Bitcoin (BTC) bắt đầu một tuần quan trọng với một loại cocktail quen thuộc của tăng giá trộn lẫn với nỗi sợ rằng thị trường gấu sẽ trở lại.

Sau khi đóng cửa hàng tuần cao nhất trong gần sáu tháng, BTC/USD vẫn còn hơn 40% so với mức đóng cửa hàng tháng chỉ cách 48 giờ — mức tăng có thể giữ được không?

tất cả các tỷ lệ cược, Bitcoin đã tăng lên vượt quá mong đợi trong tháng này, làm cho tháng 1 năm 2023 cho đến nay là tốt nhất trong một thập kỷ.

Trong suốt, những lo ngại đã kêu gọi một sự sụp đổ sắp xảy ra và thậm chí thấp giá BTC vĩ mô mới như một trạng thái hoài nghi quét thị trường.

Tuy nhiên, sự thay đổi ảm đạm đó vẫn chưa kết quả, và những ngày tới có thể trở thành một giai đoạn quan trọng khi nói đến xu hướng dài hạn của Bitcoin.

Các chất xúc tác hầu như không có nguồn cung – Cục Dự trữ Liên bang Hoa Kỳ sẽ quyết định tăng lãi suất tiếp theo trong tuần này, với Chủ tịch Jerome Powell cũng đưa ra nhiều lời bình luận dự kiến về nền kinh tế và chính sách.

Ngân hàng Trung ương Châu Âu (ECB) sẽ đưa ra quyết định tương tự một ngày sau đó.

Thêm vào đó áp lực tâm lý của việc đóng cửa hàng tháng và thật dễ dàng để thấy tuần tới có thể là một trong những biến động hơn trong lịch sử gần đây của Bitcoin.

Cointelegraph xem xét năm vấn đề chính cần cân nhắc khi nói đến hành động giá BTC.

Giá Bitcoin tăng 24K USD với dự đoán biến động của FOMC

Bitcoin tiếp tục thách thức những người bán hàng và người rút ngắn như nhau bằng cách tăng mạnh hơn bao giờ hết trên các khung thời gian thấp hơn.

Cuối tuần đã chứng minh không khác gì những người khác trong tháng Giêng, với BTC/USD chạm $23,950 qua đêm vào ngày 30 tháng Giêng – mức cao mới trong 5 tháng rưỡi.

Mức đóng cửa hàng tuần đã đạt được chiến tích tương tự, Bitcoin tuy nhiên không thể giải quyết được mức $24,000 cho sự phát triển mạnh mẽ cuối cùng.

At the time of writing, $23,700 formed a focal point, data from Cointelegraph Markets Pro and TradingView showed, with U.S. markets yet to begin trading.

Nonetheless, at current prices, Bitcoin remains up a striking 43.1% in January, making it the best month of January since 2013 — Bitcoin’s first well-known bull market year.

Market analysts are meanwhile keen to see what will happen around the Fed rate hike decision on Feb. 1. A classic source of volatility, the event could impact the monthly candle significantly, only for BTC price action to change tack altogether soon afterward.

“Có lẽ với một chút hỗ trợ từ sự biến động của FOMC? Không phải là một dự đoán, nhưng chắc chắn là một thiết lập giao dịch mà tôi rất quan tâm”, nhà giao dịch nổi tiếng Crypto Chase nhận xét về một biểu đồ dự đoán sự rút lui sau đó tăng thêm cho BTC/USD.

That roadmap took Bitcoin over $25,000, itself a key target for traders — even those who remain wary of a mass capitulation event extinguishing January’s extraordinary performance.

Among them is Crypto Tony, who notes the proximity of $25,000 to Bitcoin’s 200-week exponential moving average (EMA).

“The 200 Weekly EMA sits right above us at 25,000 which as you know is my target on BTC / Bitcoin,” he told Twitter followers on Jan. 29.

“Now flipping the 200 EMA and range high into support is massive for the bulls, but we have yet to do this and people are already euphoric. Think about that.”

An accompanying chart still laid out a potential path downhill toward $15,000.

As Cointelegraph reported at the weekend, Il Capo of Crypto, the trader now famous for his misgivings about the recovery, remains short BTC.

Continuing, on-chain analytics resource Material Indicators defined $24,000 as an important zone for bulls to flip to support, along with the 50-day and 200-day simple moving averages (SMAs).

“If bulls break $24k expecting upside illiquidity to get exploited up to the range of technical resistance ahead of the Feb 1 FED EoY terminal rate projection. What JPow says will move markets,” part of commentary on bid and ask levels on the Binance order book read this weekend.

Material Indicators referenced Fed Chair Powell’s forthcoming words, also noting that bid liquidity had been shifted higher, causing spot price to edge closer to that key area.

Macro hinges on Fed rate hike, Powell

The coming week is set to be dominated by the Federal Reserve’s interest rate hike and accompanying comments from Chair Jerome Powell.

In a familiar but still nerve-racking sequence of events for Bitcoin traders, the Federal Open Market Committee (FOMC) will meet on Feb. 1.

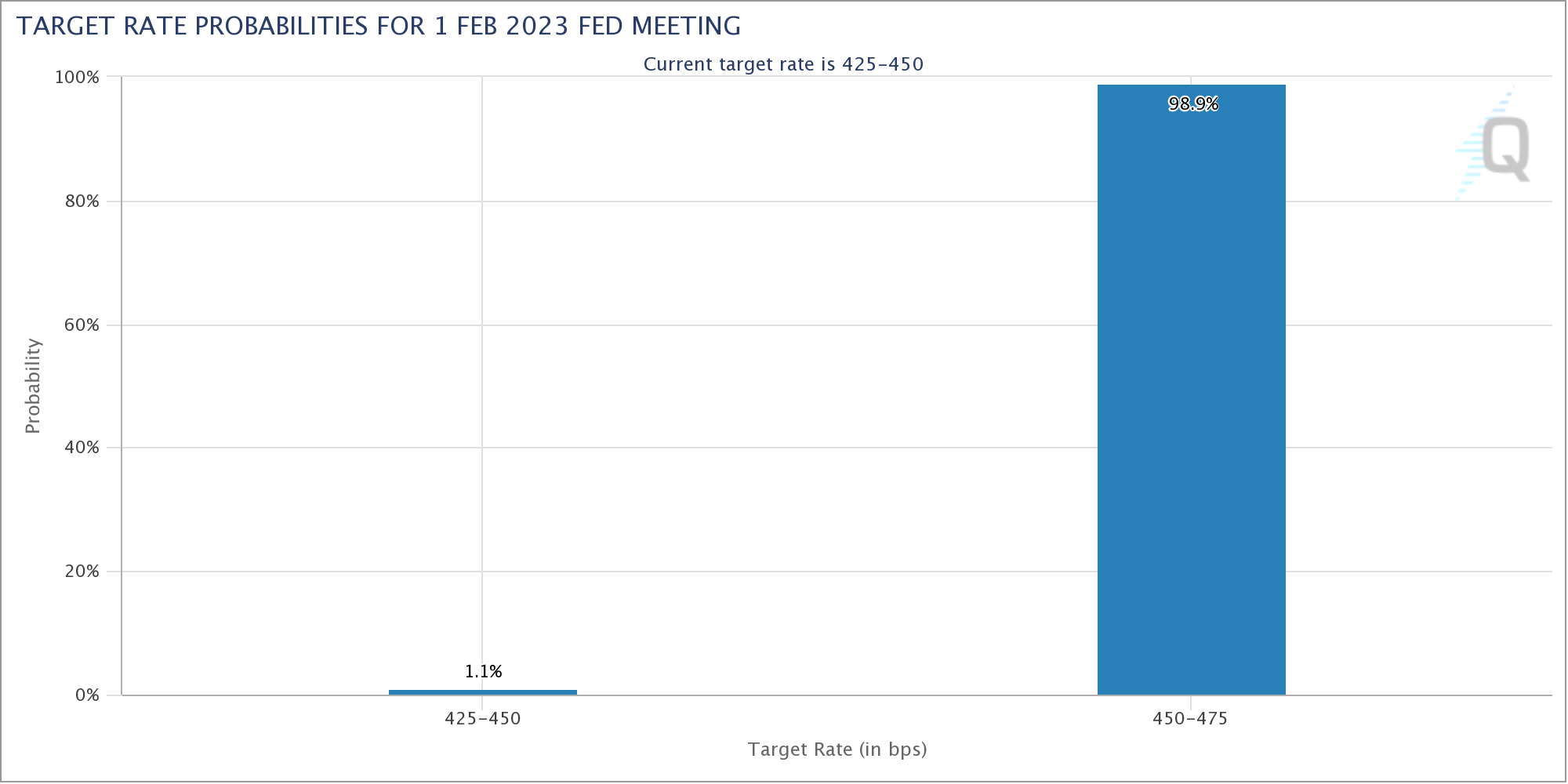

The result this time around may offer few surprises, with expectations practically unanimous in predicting a 25-basis-point hike. Nonetheless, the scope for volatility around the unveiling remains.

“The first two days of Feb are going to be volatile (much fun),” trader and commentator Pentoshi tweeted in part of comments last week, also noting that the FOMC would be followed by a similar decision from the European Central Bank a day later.

According to CME Group’s FedWatch Tool, there is currently 98.4% consensus that the Fed will hike by 25 basis points.

This will be a further reduction compared to other recent moves, and the smallest upward adjustment since March 2022.

“Wouldn’t be surprised if markets pumped all week ahead of the FOMC announcements,” popular social media commentator Satoshi Flipper continued.

“We already know it’s 25 BP. So what is there even remaining for J Powell to give guidance about? Another 25 or 50 BP remaining for the year? My point is regarding rates: the worst is now behind us.”

Should speculators be right in assuming that the Fed will now trend towards halting rate hikes altogether, this would notionally offer long-term breathing space to risk assets across the board, including crypto.

As Cointelegraph continues to report, however, many are worried that the coming year will be anything but plain sailing when it comes to a Fed policy transition. That may only come about, one theory states, when policymakers have no choice but to stop the economic ship from sinking.

Another, from former BitMEX CEO Arthur Hayes, calls for extensive risk asset damage before the Fed is forced to change course, including a $15,000 BTC price.

Continuing the longer-term warnings, Alasdair MacLeod, head of research at Goldmoney, referenced geopolitical tensions surrounding the Russia-Ukraine conflict as a key future risk asset downside trigger.

“No one is thinking through the effect on markets of the resumption of the Ukraine conflict,” he argued, precising a Goldmoney article on Jan. 29.

MacLeod predicted that energy prices would be “sure to spike higher,” along with U.S. inflation estimates.

“Bond yields will rise, equities will fall,” he added.

Index generates first “definitive buy signal” in 4 years

While few pundits are willing to go on record calling an end to the latest Bitcoin bear market, one on-chain metric is potentially leading the way.

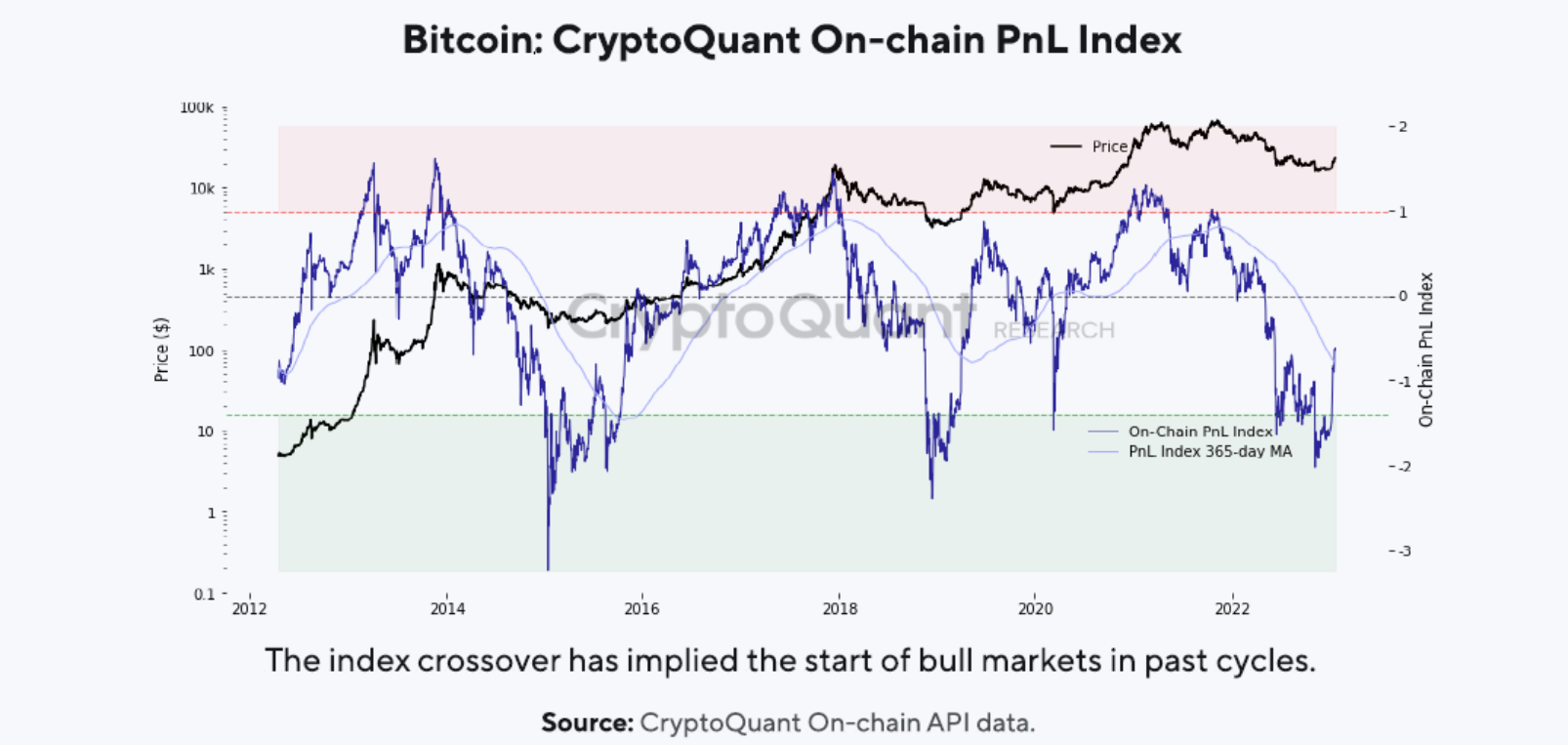

The Profit and Loss (PnL) Index from on-chain analytics platform CryptoQuant has issued a “definitive buy signal” for BTC — the first since early 2019.

The PnL Index aims to provide normalized cycle top and bottom signals using combined data from three other on-chain metrics. When its value rises above its one-year moving average, it is taken as a long-term buying opportunity.

This has now occurred with January’s move up in BTC/USD, and while CryptoQuant acknowledges that the situation may flip bearish again, the implications are clear.

“Although it is still possible for the index to fall back below, the CryptoQuant PnL Index has issued a definitive buy signal for BTC, which occurs when the index (dark purple line) climbs above its 365-day moving average (light purple line),” it wrote in a blog post alongside an explanatory chart.

“Historically, the index crossover has signaled the beginning of bull markets.”

CryptoQuant is not alone in eyeing rare recoveries in on-chain data, some of which were even absent throughout Bitcoin’s trip to all-time highs following the March 2020 COVID-19 crash.

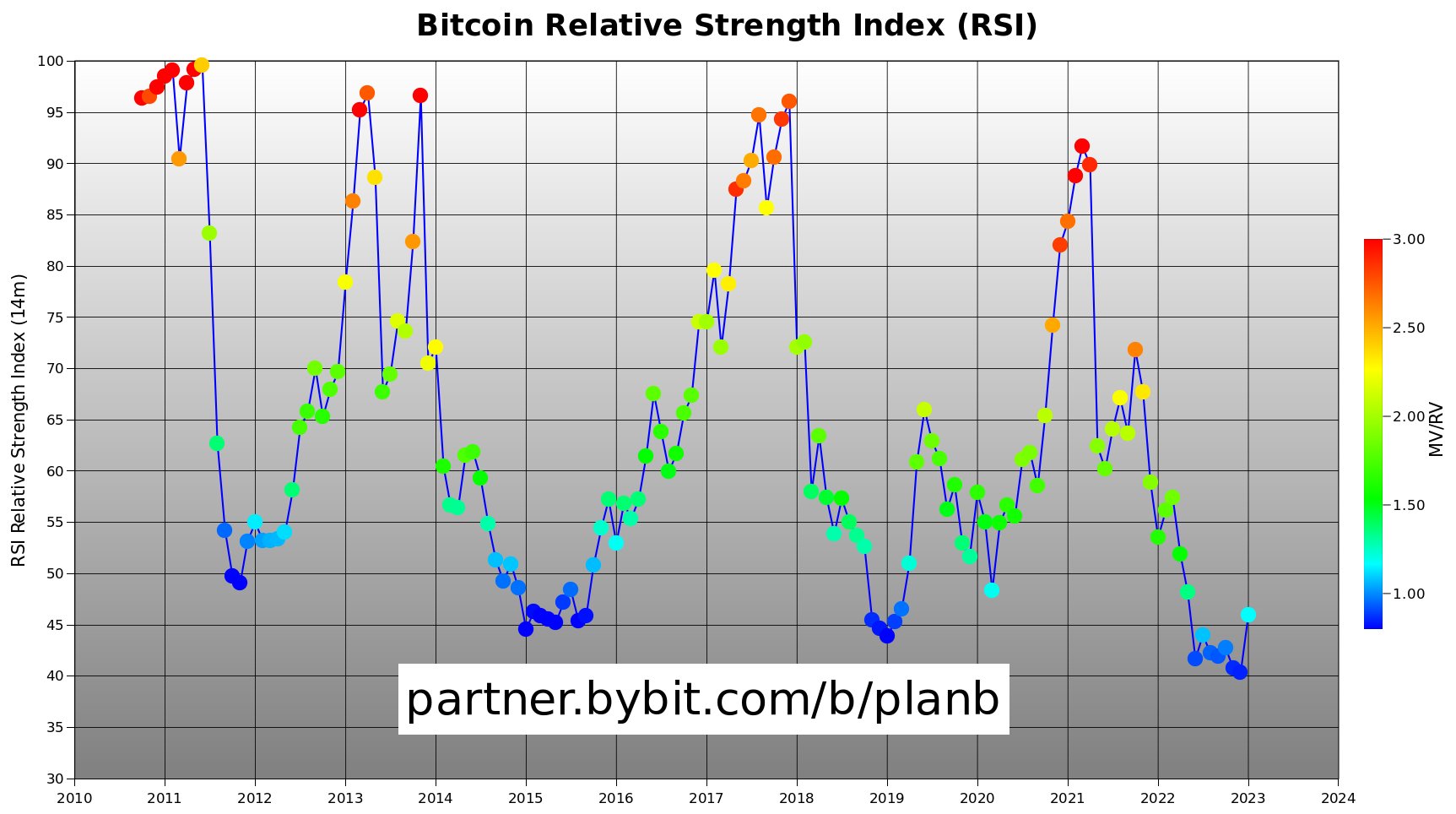

Among them is Bitcoin’s relative strength index (RSI), which has now bounced from its lowest levels ever.

As noted by PlanB, creator of the Stock-to-Flow family of Bitcoin price forecasting models, the last such rebound from macro lows in RSI likewise occurred at the end of Bitcoin’s last bear market in early 2019.

BTC hodlers stay disciplined

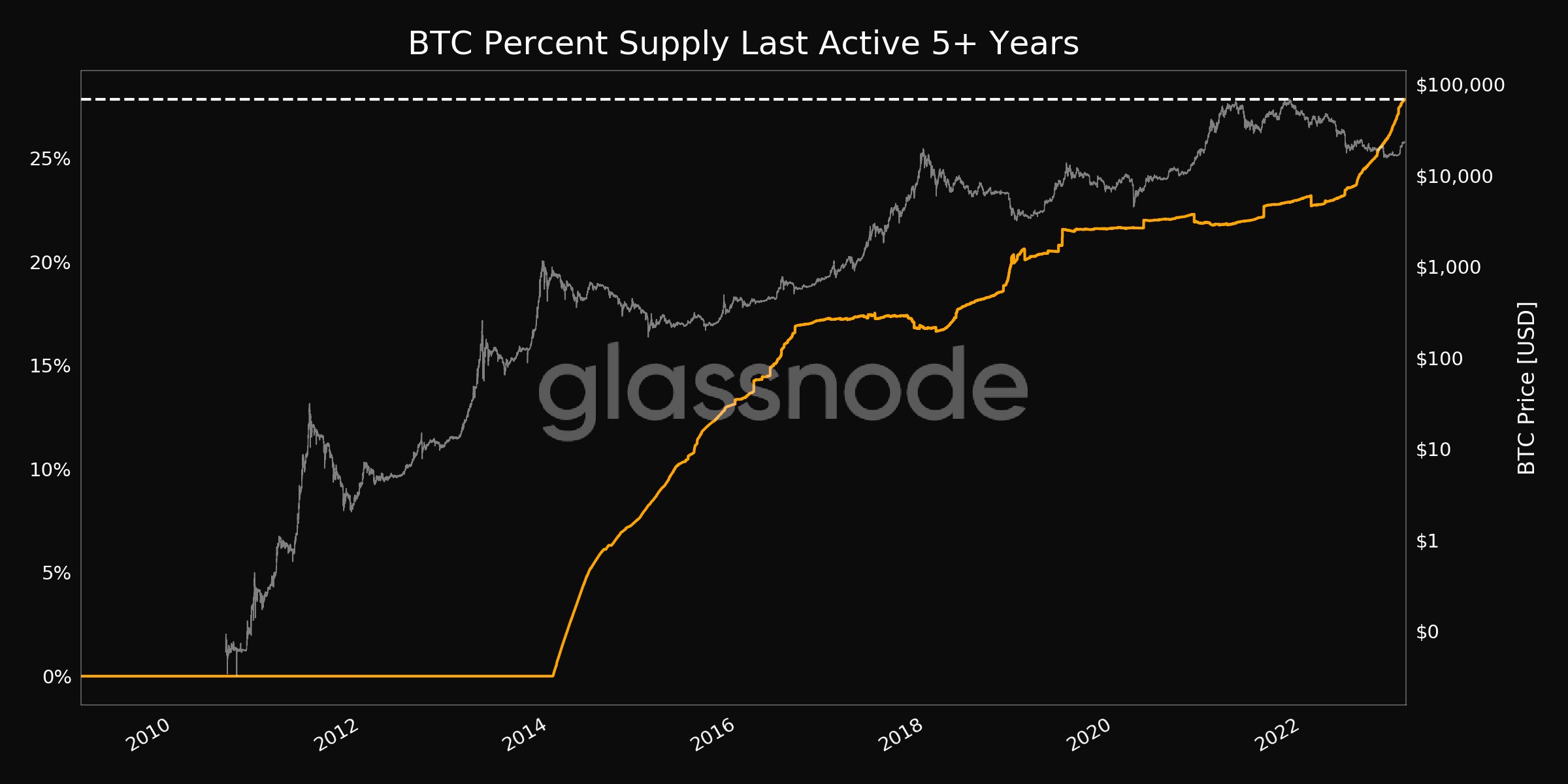

Contrary to expectations, mass profit-taking by the average Bitcoin hodler has yet to kick in.

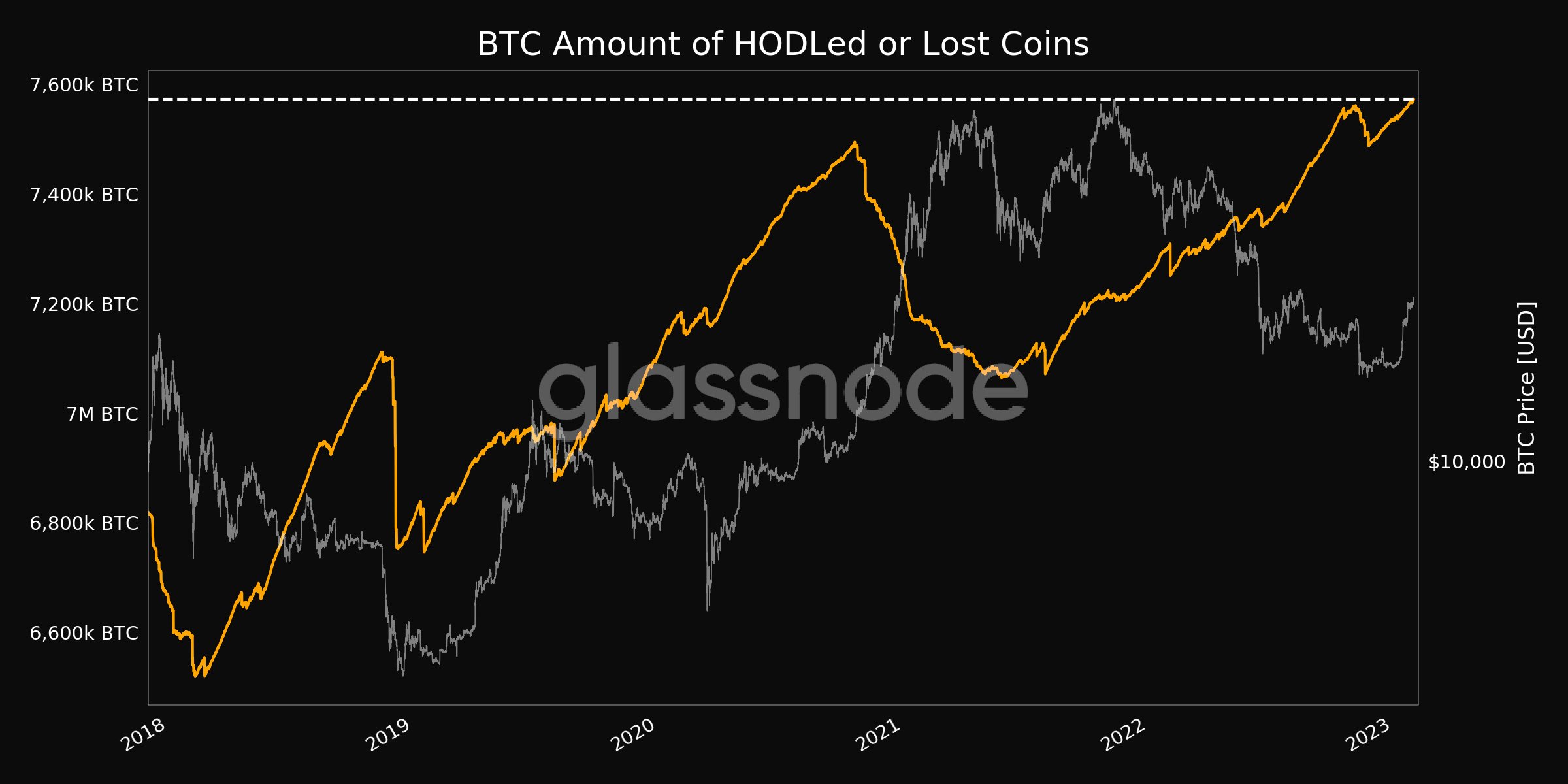

On-chain data from Glassnode confirms this, with the BTC supply continuing to age despite the recent price gains.

Coins dormant in wallets for five years or more, as a percentage of the overall supply, hit new all-time highs of 27.85% this weekend.

The amount of hodled or lost coins — “large and old stashes” of BTC traditionally dormant — has also reached its highest level in five years.

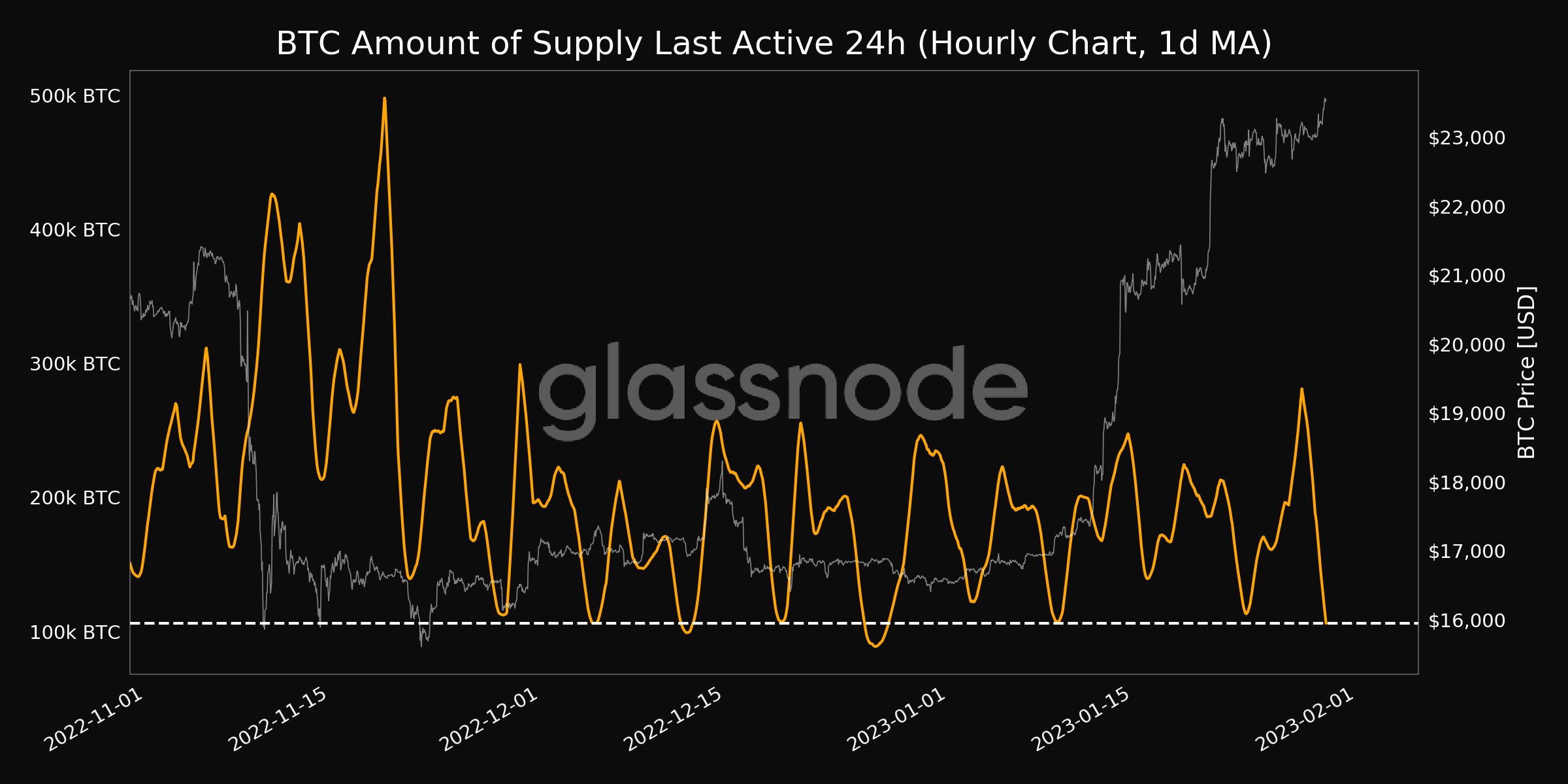

On lower timeframes, meanwhile, the amount of the supply last active in the past 24 hours in fact hit one-month lows on Jan. 29.

Despite this, a feeling of “greed” is rapidly entering into the market psyche, especially among recent investors, data below from CryptoQuant warns.

Sentiment “greediest” since $69,000

What began as disbelief as Bitcoin rose is rapidly becoming a textbook case of market exuberance, non-technical data shows.]

Related: Bitcoin will hit $200K before $70K ‘bear market’ next cycle — Forecast

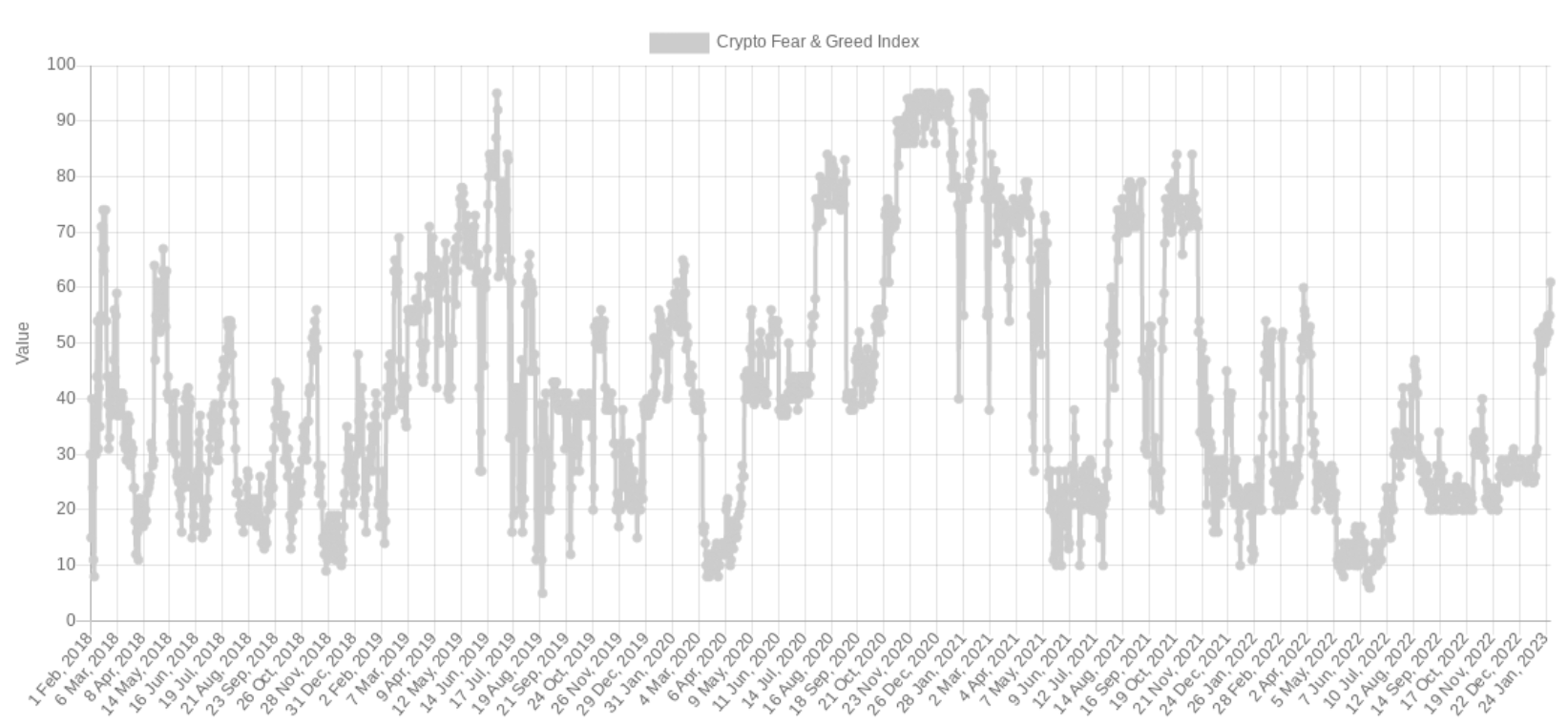

According to the Crypto Fear & Greed Index, the classic crypto market sentiment indicator, the mood among Bitcoin and altcoin investors is now predominantly one of “greed.”

The Index, which divides sentiment into five categories to identify potential blow-off tops and irrational market bottoms, currently measures 55/100 on its normalized scale.

While still far from its extremes, that score marks the Index’s first trip into “greed” territory since March 2022 and its highest since Bitcoin’s November 2021 all-time highs.

On Jan. 1, 2023, it measured 26/100 — less than half its latest reading.

Nonetheless, sentiment, as measured by Fear & Greed, has now erased losses from both FTX and the Terra LUNA meltdown.

In a cautious reaction, CryptoQuant contributor warned that sentiment among those only recently entering the market is now echoing the atmosphere of early 2021, when BTC/USD was making new all-time highs on an almost daily basis.

“Sentiment from Bitcoin short-term on-chain participants (short-term SOPR) has reached the greediest level since January 2021,” a blog post read, referencing the spent output profit ratio (SOPR) metric.

“While SOPR trending above 1 indicates a bullish trend, the indicator is way above 1 right now and overly stretched. Without increase in stablecoin reserves on spot exchanges, the bull fuel could run out quickly.”

Among its other uses, SOPR offers insight into when Bitcoin investors may be more inclined to sell after entering profit.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.