The Latin American region is tapping into blockchain-based services for payments and access to financial services, signaling that the crypto industry serves more than just financial speculators chasing the next memecoin pump.

Latin American citizens are increasingly using cryptocurrency to replace the region’s inadequate banking infrastructure, allowing them to facilitate digital payments and create stablecoin-based savings accounts.

“LATAM adoption is quite high. People are using stablecoins for daily life, so it’s a whole different market,” said Patricio Mesri, co-CEO of cryptocurrency exchange Bybit’s Latin American division. “Crypto is actually changing the lives of people. You see adoption in Argentina, Venezuela, Bolivia and Mexico increasing rapidly,” he told Cointelegraph during an interview at the European Blockchain Convention 2025 in Barcelona.

Some of the most interesting use cases include stablecoin payments to circumvent the high remittance fees of the SWIFT banking network, and taking up crypto-based loans for major purchases such as cars or homes, he said.

Related: $19B market crash paves way for Bitcoin’s rise to $200K: Standard Chartered

Fiat money inflation is driving Latin American regions to stablecoins

Countries like Argentina, where annual inflation surpassed 100%, have seen a surge in demand for US dollar-backed stablecoins, including USDC (USDC) and USDt (USDT).

On local crypto exchange Bitso, stablecoin transactions accounted for 39% of total purchases in 2024 as the most sought-after digital assets, Cointelegraph reported in March.

Related: SpaceX moves $257M in Bitcoin, reignites questions over its crypto play

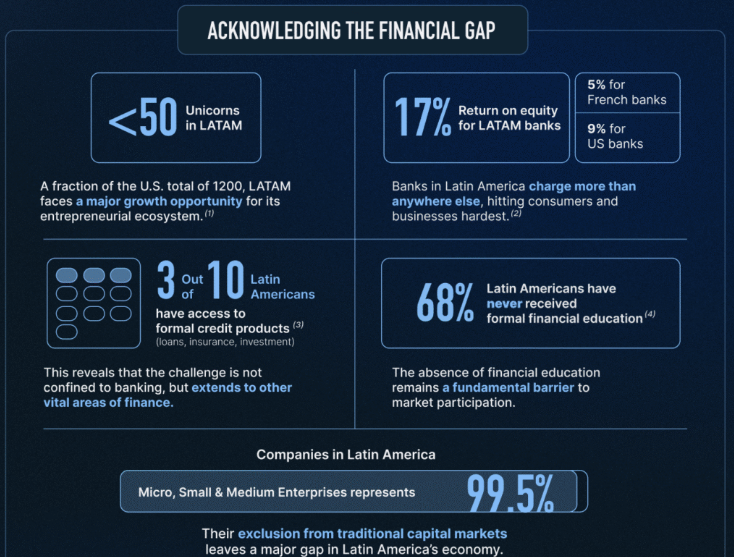

The lack of banking access has also created systemic inefficiencies in the region, including technological barriers and high startup costs, which are slowing the flow of investment into Latin American capital markets.

Still, the region’s liquidity latency issues may be improved by adopting blockchain-based instruments, such as real-world asset (RWA) tokenization, according to an August report from Bitfinex Securities.

Tokenized products could expand investor access and bring more capital to the region, as they can reduce issuance costs for capital raises by up to 4% while reducing listing times by up to 90 days, according to Bitfinex.

“For decades, businesses and individuals, particularly in emerging economies and industries, have struggled to access capital through legacy markets and organisations,” said Paolo Ardoino, CEO of Tether and chief technology officer of Bitfinex Securities.

“Tokenisation actively removes these barriers,” he said, adding that RWAs can unlock capital more efficiently than traditional financial products.

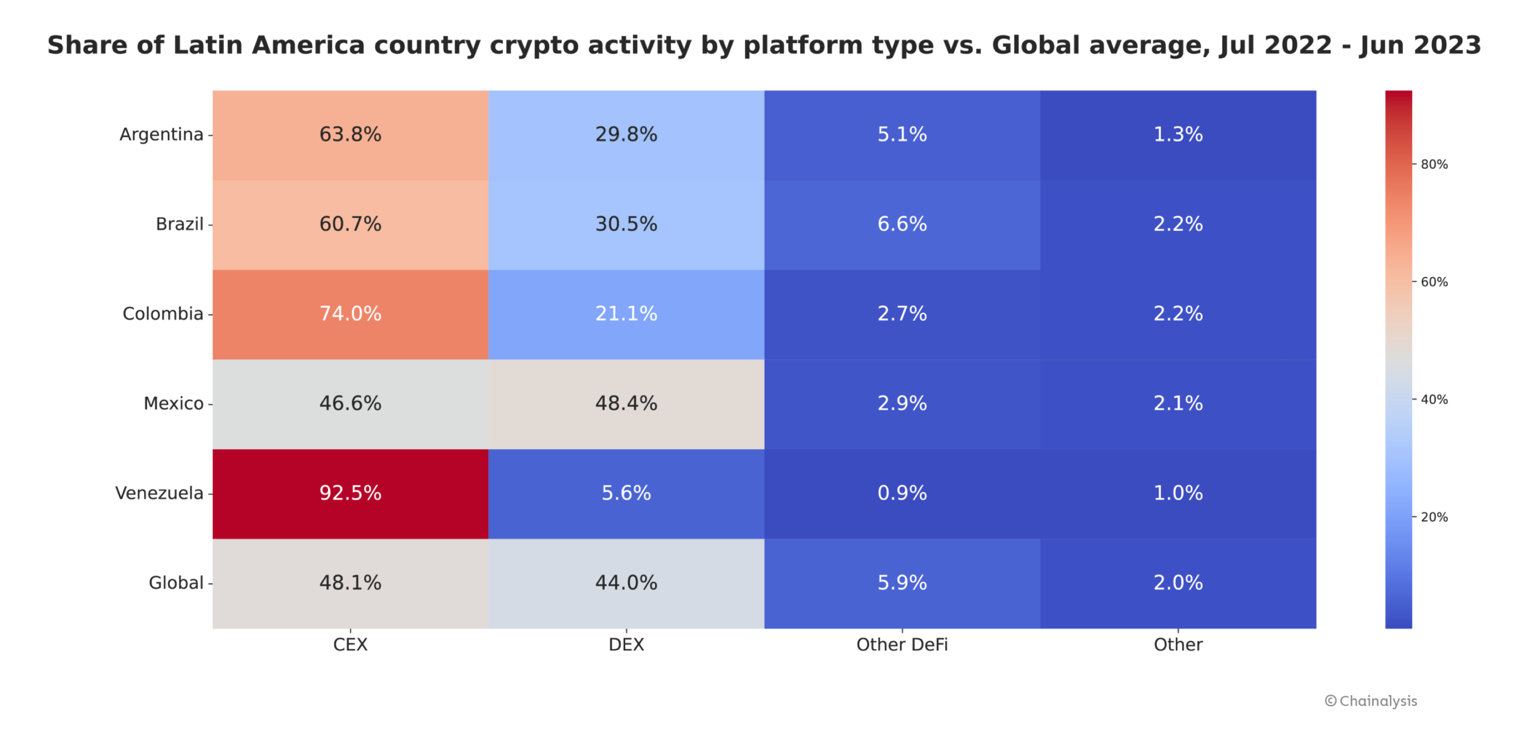

Latin America was the seventh-largest crypto economy in the world in 2023, trailing the Middle East and North America (MENA), Eastern Asia and Eastern Europe, according to blockchain analytics firm Chainalysis.

Magazine: The one thing these 6 global crypto hubs all have in common…