Institutional investors new to crypto may have been caught off guard by Bitcoin’s volatility, and has put downward pressure on its price, according to crypto entrepreneur and investor Anthony Pompliano.

During an interview on CNBC’s Squawk Box on Monday, Pompliano said Bitcoin (BTC) draws down roughly once every 1.5 years, and the recent slump isn’t likely to surprise Bitcoiners who have been in the game for a long time.

“Over the last decade, Bitcoin has drawn down 30% or more 21 different times,” said Pompliano.

“So Bitcoiners are used to this. Now, who’s not used to this are the people who are coming from Wall Street. They’re not used to this type of volatility.”

“These new people are very, very fearful. We’re going into end of year. There’s things around bonuses people are trying to figure out, should I actually sell this asset that I thought I was really excited about? And I think that’s putting some downward pressure on the price,” he added.

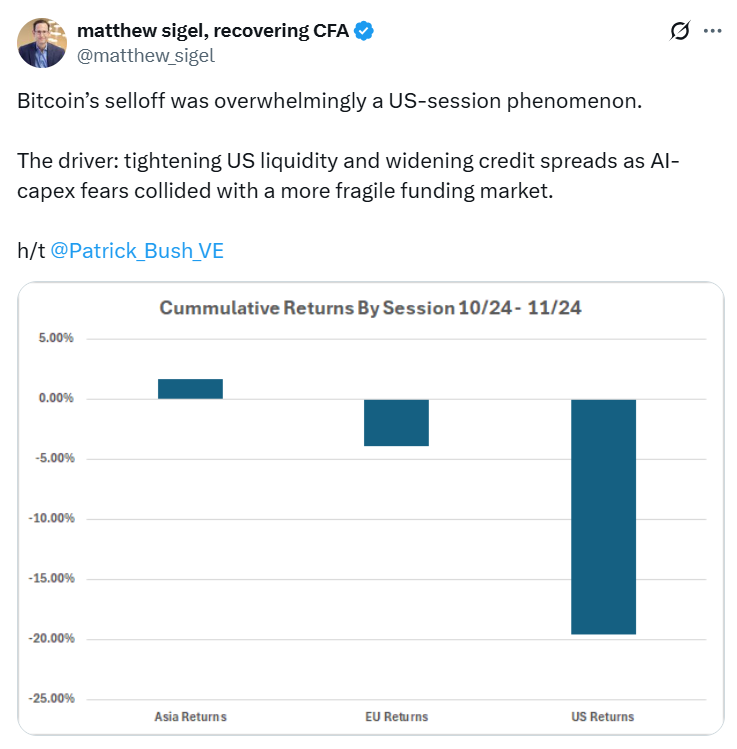

Bitcoin sell-off was mostly US-based

Matthew Sigel, head of digital assets research at investment manager VanEck, said on Monday that Bitcoin’s recent sell-off, which saw the token drop to lows of around $82,000, was “overwhelmingly a US-session phenomenon.”

He pointed to tightening US liquidity and widening credit spreads as key drivers, as fears over the large‑scale capital expenditures tied to artificial intelligence collided with a more fragile funding market.

Crypto volatility helps push the price higher

Bitcoin’s price volatility has surged over the last two months and was creeping back up to about 60 as of Monday, which can spark large market moves in both directions, according to Bitwise market analyst Jeff Park.

Related: Anthony Pompliano to lead new Bitcoin-buying group raising $750M: FT

Pompliano told CNBC that people who have been involved in crypto for a while understand that volatility is a strong indicator.

“It’s not a negative. I would be worried if Bitcoin’s volatility essentially was zero. You need volatility for the asset to go up.”

“You know Bitcoin is up 240x over the last decade. It’s about a 70% compound annual growth rate. We are not going to continue to have that level of growth moving forward,” he said.

“But if we get something that is 20, 25, 30, 35% compound annual growth rate for the next decade, you’re going to outperform equities. And I think that’s why a lot of Bitcoiners are very excited about this asset as part of their portfolio,” Pompliano added.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds: Trade Secrets