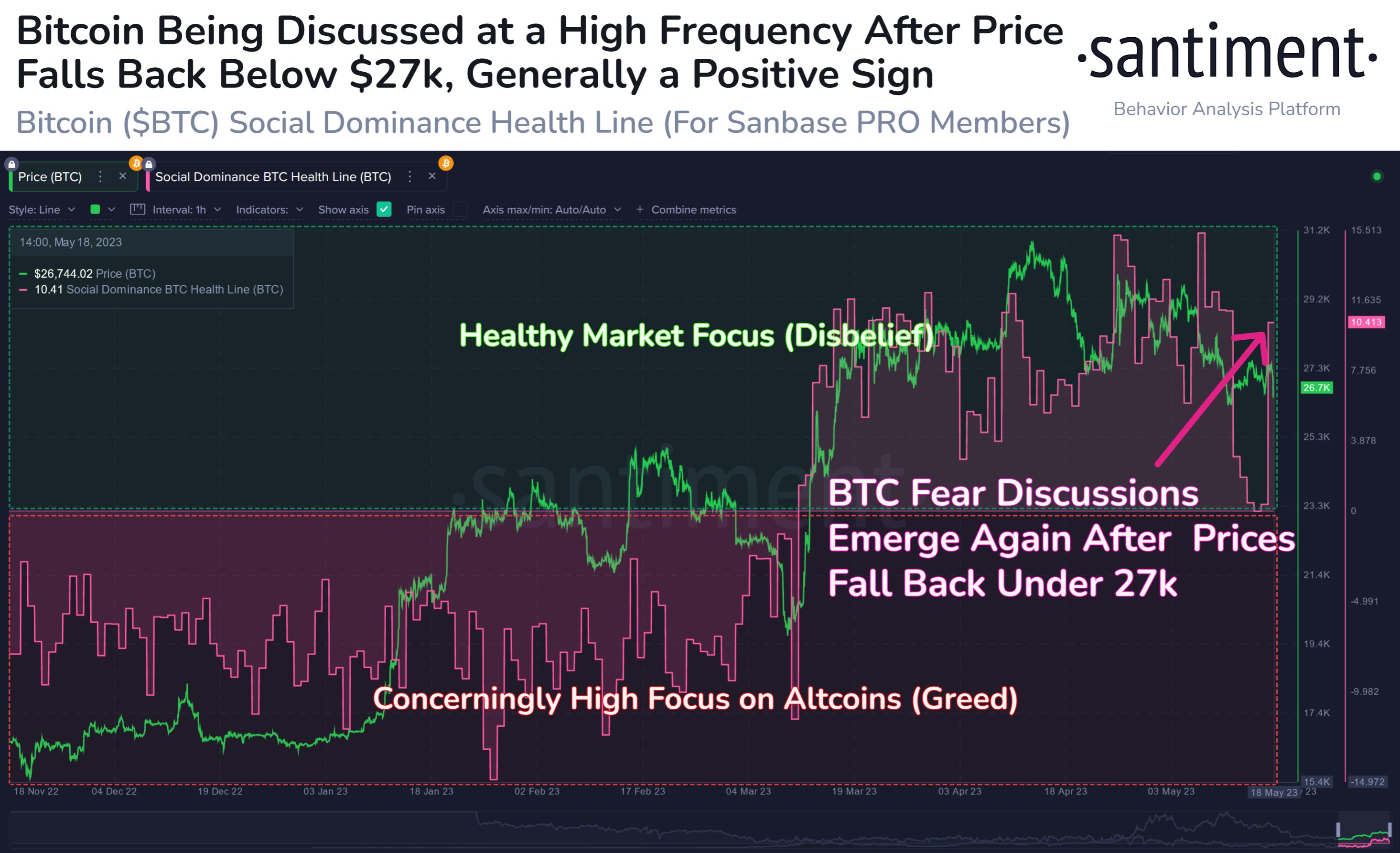

“With Bitcoin revisiting the $26k level, traders are showing increased worries of prices falling back to the $20k to $25k range,” research firm Santiment added on May 19.

“$BTC social dominance has jumped high again, typically a sign of fear. Fear signals increase the probability of a rebound.”

Magazine: ‘Moral responsibility’: Can blockchain really improve trust in AI?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.