Bitcoin (BTC) bắt đầu một tuần mới tại trung tâm của ngành công nghiệp mật mã tươi như mức phí cao nhất trong hai năm áp lực giá hành động.

Nhược điểm biến động là chào đón các nhà giao dịch nhờ vào một bản ghi nhớ đầy đủ, và các giải thích chỉ ngón tay vào nhiều bên.

Trao đổi lớn nhất Binance đang thêm vào sự nhầm lẫn, tạm dừng rút tiền BTC nhiều lần so với những gì nó gọi là mạng “tắc nghẽn”.

Trong bối cảnh hỗn loạn, BTC/USD đang có dấu hiệu căng thẳng, phá vỡ từ $28,000 để đe dọa một lối ra của phạm vi giao dịch rộng hơn của nó.

Các sự kiện đánh dấu sự khởi đầu búng túng đến một tuần đã đầy tiềm năng của các chất xúc tác biến động giá BTC. Những thông tin này đến dưới dạng các dữ liệu kinh tế vĩ mô, bao gồm Chỉ số Giá tiêu dùng (CPI), cũng như báo cáo thu nhập quý 1

As Bitcoin network metrics begin to show the impact of current network activity, miners are still selling their holdings, data shows, leading analysis to conclude that the 2022 bear market is still in play.

Cointelegraph takes a look at these factors and more in the weekly rundown of what’s moving crypto markets.

Giám đốc điều hành Binance gọi “FUD” trong bối cảnh tạm ngưng rút tiền BTC

Bitcoin đang chịu áp lực vào đầu tuần, nhưng không phải vì những lý do thông thường.

Khi BTC/USD giảm xuống $28,000, các nhà quan sát đang theo dõi chặt chẽ các sự kiện trên chuỗi và tại sàn giao dịch toàn cầu lớn nhất, Binance.

Chúng tôi biết rằng một số dữ liệu đang cho thấy một khối lượng lớn các dòng chảy từ #Binance. “

Dòng chảy” này thực sự là những chuyển động giữa ví nóng và lạnh Binance do sự điều chỉnh địa chỉ BTC. — Binance (@binance) Tháng Năm 8, 2023

Động thái của Binance đến khi số lượng lớn các giao dịch vào Mempool Bitcoin, đẩy phí đã cao hơn nữa vào lãnh thổ không thấy trong nhiều năm.

That had the unintended result of creating Bitcoin’s first-ever block in which miners earned more from fees than the block subsidy itself — 6.75 BTC versus 6.25 BTC, respectively.

Attention focused on Ordinals and even crypto investment giant, Digital Currency Group, as the source of the transactions. Later, market participants including researcher and investor Eric Wall revealed a potential source of the on-chain “spamming.”

tl;dr: a hex derivative (xen) that’s notable for spamming EVM chains has pivoted to spamming bitcoin via the ordinals brc-20 protocol causing an otherside-like mint event pic.twitter.com/3u2KHNpEyu

— Eric Wall ♂️ Taproot Wizard #2 (@ercwl) May 7, 2023

Binance, meanwhile, came in for criticism from some of the industry’s best-known names over its policy.

“Bitcoin không bị tắc nghẽn. Nó đang trải qua nhu cầu cao”, nhà phát triển cốt lõi Peter Todd lập luận

“binance chỉ có thể cho phép người dùng xác định những gì lệ phí của họ sẵn sàng trả cho rút, và trả lệ phí đó. Chi phí ~$5 để có được một đầu ra trong khối tiếp theo. nbd Good chance @binance có một dự trữ phân số

Binance CEO, Changpeng Zhao, also known as “CZ,” indirectly referred to “BTC withdrawal issues” at the exchange, labeling them “FUD.”

“Bitcoin network fees are fluctuating, 18x in a month,” part of a Twitter post stated.

As the events unfolded, BTC price action felt the strain, with a short-timeframe downtrend continuing at the time of writing.

Analyzing trader behavior, monitoring resource Skew noted bid activity increasing on Binance as Bitcoin returned to the $28,000 mark.

$BTC Binance Spot

Update: spot buyers around $28K & likely to sell around $28.5K – $28.7KStill decent bid depth here https://t.co/F1I9UhJETx pic.twitter.com/DSRTwfb5kK

— Skew Δ (@52kskew) May 8, 2023

Traders eye key levels as BTC price hits 2-week lows

Beyond the immediate events surrounding Binance and fees, market participants continue to eye important levels for BTC/USD.

As the pair trends below $28,000, popular trader Captain Faibik is eyeing $27,300 as a line in the sand.

$BTC Ascending Broadening Wedge Sill in Play..!!

If Bulls can Successfully defend the 27.3k Support, it’s likely that we’ll see a Significant Bounce Back in the Coming days.#Crypto #Bitcoin #BTC #BTCUSDT pic.twitter.com/pwERANhUGE

— Captain Faibik (@CryptoFaibik) May 8, 2023

A further tweet on the day highlighted a tightening wedge structure in place for Bitcoin, with the logical outcome in the form of a breakout now due.

Fellow trader Andrew meanwhile bet on the 50-day exponential moving average (EMA) as a potential support zone, this currently residing near $27,950 and already violated on shorter timeframes.

The day’s current low of $27,617 meanwhile marked Bitcoin’s deepest dip since April 26, per data from Cointelegraph Markets Pro and TradingView.

“BTC is retesting at .618 after the Binance FUD. This is another Bitcoin vs $BTC moment,” crypto educator Crypto Busy summarized, referring to Fibonacci retracement levels.

“Bitcoin as a network is always stable, but exchanges and wallets need more scalability solutions. $BTC as an asset is retesting due to selling pressure and FUD. Remember, not your keys, not your crypto!”

CPI “good candidate” for risk-on rally

Turning to macroeconomic events, the week is set to be marked by the April print of the United States Consumer Price Index (CPI).

Due on May 10, CPI will be keenly scrutinized for signs that inflation is continuing to abate, potentially increasing the scope for lawmakers to slacken economic policy.

If there is one data release that could sink or ignite a stock rally, CPI would be a good candidate. Coming Wednesday 8:30 am ET.

— Chris Ciovacco (@CiovaccoCapital) May 7, 2023

In April, a slight dip below market expectations accompanied Bitcoin gunning for new ten-month highs.

CPI is just one of several important U.S. data sets due this week, however, with jobless claims and Producer Price Index (PPI) numbers set for release.

Four Federal Reserve speakers will take to the stage, while the week marks the last of the Q1 earnings reports by major corporations.

Key Events This Week:

1. CPI inflation data – Wednesday

2. PPI inflation data – Thursday

3. Jobless claims data – Thursday

4. Consumer sentiment data – Friday

5. Total of 4 Fed speakers this week

6. Last big week of Q1 earnings

RT & LIKE if you enjoy these weekly previews!

— The Kobeissi Letter (@KobeissiLetter) May 7, 2023

“Numbers are expected to be ‘Good looking,’ good numbers are expected by market and partly priced in,” crypto trading and analysis account Doctor Profit told Twitter followers about CPI in part of weekly updates.

CPI is known as a volatility catalyst across crypto, but this month, not everyone is predicting upside continuation, even in the event of positive numbers.

Among them is popular trader Aqua, who revealed a broader correction inbound for BTC/USD thanks to what he fears is “distribution” — tactical selling.

This we take 24.8K nPOC soon, maybe, we have one more last upside squeeze if CPI data is good, CPI is in 2 days. But this here is looking more and more like a distribution and we are bound to see market correction in the coming weeks. #Bitcoin #BTCUSD #BTCUSDT #memecoin pic.twitter.com/n4Hp3LB97t

— Aqua (@PayneResidence) May 8, 2023

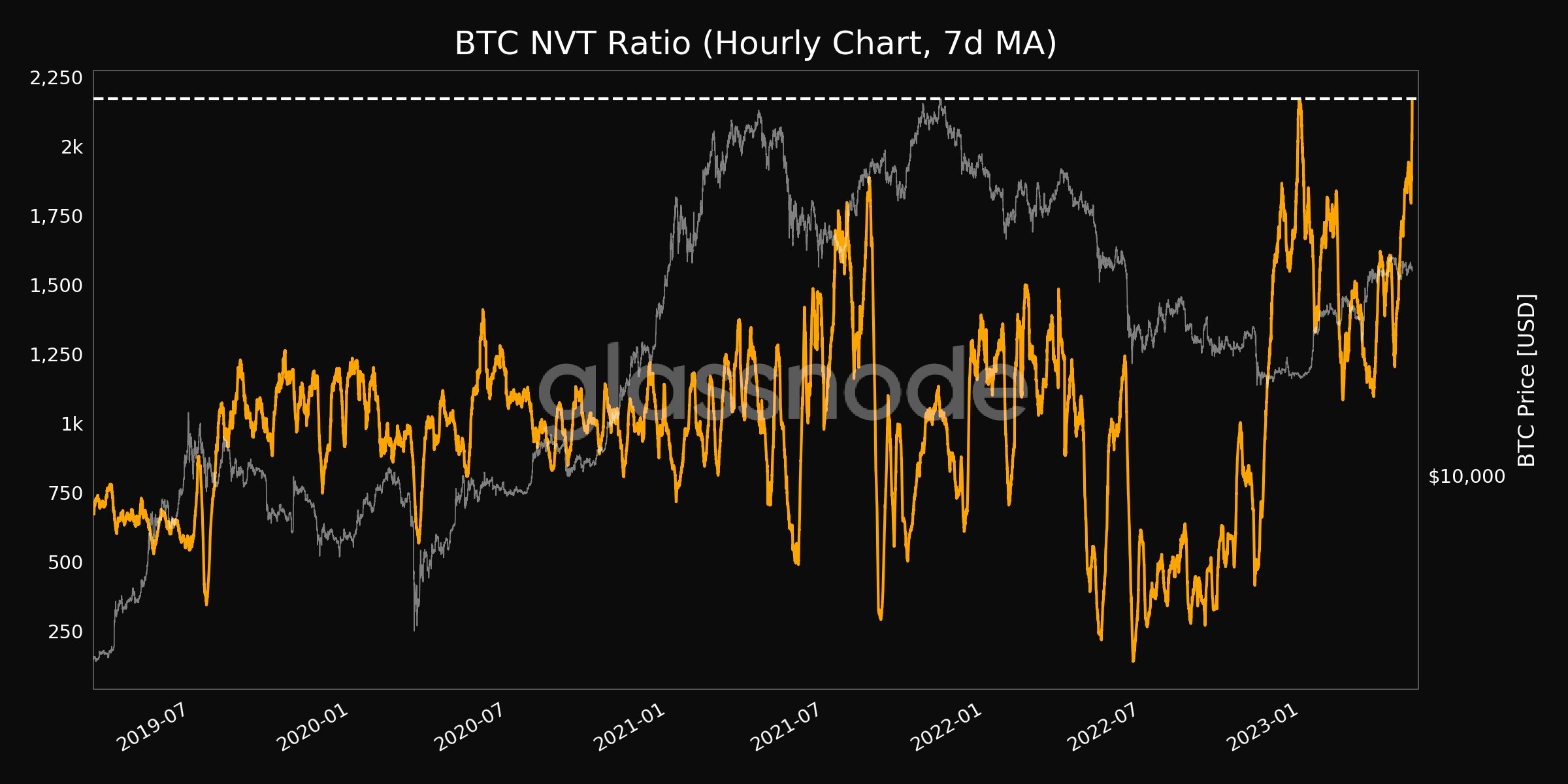

NVT underscores overheated network

The upheaval caused by high fees is already having an impact on long-term Bitcoin metrics.

Among them is the network value to transaction (NVT) ratio, which on May 8 hit its highest levels in four years.

As confirmed by on-chain analytics firm Glassnode, NVT is now at levels not seen since 2019.

Created by statistician Willy Woo, NVT ratio measures the relationship between value moved on-chain and Bitcoin’s overall market cap.

“When Bitcoin`s NVT is high, it indicates that its network valuation is outstripping the value being transmitted on its payment network, this can happen when the network is in high growth and investors are valuing it as a high return investment, or alternatively when the price is in an unsustainable bubble,” Woo explains on his own data website, Woobull.

Cointelegraph has extensively covered both NVT ratio and its follow-up NVT signal metric, the latter containing important nuances which influence how NVT data is interpreted.

Bitcoin miners still reducing BTC holdings

In a signal that Bitcoin miners continue to deal with the consequences of the 2022 bear market, BTC reserves they hold are at two-year lows.

Related: Watch these Bitcoin price levels next as BTC dips 3% in choppy weekend

As noted by on-chain analytics platform CryptoQuant, the amount of BTC in miners’ wallets is still trending downward, despite the recovery in BTC price seen through 2023.

“The return of miners’ interest in holding bitcoins for a longer time will be one of the other valuable factors for the growth of the price counties, which is necessary to be attention to in the coming days on the market,” contributor Crazzyblockk wrote in one of CryptoQuant’s Quicktake market updates on May 1.

Miners currently hold 1,826,695 BTC as of May 8, data shows — the least since July 2021.

As Cointelegraph reported, miners faced considerable pressure during 2022, as BTC/USD fell to risk their cost basis outstripping any revenue earned by mining.

Last week, separate numbers revealed that since 2010, miner revenues have nonetheless totaled over $50 billion.

Magazine: Joe Lubin — The truth about ETH founders split and ‘Crypto Google’

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.