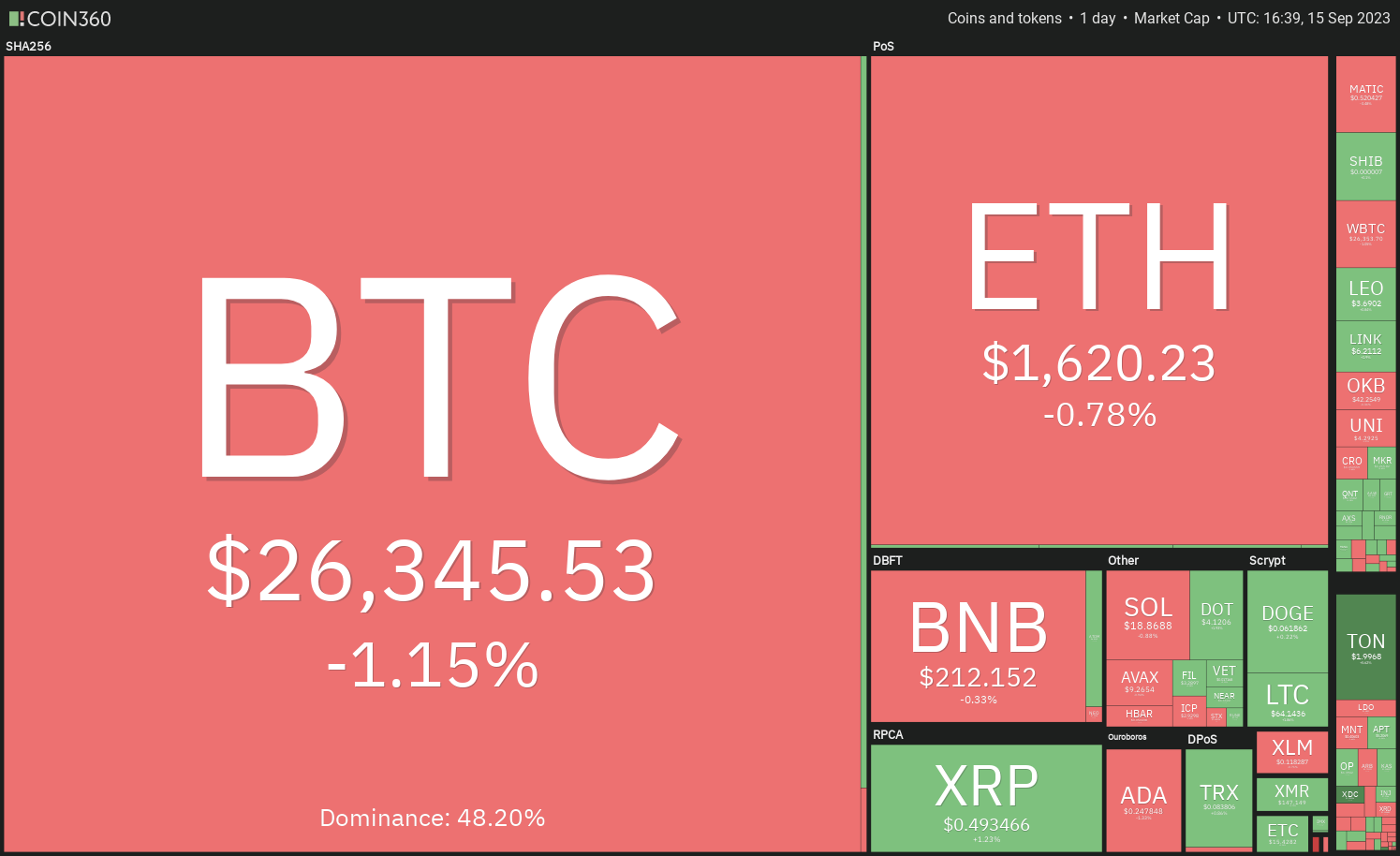

Bitcoin (BTC) đã bị mắc kẹt trong một phạm vi rộng kể từ tháng Tư, cho thấy sự thiếu quyết đoán về động thái định hướng tiếp theo. Những nỗ lực của phe gấu để giảm giá xuống dưới mức hỗ trợ của phạm vi đã bị cản trở bởi phe bò vào ngày 11 tháng 9. Tuy nhiên, Bitcoin vẫn chưa ra khỏi rừng.

Jamie Coutts, a chartered market technician and crypto market analyst at Bloomberg Intelligence, while speaking to Cointelegraph said that if the tightening cycle extends, followed by “an uptick in unemployment and more stress in the banking sector, then there could be a bit more pain for risk assets like Bitcoin.”

Cryptocurrency traders have also remained cautious. A Bitfinex report shows that the cryptocurrency industry witnessed capital outflows of $55 billion in August. The drop in liquidity has caused isolated events to “have a bigger impact on market movements,” the report added.

Bitcoin sẽ giảm và kiểm tra lại mức hỗ trợ quan trọng của nó? Sự yếu kém của Bitcoin có thể kích hoạt việc bán thêm các altcoin không? Hãy cùng nghiên cứu biểu đồ của 10 loại tiền điện tử hàng đầu để tìm hiểu

Bitcoin price analysis

Bitcoin đã phá vỡ và đóng cửa trên đường trung bình động theo cấp số nhân 20 ngày ($26,228) vào ngày 14 tháng 9, cho thấy đà giảm đang suy yếu.

The 20-day EMA is flattening out and the relative strength index (RSI) is near the midpoint, signaling that the BTC/USDT pair may stay range-bound between $24,800 and $28,143 for some more time.

If bears want to make a comeback, they will have to quickly pull the price back below the 20-day EMA. Such a move will suggest that higher levels are being sold into. That could result in a retest of the strong support at $24,800.

Ether price analysis

Ether (ETH) plunged below the $1,550 support on Sep. 11 but the bears could not build upon this strength. This suggests solid buying at lower levels.

The bulls thereafter started a recovery, which has reached the 20-day EMA ($1,638). This level is likely to witness a tough battle between the bulls and the bears. A break and close above the 20-day EMA could trap several aggressive bears, resulting in a short squeeze. That could propel the price to $1,745.

Thay vào đó, nếu giá giảm từ đường EMA 20 ngày, nó sẽ gợi ý rằng phe gấu vẫn nắm quyền. Sau đó, người bán sẽ thực hiện một nỗ lực khác để đẩy cặp ETH/USDT xuống dưới $1,550 và tiếp tục

Phân tích giá BNB

BNB (BNB) đã bật lên khỏi ngưỡng hỗ trợ tâm lý gần 200 đô la vào ngày 12 tháng 9, cho thấy phe bò đang hoạt động ở mức thấp hơn.

Sự phục hồi đã đạt đến đường EMA 20 ngày ($215), đây là một mức quan trọng cần chú ý. Nếu cặp BNB/USDT giảm xuống so với mức hiện tại, điều đó sẽ chỉ ra rằng tâm lý vẫn tiêu cực và các nhà giao dịch đang bán trên các đợt phục hồi cứu trợ. Điều đó sẽ làm tăng nguy cơ phá vỡ dưới 200 đô la.

Ngược lại, chỉ báo RSI đang hình thành một phân kỳ tích cực, cho thấy áp lực bán có thể đang giảm. Việc tăng trên đường EMA 20 ngày có thể mở ra cánh cửa cho việc kiểm tra lại đường SMA 50 ngày

XRP price analysis

XRP (XRP) đã được giao dịch trong khoảng từ 0,41 đô la đến 0,56 đô la trong vài ngày qua. Giá đã phục hồi về đường EMA 20 ngày ($0.50), đây là mức quan trọng cần theo dõi

If buyers thrust the price above the 20-day EMA, it will indicate that the selling pressure is reducing. That could start a sustained recovery toward the overhead resistance at $0.56. This level may again act as a roadblock.

If the price turns down from $0.56, it will indicate that the range-bound action may continue for some more time. The next trending move is likely to begin after bulls push the price above $0.56 or bears sink the XRP/USDT pair below $0.41.

Cardano price analysis

The strong selling in Cardano (ADA) pulled the price to $0.24 on Sep. 11 but the bears could not break the crucial support.

The rebound off $0.24 on Sep. 12 reached the 20-day EMA ($0.26) on Sep. 15. This level is likely to witness a tussle between the buyers and sellers. If the ADA/USDT pair turns down sharply from the 20-day EMA, it will indicate that every minor rise is being sold into. That could increase the risk of a drop to $0.22.

Contrarily, if buyers shove the price above the 20-day EMA, it will signal the start of a stronger recovery to $0.28.

Dogecoin price analysis

Dogecoin (DOGE) continues to trade between the 20-day EMA ($0.06) and the solid support at $0.06. This tight-range trading is unlikely to continue for long and a breakout may happen soon.

If buyers kick the price above the 20-day EMA, it will suggest that the sellers may be losing their grip. That could start a relief rally to the 50-day SMA ($0.07) where the bears are expected to intensify selling.

Contrary to this assumption, if the price turns down sharply from the 20-day EMA, it will enhance the prospects of a break below $0.06. If this support breaks down, the DOGE/USDT pair may plummet to $0.055.

Solana price analysis

Solana (SOL) has been swinging between $14 and $27.12 for the past several months. The price has reached the 20-day EMA ($19.51) where the bears are likely to pose a stiff challenge.

If buyers thrust the price above the 20-day EMA, the SOL/USDT pair could reach the overhead resistance at $22.30. This level may again act as a strong hurdle but if bulls overcome it, the pair could climb to $27.12.

On the contrary, if the price turns down from the 20-day EMA, it will signal that demand dries up at higher levels. The bears will then try to resume the downtrend and yank the price to the vital support at $14.

Related: Japan to allow startups to raise funds by issuing crypto instead of stocks: Report

Toncoin price analysis

Toncoin (TON) snapped back from the 20-day EMA ($1.75) on Sep. 12, indicating that the bulls are viewing the dips as a buying opportunity.

The price reached the first resistance at $1.98 on Sep. 13 where the bears are trying to halt the up-move. A minor advantage in favor of the bulls is that they have not ceded ground to the bears. This suggests that the bulls are in no hurry to book profits as they anticipate the up-move to continue.

If the $1.98 level is taken out, the TON/USDT pair could reach $2.07. This is an important level for the bears to defend because a break above it could propel the pair to $2.40. On the downside, a slide below the 20-day EMA could tilt the advantage in favor of the bears.

Polkadot price analysis

Polkadot (DOT) has been trading below the breakdown level of $4.22 for the past few days, which is a negative sign.

The bulls are trying to start a relief rally but that is likely to face strong selling at $4.22. If the price turns down from the overhead resistance, it will suggest that bears remain in control. The sellers will then try to sink the DOT/USDT pair below $3.90. If they succeed, the pair could collapse to $3.44.

If bulls want to prevent the decline, they will have to push and sustain the price above $4.22. If they do that, it will suggest that the markets have rejected the breakdown. The pair may then attempt a rally to the 50-day SMA ($4.61).

Polygon price analysis

Polygon (MATIC) slipped below the critical support at $0.51 on Sep. 11 but the bears could not maintain the selling pressure. That started a rebound, which is nearing the 20-day EMA ($0.54).

The bears will attempt to stall the recovery at the 20-day EMA and tug the price below $0.50. If they manage to do that, it will signal the resumption of the downtrend. The MATIC/USDT pair could then slump to $0.45.

Although the downsloping moving averages indicate advantage to bears, the positive divergence on the RSI suggests that the bearish momentum may be slowing down. If buyers clear the obstacle at the 20-day EMA, the pair may climb to $0.60.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.