Bitcoin (BTC) tiếp tục thúc đẩy một kết thúc tăng đến tháng Hai khi đóng cửa hàng tháng bắt đầu hành động giá trong tuần khác.

The largest cryptocurrency looks set to preserve its gains as it closes the second month of 2023 — and is keeping bulls’ hopes alive in the process.

Can the good times continue? The coming week could mean decision time for a key area of BTC price action around $25,000.

Analysts are eyeing a breakout toward $30,000 if support can become more permanent, while concerns nonetheless remain that a trip back towards resistance reclaimed in January is still on the cards.

Amid a quiet week for macroeconomic data, any catalysts for determining whether BTC/USD goes up or down may come from within Bitcoin itself.

Một điều chắc chắn là, dữ liệu trên chuỗi cho thấy – các nhà đầu tư Bitcoin dài hạn không có tâm trạng bán được nêu ra, và với giá hiện tại tiếp tục tăng cường tiếp xúc với BTC của họ hàng loạt.

Cointelegraph xem xét một số yếu tố chính cần lưu ý khi nói đến những gì Bitcoin có thể làm trong tuần tới.

Bitcoin monthly close precludes March trend showdown

Nó có vẻ chạm vào cuối tuần, nhưng Bitcoin đã quản lý để tránh một sự thoái lui lớn và đảo chiều đi lên vào tuần mới.

Đóng cửa hàng tuần ở mức $23,500 là âm nhạc cho những người muốn thấy sự phục hồi tăng sớm hơn là muộn.

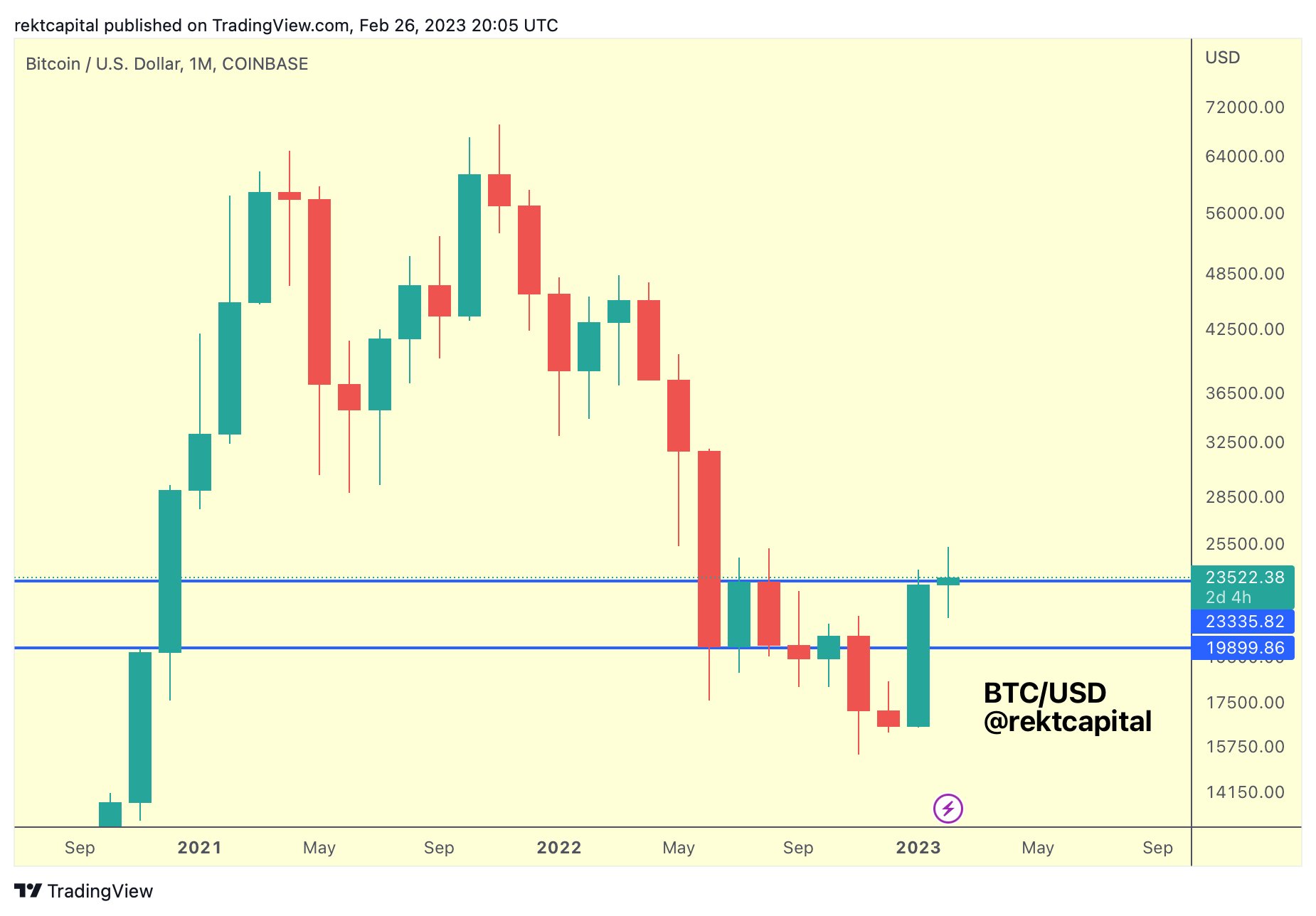

Nhà giao dịch nổi tiếng và nhà phân tích Rekt Capital giải thích: “BTC đã quản lý để phá vỡ trên mức $23400, đó là phạm vi cao của phạm vi vĩ mô hàng tháng”.

“Đây là những gì BTC cần tiếp tục làm để có xu hướng tăng khi tháng Hai sắp kết thúc. Đóng cửa hàng tháng sắp tới sẽ rất thú vị.”

Ở mức hiện tại, BTC/USD tăng khoảng 1,25% trong tháng 2 năm 2023 — khiêm tốn theo tiêu chuẩn lịch sử nhưng vẫn rõ ràng trong việc duy trì mức tăng của năm nay.

Đối với Rekt Capital, tháng Ba đánh dấu tháng thực sự của BTC/USD khi nó tiếp cận một đường xu hướng dài hạn, một sự phá vỡ của nó sẽ báo hiệu một xu hướng đảo chiều hoàn toàn.

“Tháng Hai gần gần và thực sự không quá hứng thú với BTC, như đã từng là trường hợp trước khi phá vỡ Monthly Candle”, ông tiếp tục.

“Given how the Macro Downtrend is a sloping trendline, the breakout price for BTC will be a little lower in March at ~$24500.”

Một bài viết tiếp theo nhắc lại $25,000 là mức để phá vỡ để “xác nhận” một xu hướng tăng vĩ mô.

nhà giao dịch Crypto Chase đã phân loại hơn về hành động giá ngắn hạn. Trong một tweet qua đêm, ông tương tự như vậy gắn cờ $25,000 là dòng trên cát.

“Perfect tag of 22.7 and bounce. Weekend move though.. I wouldn’t be surprised to see another retest of the 0.618 or a 3rd drive,” he commented about the weekend lows.

“At that point, it becomes make or break for me. Hold and we can still see 25K+ liq, lose it and 20K next.”

4h chart – short term bullish reversal pic.twitter.com/ukjn3kOqIh

— Stockmoney Lizards (@StockmoneyL) February 26, 2023

Trading resource Stockmoney Lizards meanwhile described a “short term bullish reversal” for both price and relative strength index (RSI) on the 4-hour chart as the weekend drew to an end.

Macro focus flips to central bank liquidity

In a refreshing change to the previous two weeks, U.S. macroeconomic data releases will be more subdued at the start of March.

As Cointelegraph reported, however, analysts are increasingly eyeing counterpart releases from Asia as a potential BTC price influencer.

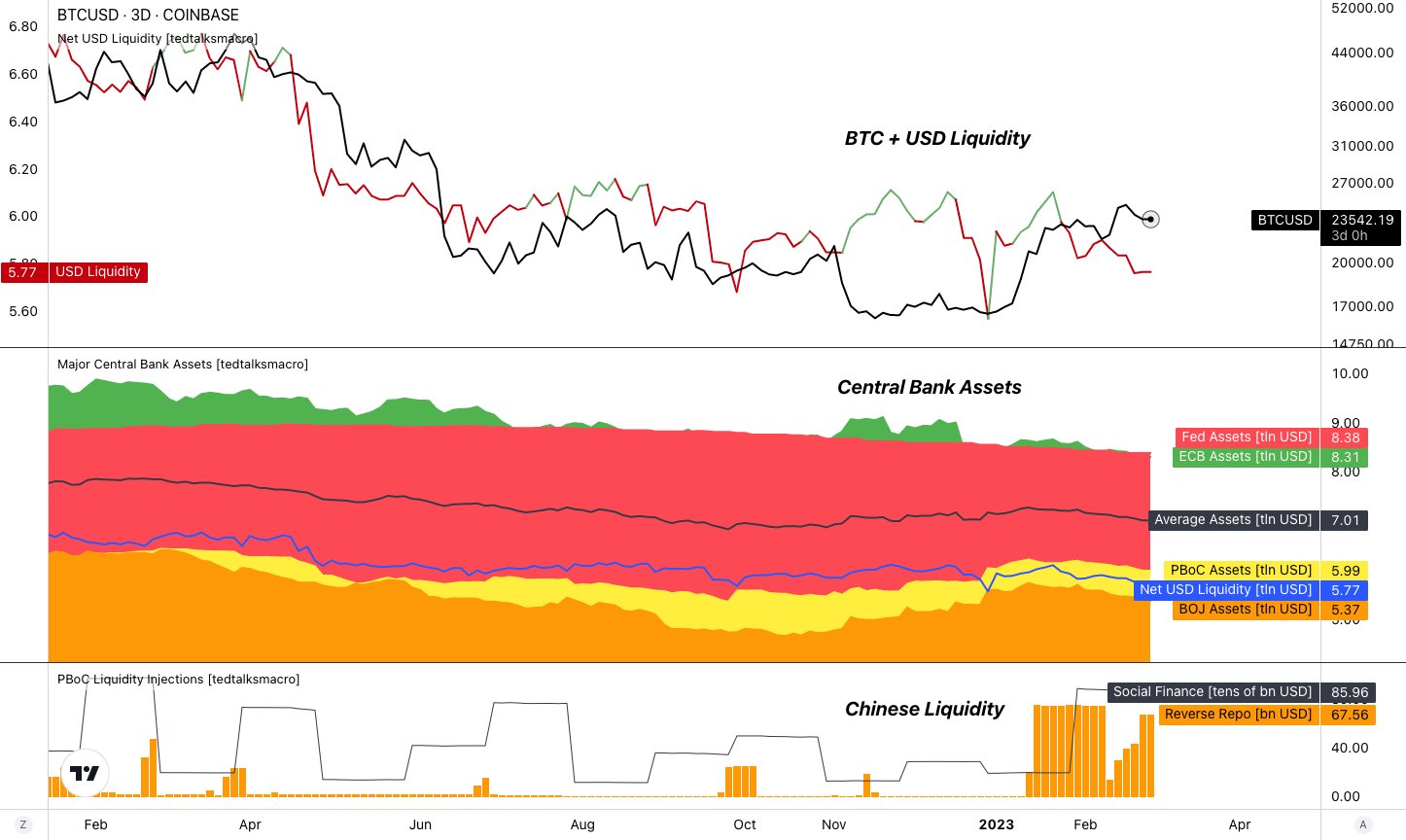

Central bank liquidity injections — running contrast to the Federal Reserve — remain a key topic.

“Global liquidity – projected to rise in 2023, but recently has pulled back,” popular commentator Tedtalksmacro tweeted on the day.

“- China injected ~$450Bn into money markets during December + January – US liquidity has flat lined, government liquidity has outpaced Fed QT recently. Markets are a product of liquidity * risk appetite.”

Tedtalksmacro nonetheless highlighted a potential countertrend in the form of Japan’s central bank, the Bank of Japan (BoJ), which he warned may yet resort to financial tightening to tame inflation.

“On Friday last week, Japanese core inflation printed at the highest level since 1981 –> fueling speculation that the BOJ will need to tighten after years of extremely easy monetary policy,” he noted.

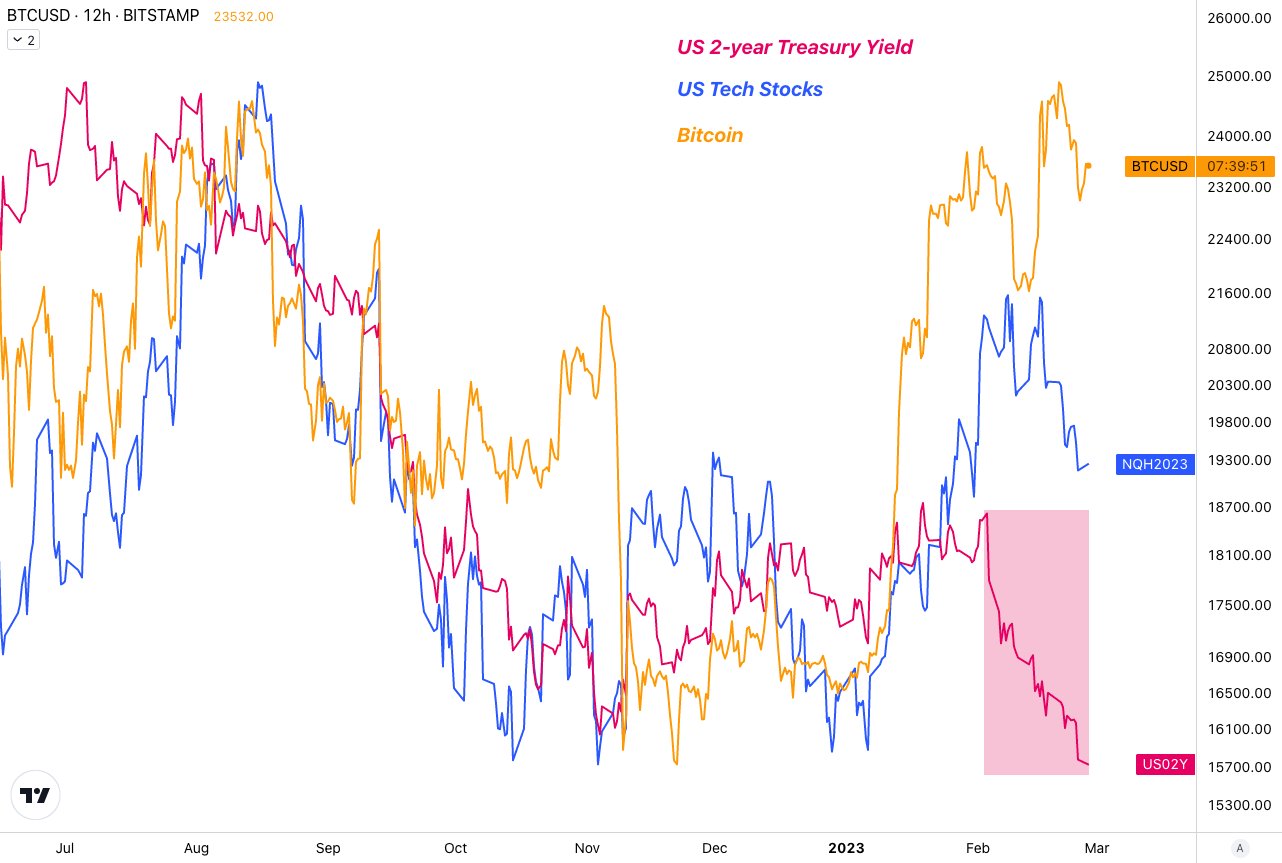

Comparing U.S. macro asset performance to crypto following the January Consumer Price Index (CPI) data print, meanwhile, he added that crypto assets remained “stubborn” despite others beginning to move higher.

Analysis platform Mosaic Asset focused on the potential for the Fed to hike benchmark interest rates more than expected at its March meeting.

“With no signs that the economy is slowing and yet another inflation report running hotter than expected last week…that’s ratcheting up pressure on the Federal Reserve to keep hiking rates quicker and longer than markets are expecting,” it wrote in the latest edition of its updates series, “The Market Mosaic,” on Feb. 26.

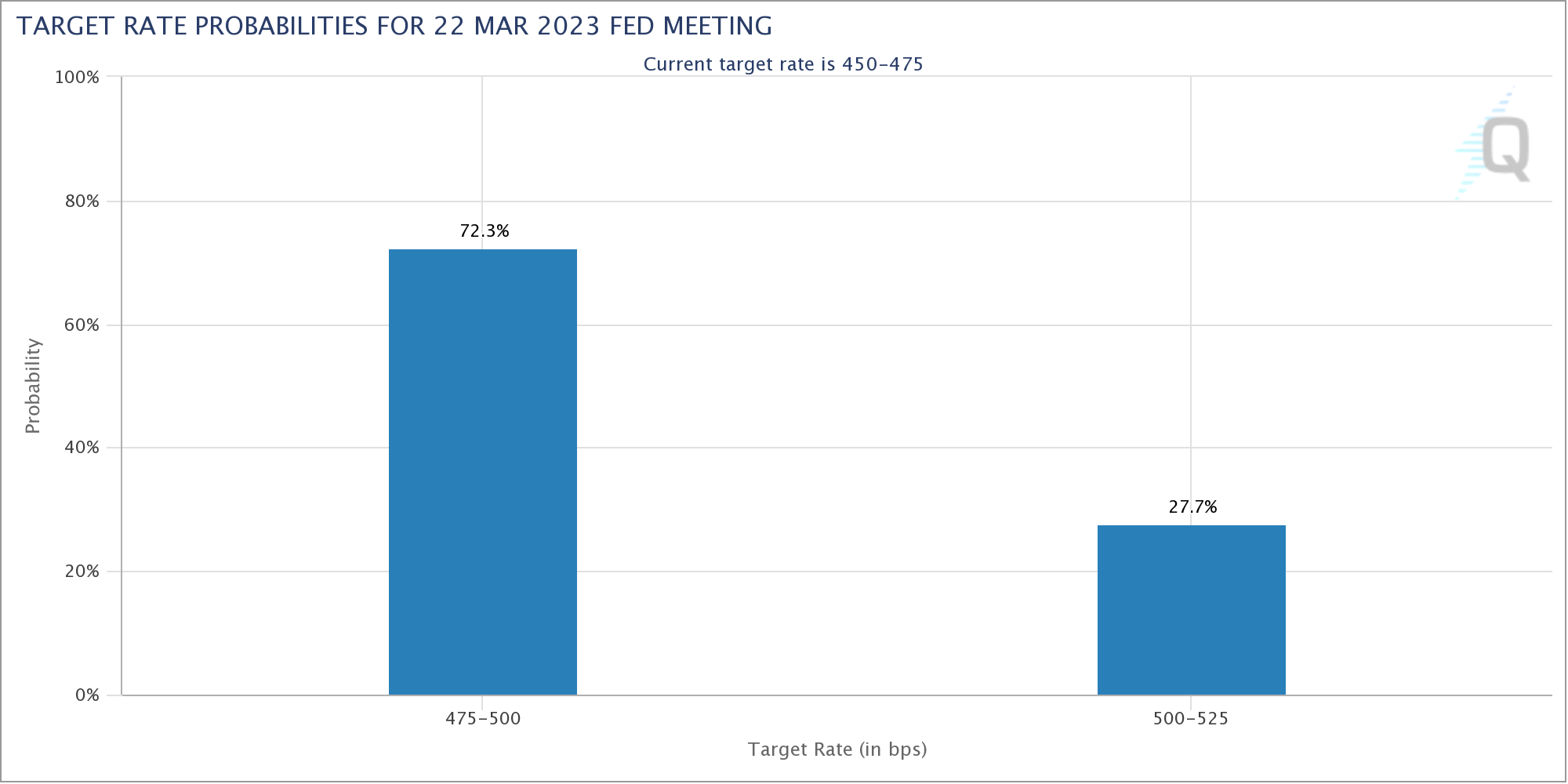

“You can see that reflected in the odds of the next rate hike’s magnitude, where market implied estimates currently favor another 0.25% increase. But views are quickly shifting to the possibility of 0.50%, with more on the way while rates stay higher for longer.”

According to CME Group’s FedWatch Tool, the odds of a 0.5% hike instead of the 0.25% seen in February currently stand at 27.7%.

Sellers see first week of net losses in 2023

While Bitcoin may be up over 40% year-to-date, the road to recovery for the average hodler remains a fragile one.

That is the conclusion of the latest data from research firm Santiment, which shows that last week’s mixed BTC price action still managed to deliver net realized losses among sellers.

Ether (ETH) saw the same phenomenon play out, marking the first week in 2023 where sellers lost out.

“Bitcoin & Ethereum are both having more traders sell at a loss than at a profit this week, the first such week so far in 2023,” Santiment commented.

“Historically, once the crowd is exiting their positions more frequently at a loss, bottoms are more likely to form.”

Sellers’ bad luck contrasts with the strategy still firmly in place for long-term holders, who continue to add to their BTC positions.

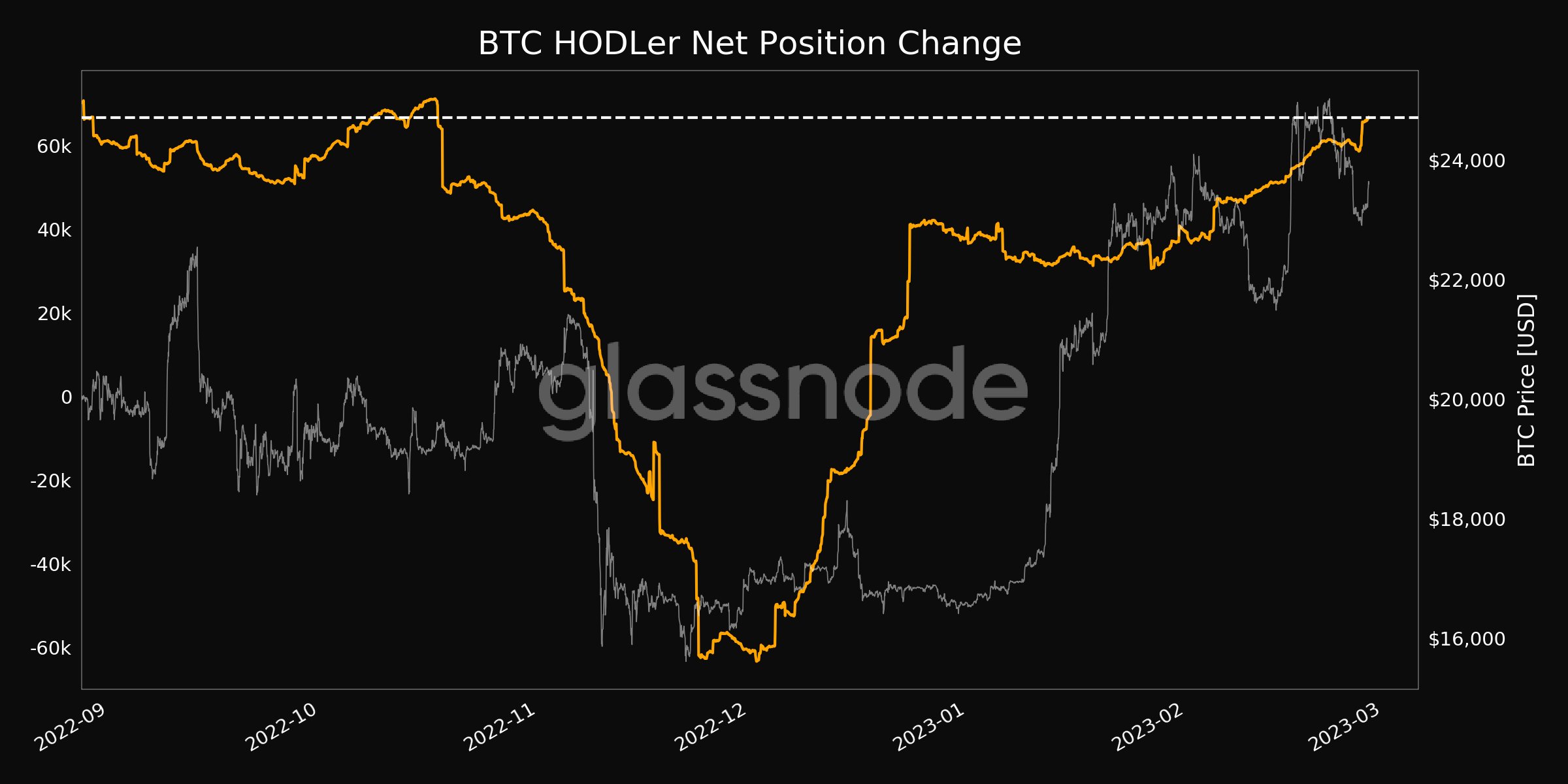

According to on-chain analytics firm Glassnode, hodlers’ net position change reached a new four-month high this weekend, reflecting the rate at which accumulation is occurring.

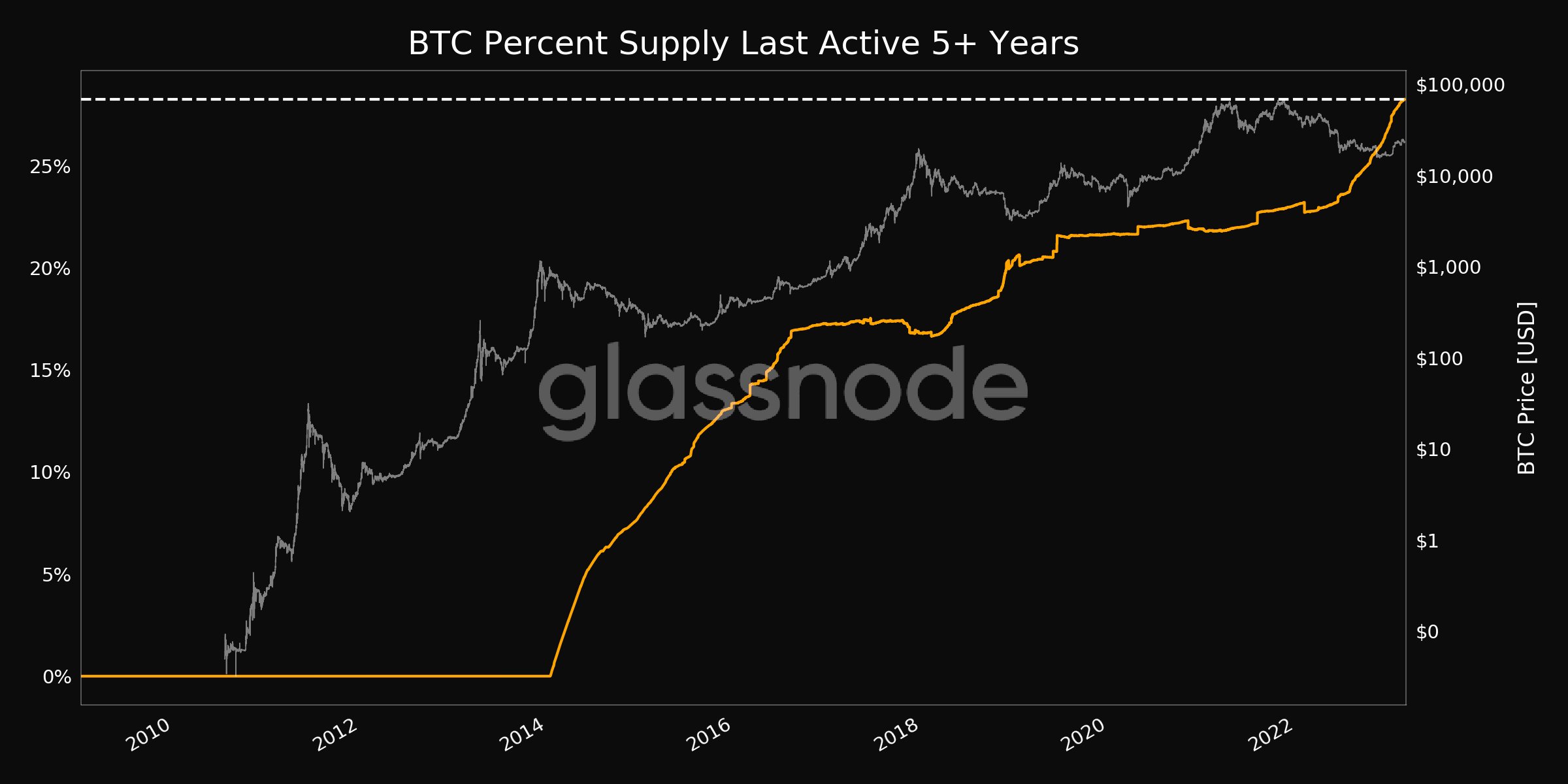

In addition, the percentage of the BTC supply which has now been dormant for at least five years is now higher than ever before at 28.24%.

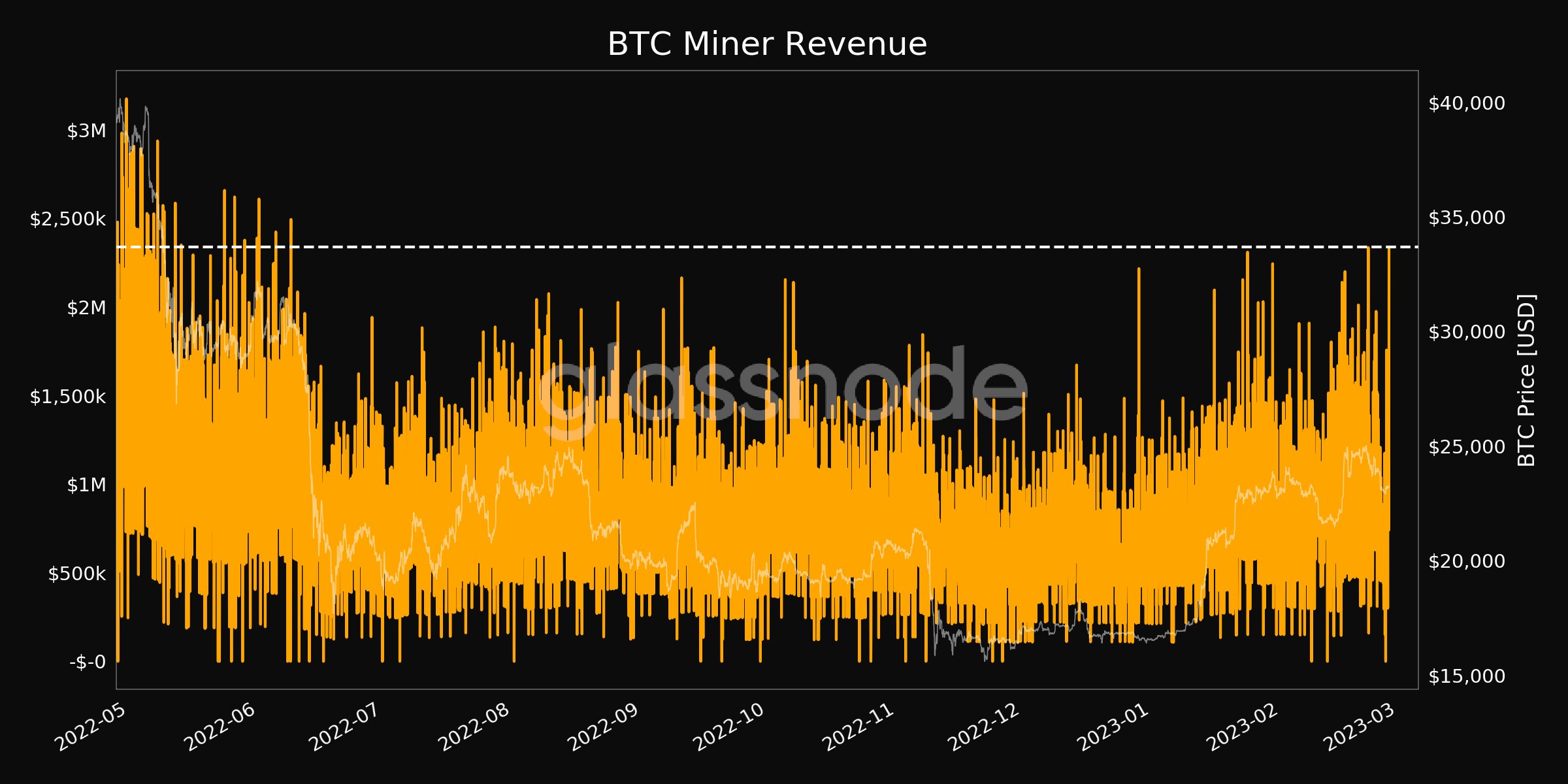

Bitcoin revenue hits 8-month high

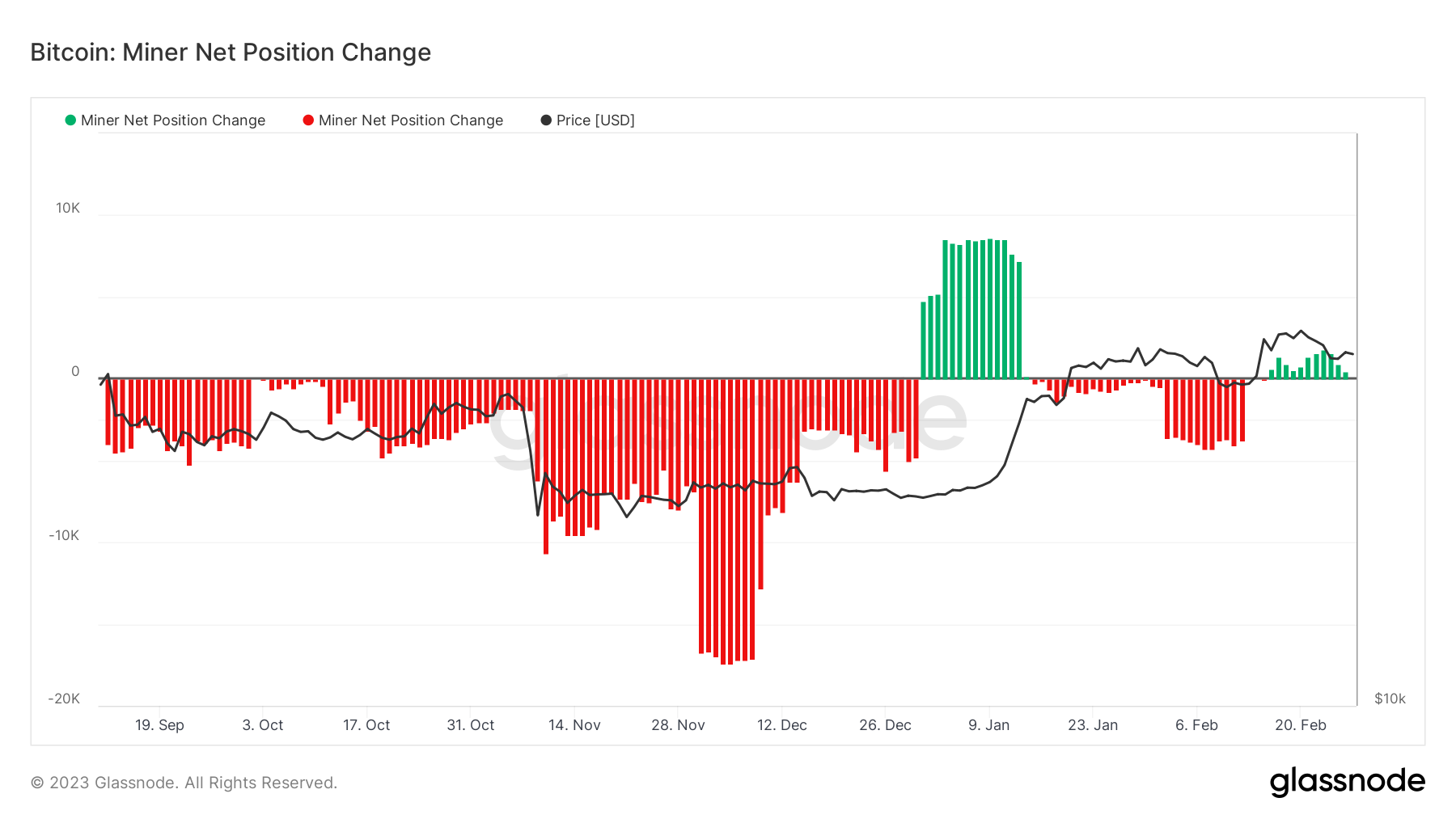

A broadly similar situation is currently being witnessed among Bitcoin miners.

Here, Glassnode data shows that on a rolling 30-day basis, miners are holding onto more BTC than they sell, but current prices are keeping the trend precarious.

While it would not take much of a price decrease to flip it back to net selling, current conditions remain far healthier than those seen in preceding months.

A silver lining comes in the form of miner revenue, which while modest is nonetheless at its highest in eight months.

Income was helped by ordinals fees, which in February crossed the $1 million mark.

Ordinal fees paid to Bitcoin miners cross $1M

What is an Ordinal – its arbitrary data stored on BTC blockchain into a taproot address. BTC block sizes were raised to 4MB per block, allowing for the storage of data, such as NFTs in the form of images. pic.twitter.com/yz0RM9kBLt

— Jack Levin (@mrJackLevin) February 18, 2023

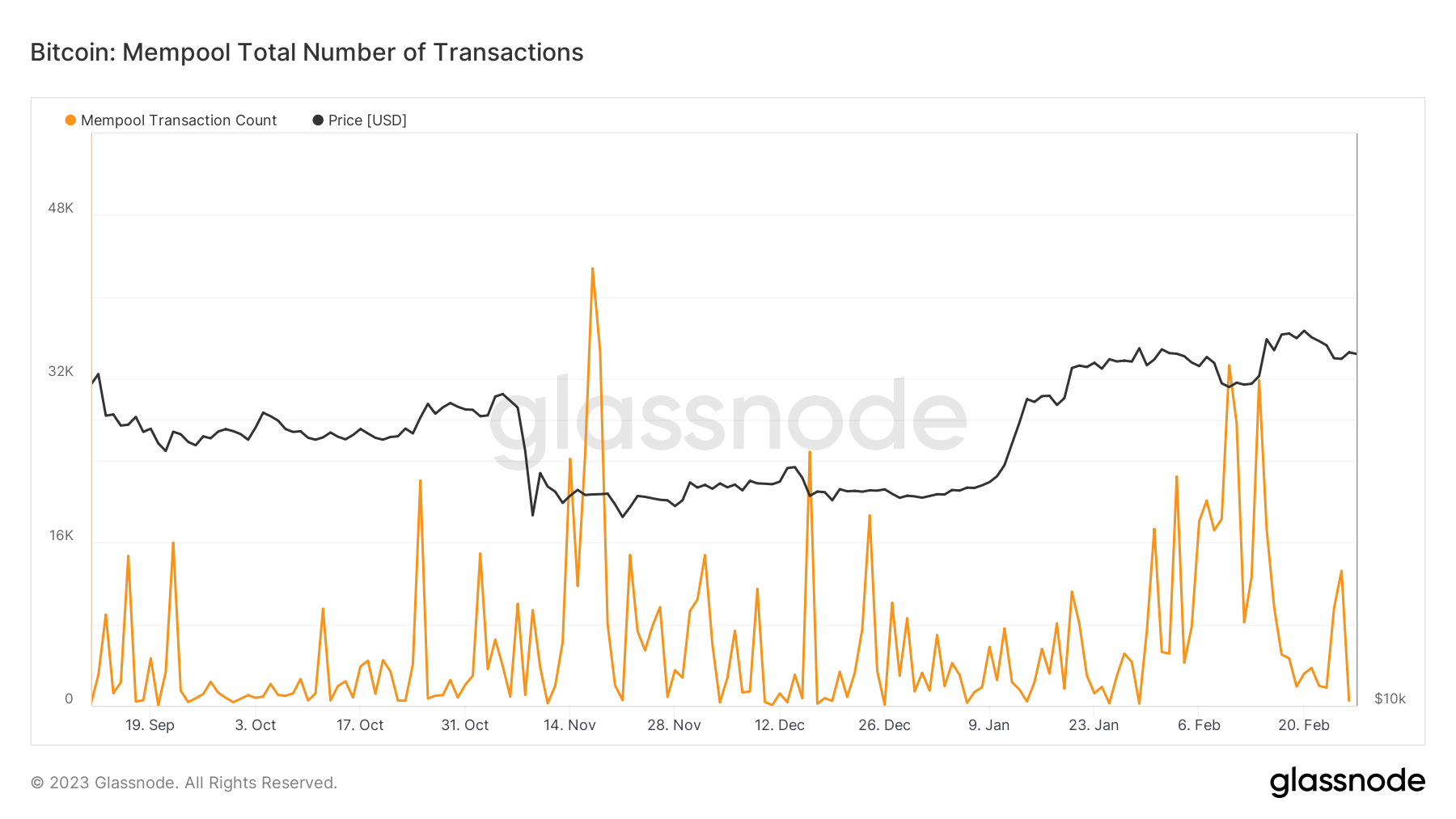

Despite ordinals resulting in a “fuller mempool” for Bitcoin, research noted last week, miners have still managed to clear it, Glassnode shows.

For Bitcoin whales, it’s early 2020

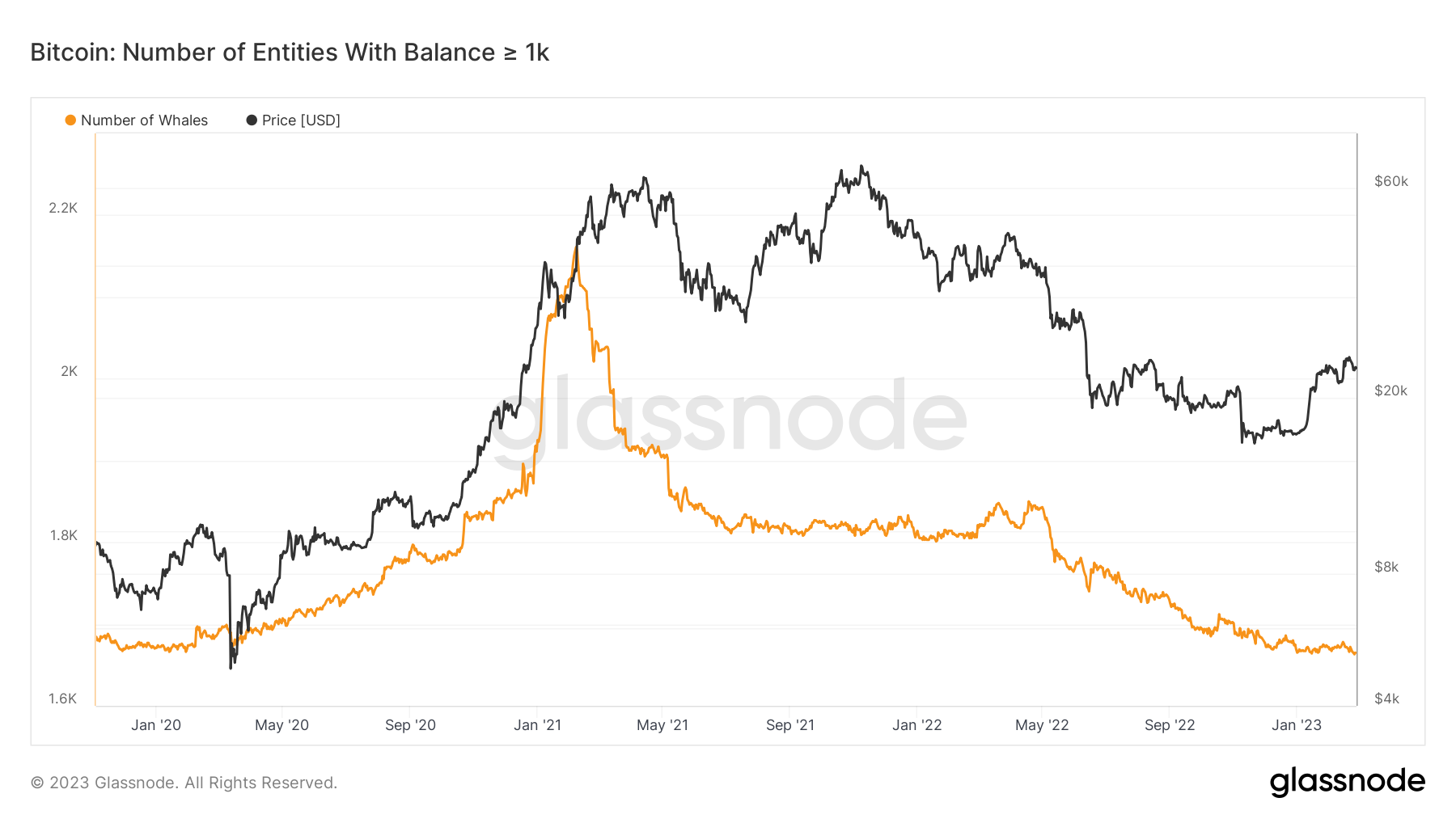

They may be responsible for some interesting events on exchange order books, but Bitcoin whale numbers are in fact dwindling.

Related: Bitcoin may only need 4 weeks to hit $30K as key monthly close looms

With price action still a good 65% below all-time highs, the biggest Bitcoin investors have not yet decided that now is the time to return to the market.

According to Glassnode, whale numbers are now at their lowest in three years — just 1,663 unique entities now control 1,000 BTC or more. Three years ago, in February 2020, Bitcoin traded at under $10,000.

Glassnode defines a unique entity as “a cluster of addresses that are controlled by the same network entity.”

At their peak in February 2021, there were 2,161 such whale entities.

“Clusters” of whale transaction activity can nonetheless offer an insight into support and resistance, even with depleted whale numbers.

As monitoring resource Whalemap notes, $23,000 remains a key price focus thanks to that whale factor this month.

BTC broke through bubble resistance

Now it will be our support in case we start falling

$27,100 seems to be the closest target according to onchain on the way up

Beastly BTC performance today pic.twitter.com/fOcag9eBFX

— whalemap (@whale_map) February 15, 2023

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.