The recent banking crisis in the United States seems to have shaken the belief of some customers in the legacy banking system. According to Federal Reserve data, customers pulled nearly $100 billion in deposits in the week ending March 15.

American venture capital investor and entrepreneur Tim Draper said in a March 25 report that “founders need to consider a more diversified cash management approach” due to the over-regulation of banks and micromanagement by the government. As part of a contingency plan, Draper suggested businesses keep “ at least 6 months of short-term cash in each of two banks, one local bank and one global bank, and at least two payrolls worth of cash in Bitcoin (BTC) or other cryptocurrencies.”

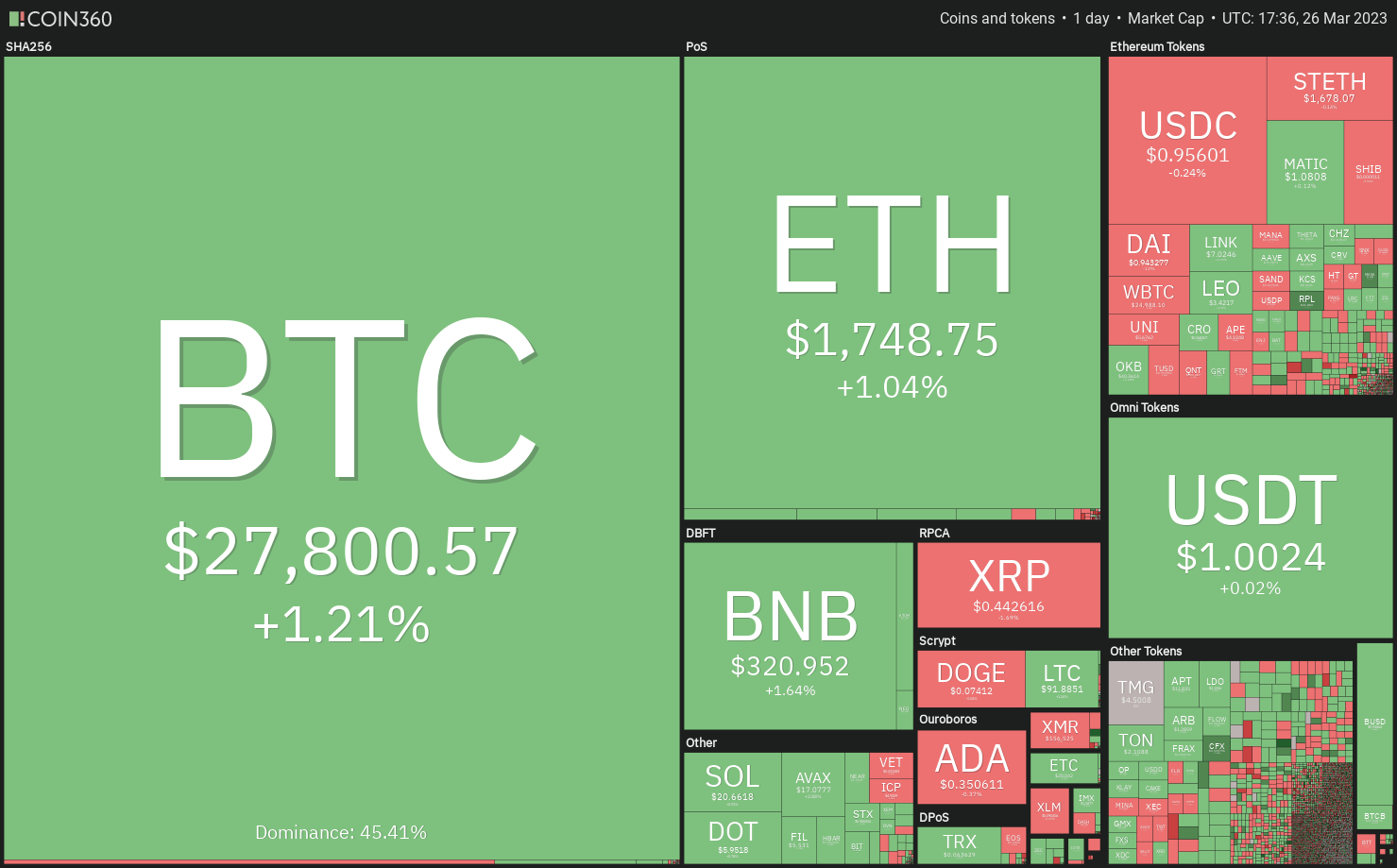

The move from the traditional banking system to cryptocurrencies may have already started as seen from the strong showing of Bitcoin in the past few days. Even after the recent up-move, investors do not seem to be hurrying to book profits in Bitcoin. However, the same cannot be said about most altcoins as they have witnessed a minor pullback.

Trong ngắn hạn, các nhà giao dịch cần phải chọn lọc các loại tiền điện tử để giao dịch. Hãy nghiên cứu các biểu đồ của Bitcoin và chọn altcoins mà có thể bắt đầu bước tiếp theo của xu hướng tăng lên.

Bitcoin price analysis

Bitcoin đã lơ lửng quanh mức $28,000 trong vài ngày qua. Sự củng cố sau một đợt tăng mạnh là một dấu hiệu tích cực vì nó cho thấy các nhà giao dịch đang giữ vị thế của họ, mong đợi một xu hướng tăng thêm.

trung bình di chuyển theo cấp số mũ 20 ngày ($25,936) và chỉ số sức mạnh tương đối (RSI) trong vùng tích cực cho thấy những con bò vẫn kiểm soát. Điều đó tăng cường triển vọng của một sự phá vỡ trên $28,900.

Nếu điều đó xảy ra, cặp BTC/USDT có thể tăng lên vùng kháng cự $30,000 đến $32,000. Những con gấu sẽ cố gắng bảo vệ khu vực này với tất cả sức mạnh của họ bởi vì nếu họ thất bại trong nỗ lực của họ, cặp tiền có thể tăng vọt lên $40,000.

Sự hỗ trợ quan trọng trên mặt giảm là $25,250. Nếu mức này không giữ được, cặp tiền có thể giảm xuống mức trung bình động đơn giản 200 ngày ($20,179).

Biểu đồ 4 giờ cho thấy cặp tiền đã giao dịch trong phạm vi giữa $26,500 đến $28,900 trong một thời gian. Chỉ số 20-EMA phẳng và RSI nằm ngay trên điểm giữa, cho thấy sự cân bằng giữa cung và cầu.

Một sự phá vỡ trên $28,900 sẽ báo hiệu rằng những con bò đã vượt qua những con gấu. Điều đó sẽ cho thấy việc nối lại di chuyển lên. Ngược lại, nếu giá phá vỡ dưới $26,500, cặp này có thể giảm xuống $25,250 và sau đó xuống $24,000.

Phân tích giá XRP

XRP (XRP) soared above the overhead resistance of $0.43 on March 21. The bears tried to trap the aggressive bulls by pulling the price below the moving averages but the bulls held their ground.

Người mua đang cố gắng đẩy giá lên mức kháng cự trên cao ở mức $0.51. Nếu bulls vượt qua chướng ngại vật này, cặp ETH/USDT có thể cố gắng tăng lên $0.56. Mức này có khả năng chứng kiến sự bán mạnh mẽ của những người bán nhưng nếu người mua đi qua đường đi qua, điểm dừng tiếp theo có thể là $0.80.

Another possibility is that the price turns down from $0.51. During the pullback, if bulls flip the $0.43 level into support, it will suggest that the sentiment has turned positive. That will increase the likelihood of a break above $0.51.

The crucial support to watch on the downside is $0.40. If this level gives way, the next support is $0.36.

Biểu đồ 4 giờ cho thấy những người bán đang cố gắng bảo vệ mức thoái lui Fibonacci 61.8% ở mức $0.46 và những con bò đực đang mua giảm xuống mức 20 EMA. Điều này cho thấy trạng thái cân bằng giữa bò đực và gấu.

If the price sustains above $0.46, it will suggest that bulls have seized control. The pair could then attempt a rally to $0.49 where the bears may again mount a strong defense. On the other hand, if the price slips below the 20-EMA, the pair may fall to $0.43 and then to $0.40.

Litecoin price analysis

While most major altcoins are struggling to start a recovery, Litecoin (LTC) is showing signs of strength. The 20-day EMA ($86) has started to turn up and the RSI is in the positive zone, indicating advantage to buyers.

The LTC/USDT pair could first rise to $98 and then retest the strong overhead resistance at $106. This is an important level to keep an eye on because if it crumbles, the pair may accelerate to $115 and then to $130.

Alternatively, if the price turns down sharply from $106, it will suggest that bears are active at higher levels. The pair could then drop to the 20-day EMA. If the price rebounds off this level, it will suggest that the sentiment remains positive. The bulls will then make another attempt to resume the up-move.

The first sign of weakness will be a break and close below the 20-day EMA. That could open the doors for a drop to $75.

The rebound off the 20-EMA on the 4-hour chart shows that the bulls are viewing the dips as a buying opportunity. The bulls will try to kick the price above $96 and extend the up-move to the overhead resistance at $106.

Contrarily, if the price breaks below the 20-EMA, it will suggest that the bullish momentum is weakening. The pair could then descend to the uptrend line. This is an important level for the bulls to defend because if it cracks, the pair may tumble to $75.

Related: Bitcoin is 1 week away from ‘confirming’ new bull market — analyst

Monero price analysis

After trading near the moving averages for a few days, Monero (XMR) has broken free and is trying to climb higher.

The 20-day EMA ($153) has started to turn up and the RSI is in the positive territory, indicating that buyers have the edge. There is a minor resistance at $170 but if bulls overcome this barrier, the XMR/USDT pair could pick up momentum and soar to $187 and subsequently to $210.

The moving averages are expected to provide support during pullbacks. A break and close below the 200-day SMA ($150) could turn the tide in favor of the bears. The pair may then slump to $132.

The 20-EMA on the 4-hour chart is sloping up and the RSI is in the positive zone, indicating that bulls have the upper hand. The pair could reach $169 where the bulls may again face stiff resistance from the bears.

However, on the way down, if bulls do not allow the price to break below the 20-EMA, it will increase the likelihood of a rally above $169. If that happens, the pair may climb to $180 and later to $188.

The first sign of weakness will be a break and close below the 20-EMA. That could open the doors for a possible drop to the 200-SMA.

Avalanche price analysis

The bulls have successfully held Avalanche (AVAX) above the moving averages, indicating that lower levels are attracting buyers.

The price has been consolidating between $18.25 and the 200-day SMA ($16.05) for the past few days but this range-bound action is unlikely to continue for long. If buyers thrust the price above $18.25, the AVAX/USDT pair will attempt a rally to $22 where they may face strong selling by the bears.

This positive view will invalidate in the near term if the price plummets and sustains below the 200-day SMA. The pair could then slide to $15.24 and thereafter to $14.

The bulls have successfully guarded the $16.25 level on the downside but they have failed to propel the pair above the resistance line. This indicates that the bears have not given up and they continue to sell on rallies. The flattish 20-EMA and the RSI near the midpoint do not give a clear advantage either to buyers or sellers.

This uncertainty could tilt in favor of the bulls if they take out the resistance line. The pair may then start the next leg of the recovery to $20 and later to $22. A break and close below $16.25 will tilt the advantage in favor of the bears.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.