Chỉ số S&P 500 (SPX) tiếp tục tiến lên mức cao nhất mọi thời đại với mức tăng 3% trong tháng Bảy. Dấu hiệu của áp lực lạm phát giảm dần và kỳ vọng chấm dứt chu kỳ thắt chặt của Cục Dự trữ Liên bang là những yếu tố thúc đẩy tâm lý rủi

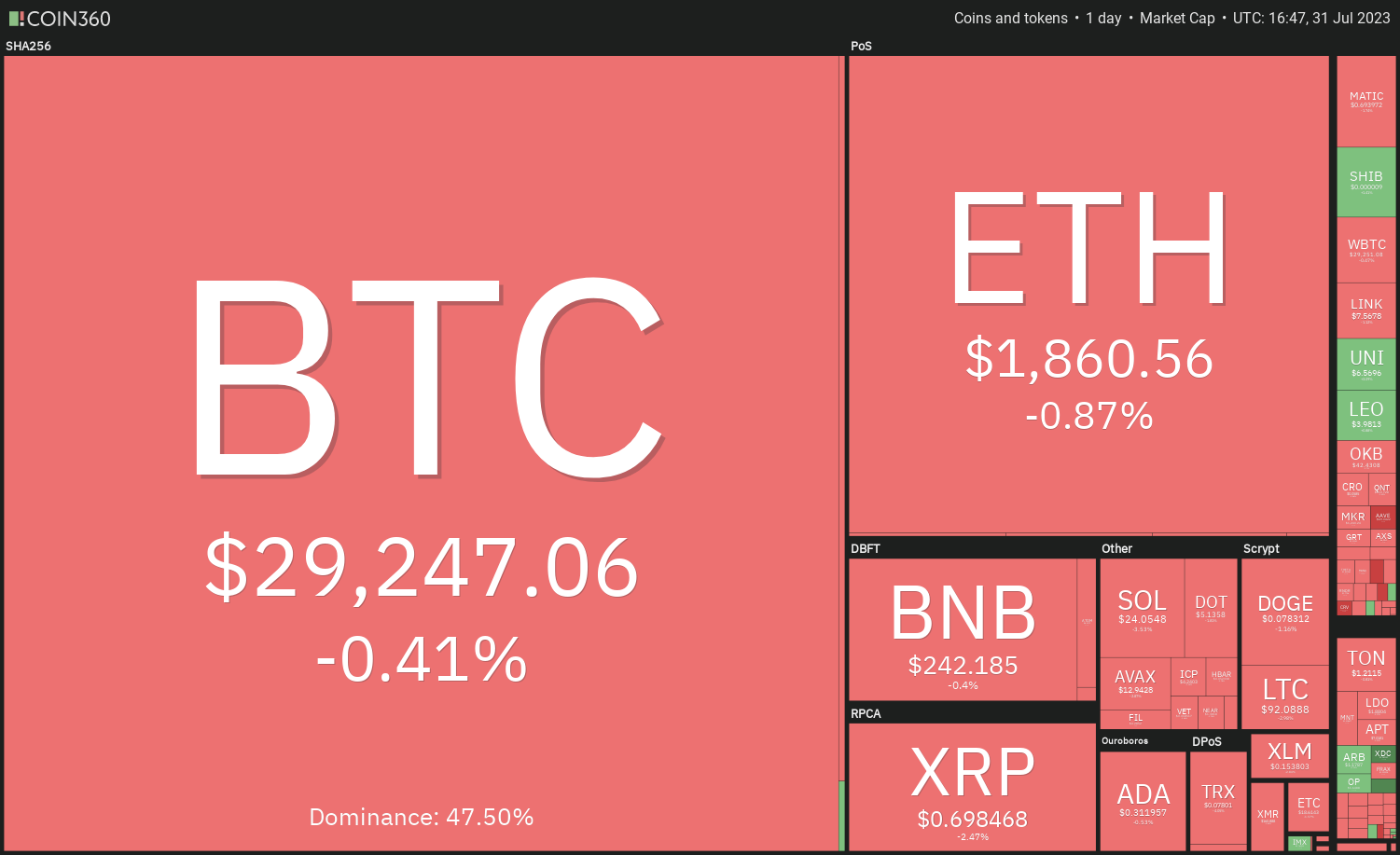

However, this bullish mood did not benefit Bitcoin (BTC) as it largely remained range-bound in July and is on track to end the month with a loss of more than 3%. The biggest question troubling traders is when will Bitcoin’s range break and in which direction.

Typically, the longer the time spent inside the range, the greater the force needed for the breakout. Once the price escapes the range, the next trending move is likely to be strong. The only problem is that it is difficult to predict the direction of the breakout with certainty. Hence, it is better to wait for the price to sustain above or below the range before taking large bets.

Với giao dịch Bitcoin trong một phạm vi, liệu hành động này có thể chuyển sang altcoin không? Hãy phân tích các biểu đồ để tìm hiểu.

Phân tích giá chỉ số S&P 500

The S&P 500 Index has been in an uptrend. The bears tried to pull the price back below the breakout level of 4,513 on July 27 but the bulls held their ground. This suggests that buyers are trying to flip the 4,513 level into support.

Các đường trung bình động upsloping cho thấy phe bò đang kiểm soát nhưng sự phân kỳ tiêu cực trên chỉ số sức mạnh tương đối (RSI) cho thấy đà tăng có thể đang chậm lại.

The up-move is likely to face strong selling at 4,650. If the price turns down from this level but rebounds off the 20-day exponential moving average (4,509), it will suggest that the uptrend remains intact.

Dấu hiệu đầu tiên của sự suy yếu sẽ là sự phá vỡ và đóng cửa dưới đường EMA 20 ngày. Điều đó có thể mở ra cánh cửa cho khả năng giảm xuống đường trung bình động đơn giản 50 ngày (4.371

Phân tích giá chỉ số đô la Mỹ

Phe gấu đã cố gắng kéo chỉ số đô la Mỹ (DXY) xuống dưới mức hỗ trợ 100.82 vào ngày 27 tháng 7 nhưng phe bò đã quyết liệt bảo vệ mức này. Điều đó bắt đầu mua mạnh, đẩy giá lên trên đường EMA 20 ngày (10

Tiếp theo, phe bò sẽ cố gắng mở rộng sự phục hồi đến đường SMA 50 ngày (102.51) và sau đó đến đường xu hướng giảm. Đây vẫn là mức quan trọng cần theo dõi bởi vì một sự phá vỡ trên nó có thể cho thấy rằng những con gấu đang mất dần sự kìm kẹp của họ. Sau đó, chỉ số này có thể tăng lên mức kháng cự mạnh tại 106

Mặt khác, phe gấu sẽ phải chìm và duy trì giá dưới 100.82 để thiết lập uy thế tối cao của chúng. Chỉ số sau đó có thể trượt xuống 99.57. Việc phá vỡ dưới mức hỗ trợ này có thể báo hiệu sự phục hồi của xu hướng giảm

Phân tích giá Bitcoin

Bitcoin dropped below the 50-day SMA ($29,442) on July 30, indicating that the bears are trying to take control. However, the long tail on the day’s candlestick shows buying near the horizontal support at $28,861.

Đường EMA 20 ngày đi xuống (29,624 đô la) và chỉ báo RSI dưới 44 cho thấy những con gấu có một lợi thế nhẹ. Bất kỳ nỗ lực nào để bắt đầu một đợt phục hồi cứu trợ có thể phải đối mặt với việc bán tại đường EMA 20 ngày. Nếu giá giảm từ ngưỡng kháng cự này và phá vỡ dưới 28.861 đô la, nó có thể bắt đầu giảm xuống 27.500 đô la và sau đó xuống 26.000 đô la

If bulls want to prevent the fall, they will have to thrust the price above the 20-day EMA. The BTC/USDT pair could first rise to $29,500 and then to the $31,500 to $32,400 resistance zone.

Phân tích giá Ether

Ether (ETH) has been trading between the moving averages for the past few days, indicating indecision among the bulls and the bears about the next directional move.

Generally, tight ranges are followed by a range breakout that starts the next leg of the trending move. If the price plunges below the 50-day SMA ($1,859), it will indicate that bears have overpowered the bulls. That may start a downward move toward $1,700.

Instead, if the price turns up and closes above the 20-day EMA, it will signal the start of a short-term up-move. The ETH/USDT pair could first rise to $1,929 and thereafter attempt a rally to the psychological resistance at $2,000.

XRP price analysis

XRP (XRP) has been consolidating inside a large range between $0.67 and $0.85. Although the bulls successfully defended the support, they have failed to start a strong recovery.

The gradually rising 20-day EMA ($0.69) and the RSI in the positive territory indicate that the bulls have a slight edge. If buyers overcome the barrier at $0.75, the XRP/USDT pair may start a relief rally to the resistance at $0.85.

Contrarily, if the price turns down and dives below the 20-day EMA, it will suggest that every minor rise is being sold into. The pair could then retest the support at $0.69. If this support crumbles, the pair may extend the decline to the breakout level of $0.56.

BNB price analysis

BNB (BNB) continues to trade inside the symmetrical triangle pattern, indicating indecision among the bulls and the bears.

The flattish moving averages and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears. If the price sustains above the moving averages, the BNB/USDT pair could rise to the resistance line. A break and close above the triangle could propel the price to $265.

On the other hand, if the price breaks below the moving averages, it will suggest that bears are trying to pull the pair to the support line. If this support cracks, the pair may plunge to $220.

Cardano price analysis

Cardano (ADA) rose above the 20-day EMA ($0.31) on July 28 but the recovery lacks momentum. This suggests that demand dries up at higher levels.

If the price skids back below the 20-day EMA, the ADA/USDT pair could consolidate inside a tight range between $0.30 and $0.32 for some time. Buyers will have to kick the price above $0.32 to start an up-move to $0.34 and subsequently to $0.38.

Contrarily, if the price continues lower and plummets below the 50-day SMA ($0.29), it may trap several aggressive bulls. That may start a rush to the exit, resulting in a deeper correction to $0.28 and then to $0.26.

Related: Bitcoin volume hits lowest since early 2021 amid fear $25K may return

Dogecoin price analysis

Dogecoin (DOGE) is facing selling just above the $0.08 level but a minor positive is that the bulls have not ceded ground to the bears. This suggests that the buyers expect another leg higher.

The upsloping 20-day EMA ($0.07) and the RSI in the positive territory indicate that the bulls have the upper hand. If the price turns up from the 20-day EMA, the bulls will again attempt to drive the DOGE/USDT pair above the overhead resistance. If they succeed, the pair may start its northward march to $0.10 and eventually to $0.11.

Alternatively, if the price turns down and breaks below the 20-day EMA, it will suggest that the bulls are losing their grip. The pair may then slide to the breakout level at $0.07.

Solana price analysis

Solana (SOL) is trying to find support at the 20-day EMA ($24.14) but the bulls are struggling to sustain the rebound. This suggests that the bears have not given up.

If the price cracks and maintains below the 20-day EMA, the SOL/USDT pair may slide to $22.30. This remains the key short-term support to watch out for. If the price rebounds off this level, the pair may consolidate between $22.30 and $27.12 for some time. The flattening 20-day EMA and the RSI near the midpoint also suggest a range formation in the near term.

A break and close above $27.12 will signal that bulls are back in the driver’s seat. The pair may then rally to $32.13. On the downside, a break below $22.30 could pull the pair to the 50-day SMA ($20.71).

Litecoin price analysis

Buyers pushed Litecoin (LTC) above the 20-day EMA ($92) on July 29 but they could not clear the hurdle at $97.

The flattish 20-day EMA and the RSI just below the midpoint indicate the possibility of a range formation. Buyers purchased the dip on July 30 as seen from the long tail on the candlestick but they failed to build upon the strength on July 31. This suggests that bears are aggressively defending the $97 level.

If the price tumbles below the 50-day SMA ($91), the LTC/USDT pair could descend to $87. A strong bounce off this level may keep the pair range-bound for a few days. Buyers will have to propel the price above $97 to open the doors for a rally to $106.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.