Key takeaways:

-

The emergence of a bear flag on the daily chart projects a Bitcoin price drop to $88,000.

-

Traders say BTC price may drop as low as $97,500,000 if key support levels are broken.

Bitcoin’s (BTC) price is forming a classic bearish pattern in the daily time frame, triggering fears that a breakdown could lead to a drop below $90,000.

Bull flag breakout points to $88,000 target

Bitcoin’s price action has formed a textbook bear flag pattern on the daily chart, a bearish continuation setup formed when the price consolidates upward in a parallel channel after a sharp downward move.

In Bitcoin’s case, the flag began forming after BTC bottomed at around $103,530 on Oct. 11. The consolidation has persisted over the last week, with the price continuously retesting the support line of the flag, currently at $107,500.

Related: Bitcoin may ‘final flush’ to $104K before the bull market returns

A daily candlestick close below this level will validate the bear flag, opening the door for the bearish continuation toward the measured target of the pattern at $88,100. Such a move would bring the total losses to 19%.

Momentum indicators, including the relative strength index (RSI), are also supportive, with the RSI currently at 42, suggesting that market conditions still favor the downside.

As Cointelegraph reported, a validation of a similar bearish pattern in the four-hour chart projects a drop toward $98,000, which will also be a level to watch for a potential reversal in the short term.

Watch these Bitcoin price levels next: Analysts

Data from Cointelegraph Markets Pro and TradingView shows that the BTC/USD pair has dropped 13.6% from its all-time high above $126,000.

This drawdown has seen Bitcoin drop below the short-term holders’ cost basis of around $113,100, a structure that has historically preceded “the onset of a mid-term bearish phase, as weaker hands begin to capitulate,” according to onchain data provider Glassnode.

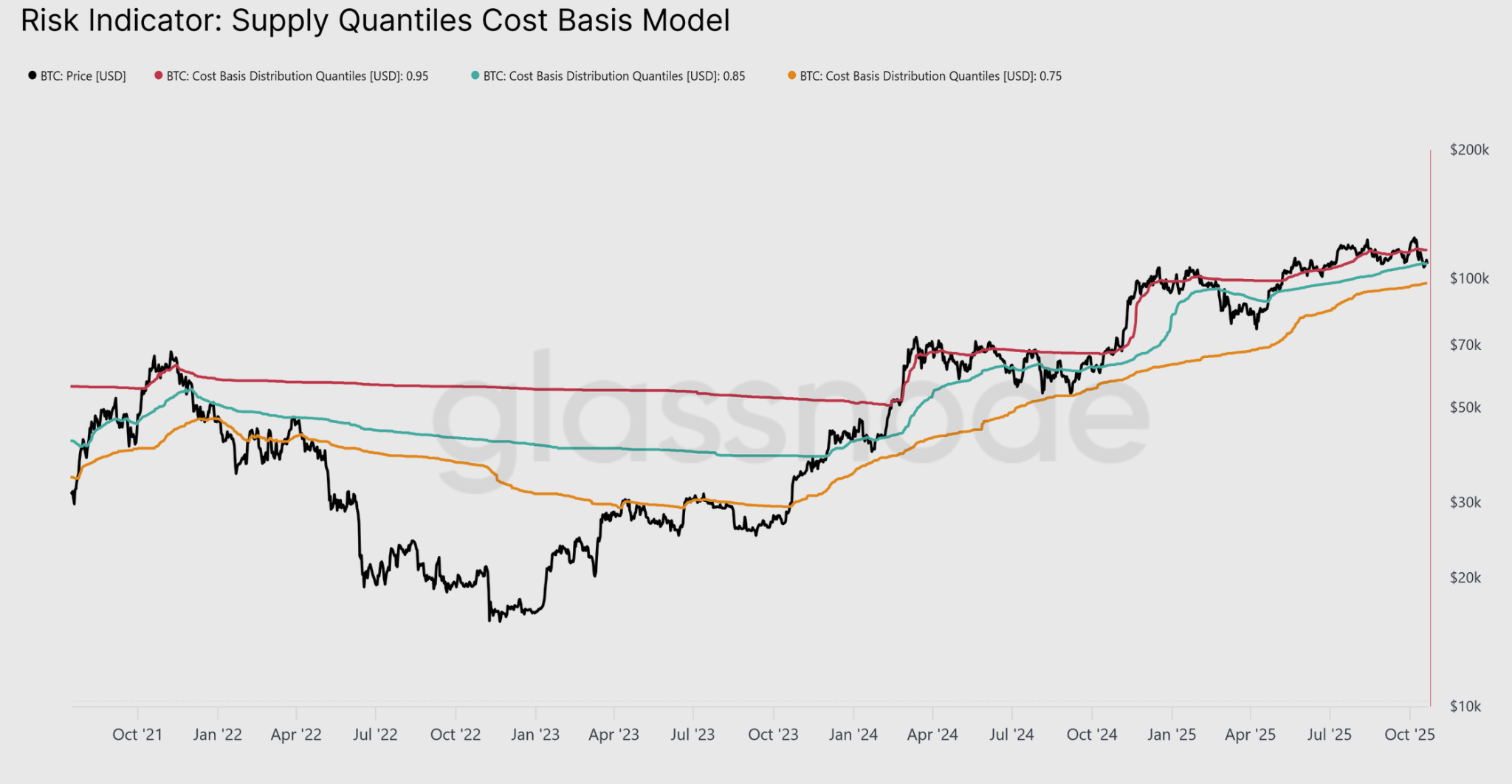

Bitcoin’s Supply Quantiles Cost Basis Model revealed that bulls need to hold BTC above the 0.85 quantile at $108,600 to avoid another sell-off, Glassnode said in its latest Week On-Chain report, adding:

“Historically, failure to hold this threshold has signalled structural market weakness and often preceded deeper corrections toward the 0.75 quantile, which now aligns near $97.5K.”

For popular crypto analyst Daan Crypto Trades, the $111,000 level is “what matters in the short term.”

“If the price can break and hold above that point, we can start looking for higher levels,” the trader said in a Thursday post on X, adding:

“It’s good that the $107K level held during all this weakness, also from stocks yesterday. But that is a key support to hold going forward.”

As Cointelegraph reported, Bitcoin is at a crucial juncture, as a daily close below the $107,000 support level would clear the path for a drop to the psychological $100,000 mark or lower.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.