Sự cạnh tranh tồn tại khắp mọi nơi. Soccer có Lionel Messi và Cristiano Ronaldo trong Soccer, bóng rổ có Stephen Curry và LeBron James trong bóng rổ, và Tennis có Serena Williams và Maria Sharapova. Nó cũng giống nhau đối với tiền điện tử. Sự khác biệt duy nhất là sự cạnh tranh giữa các tính cách trong mật mã có thể dẫn đến kết quả thị trường phi thường.

Trong khi hệ sinh thái mật mã có thể được dẫn dắt bởi một vài mọt sách toán lập dị lạnh lùng (như Vitalik Buterin và CZ của Binance), sự cạnh tranh của nó là bất cứ điều gì ngoài lạnh lùng. Các đối thủ vĩ đại trong tiền điện tử thường không đụng độ, nhưng khi họ làm vậy họ có thể đốt cháy một chuỗi phản ứng mà cuối cùng xóa sạch 8 tỷ đô la từ thị trường.

Dưới đây là năm trong số những sự cạnh tranh lớn nhất mà thế giới của mật mã đã từng thấy.

1. CZ Binance Vs. Sam Bankman-Fried (SBF)

In the early days of November 2022, Twitter users @CZ_Binance and @SBF_FTX waded into an online back and forth that would eventually lead to 8 billion dollars or more of value getting wiped off the crypto market.

While no one knows about the background of this rivalry, we do know that it reached a boiling point sometime in the fourth quarter of 2022.

Before their rivalry turned toxic, Sam Bankman-Fried, the owner and founder of FTX, and CZ, the owner and founder of Binance, had a somewhat cordial relationship. Binance had invested about $2.1 billion in FTX, so it was a huge shareholder in the exchange’s stakes. This kind of investment is usually not done on a whim, and CZ presumably believed in SBF and the FTX vision at the time.

In the time since that investment, FTX grew to become the second-largest crypto exchange in the world. The only exchange bigger than it was Binance, and there were, in institutional terms, the biggest rivals in crypto. Despite this, FTX and Binance never really had a public spat, and things went swimmingly between both companies.

However, all of that changed in 2021. According to CZ, Binance exited its position in FTX in July 2021 after being “increasingly uncomfortable” with FTX and the relationship it had with a sister firm, Alameda Research. CZ tweeted that Binance’s decision to pull out of FTX and exit their position made SBF very angry and that he became rather unhinged.

But that was just the beginning. In a bombshell thread, CZ claimed Binance would be selling all the FTT tokens it had on its books. Almost immediately, the CEO of Alameda Research, Caroline Ellison, made a tweet saying Binance should sell all its FTT to Alameda at $22.

In the early days of November 2022, Twitter users @CZ_Binance and @SBF_FTX waded into an online back and forth that would eventually lead to 8 billion dollars or more of value getting wiped off the crypto market.

While no one knows about the background of this rivalry, we do know that it reached a boiling point sometime in the fourth quarter of 2022.

Before their rivalry turned toxic, Sam Bankman-Fried, the owner and founder of FTX, and CZ, the owner and founder of Binance, had a somewhat cordial relationship. Binance had invested about $2.1 billion in FTX, so it was a huge shareholder in the exchange’s stakes. This kind of investment is usually not done on a whim, and CZ presumably believed in SBF and the FTX vision at the time.

In the time since that investment, FTX grew to become the second-largest crypto exchange in the world. The only exchange bigger than it was Binance, and there were, in institutional terms, the biggest rivals in crypto. Despite this, FTX and Binance never really had a public spat, and things went swimmingly between both companies.

However, all of that changed in 2021. According to CZ, Binance exited its position in FTX in July 2021 after being “increasingly uncomfortable” with FTX and the relationship it had with a sister firm, Alameda Research. CZ tweeted that Binance’s decision to pull out of FTX and exit their position made SBF very angry and that he became rather unhinged.

But that was just the beginning. In a bombshell thread, CZ claimed Binance would be selling all the FTT tokens it had on its books. Almost immediately, the CEO of Alameda Research, Caroline Ellison, made a tweet saying Binance should sell all its FTT to Alameda at $22.

position:absolute!Important

}.tweet-container div:last-child{

position:relative!Important

}

@cz_binance if you’re looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

function lazyTwitter(){var i=function(t){if(!t)return;var n=t.getBoundingClientRect();return 2500>n.top||-2500>n.top};if(!i(document.querySelector(“.twitter-tweet”)))return;var s=document.createElement(“script”);s.onload=function(){};s.src=”//platform.twitter.com/widgets.js”;document.head.appendChild(s);document.removeEventListener(“scroll”,lazyTwitter);document.removeEventListener(“touchstart”,lazyTwitter);console.log(“load twitter widget”)}document.addEventListener(“scroll”,lazyTwitter);document.addEventListener(“touchstart”,lazyTwitter);lazyTwitter()

Tuy nhiên, các cầu thủ ngành công nghiệp lưu ý rằng điều này là xa hành vi logic từ Ellison. Nếu cô thực sự tin rằng FTX và Alameda ổn định, cô sẽ không tuyệt vọng yêu cầu Binance bán FTT cho Alameda Research.

Là một phần của việc Binance thoát khỏi chứng khoán FTX năm ngoái, Binance nhận được khoảng 2,1 tỷ USD tương đương tiền mặt (BUSD và FTT). Do những tiết lộ gần đây đã đưa ra ánh sáng, chúng tôi đã quyết định thanh lý bất kỳ FTT còn lại trên sách của chúng tôi. 1/4

— CZ 🔶 Binance (@cz_binance) ngày 6 tháng 11 năm 2022

Trong mọi trường hợp, các chủ đề ngay lập tức tạo ra một ngân hàng chạy trên FTX mà cuối cùng đã dẫn đến thị trường hiểu rằng sàn giao dịch đã bị phá sản.

Trong các chủ đề sau này, CZ nói rằng ông sẽ không bao giờ hỗ trợ những người vận động chống lại những người chơi ngành công nghiệp khác đằng sau lưng họ. Tweet này nói về các báo cáo rằng SBF đã ủng hộ dự thảo dự thảo dự luật của DCCPA có thể đã mang lại cho FTX một lợi thế thị trường.

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Tweet này đã tiết lộ một năng động cá nhân đối với toàn bộ bộ phim truyền hình mà mọi người chưa từng nhận thức được trước đây. CZ không chỉ bán FTT vì kinh doanh, ông còn bán nó vì ông xem SBF, và do đó FTX, là diễn viên xấu.

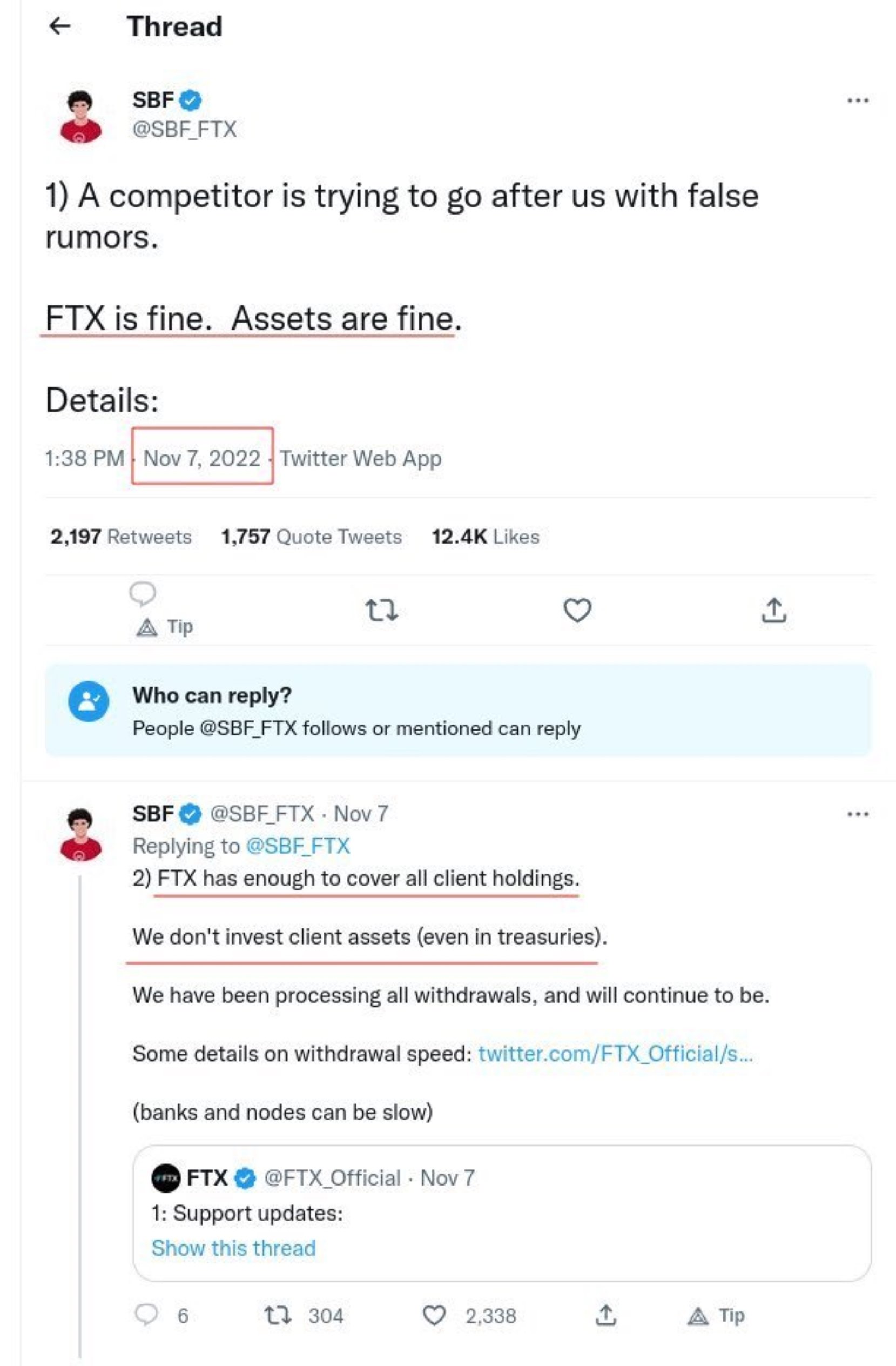

SBF giữ bình tĩnh qua tất cả những điều này, và chỉ trả lời CZ ngày sau đó. Trong câu trả lời đã bị xóa, ông nói rằng tài sản vẫn ổn và không có gì sai với FTT. Tuy nhiên, đó hóa ra là một lời nói dối khi trao đổi sớm hạn chế rút tiền.

Cuối cùng, SBF tweet rằng FTX đã đạt được một thỏa thuận để được mua lại bởi Binance. Thật không may, sự sắp xếp đó đã thất bại. Nhưng những vụ tồi tệ nhất giữa SBF và CZ vẫn chưa đến.

Khi tình hình FTX được làm sáng tỏ và mọi người nhận ra FTX hoạt động tồi tệ như thế nào, tâm lý công chúng chống lại SBF tăng lên. CZ tiếp tục gọi SBF là gian lận trong một chủ đề tweet. Ông cũng nói rằng SBF đe dọa toàn bộ đội Binance khi FTX buộc phải mua cổ phần của Binance ra. Cuối cùng, ông khẳng định rằng SBF đã sử dụng tiền của khách hàng để mua thiện chí trên các phương tiện truyền thông.

Có vẻ như $15 triệu không chỉ thay đổi suy nghĩ của @kevinolearytv về mật mã, nó còn khiến anh ta liên kết với một kẻ lừa đảo. Anh ta có nghiêm túc bảo vệ SBF không? https://t.co/JoKapOcMXr (các cuộc tấn công vô căn cứ bắt đầu khoảng 4:20).

Một sợi. 1/11 — CZ 🔶 Binance (@cz_binance) ngày 9 tháng 12 năm 2022

Để điều này, một SBF đã từ chức tweet rằng CZ nên ngừng nói dối, và nên lấy “chiến thắng”.

Anh thắng rồi, @cz_binance.

Không cần phải nói dối, bây giờ, về việc mua lại.

Chúng tôi bắt đầu các cuộc trò chuyện về việc mua bán bạn, và chúng tôi quyết định làm điều đó vì nó rất quan trọng đối với doanh nghiệp của chúng tôi.

Và trong khi tôi bực bội với chiến thuật ‘đàm phác’ của ông, tôi đã chọn vẫn làm điều đó.

— SBF (@SBF_FTX) ngày 9 tháng 12 năm 2022

To many spectators, this just outlined how nonchalant SBF was, as he still assumed that the crypto market was some kind of game one could win or lose with minimal material consequences.

In the end, the FTX crash will always be linked to CZ taking a stand and deciding to publicly make a move to protect his business from his biggest rival.

2. Vitalik Buterin Vs. Justin Sun

Ever since Ethereum came online, many cryptos have been created with the explicit mission of being Ethereum’s killer. Vitalik Buterin, the main person behind Ethereum, has hardly ever given these projects any thought.

Tron is one of these projects, and it’s led by Justin Sun. Strictly speaking, Tron and Ethereum can hardly be compared as projects. Ethereum has a way bigger market cap, better use cases, and hosts bigger projects than Tron.

However, this hasn’t stopped Sun and Buterin from clashing on several issues. One time, Sun made a tweet listing seven reasons why Tron was better than Ethereum. Buterin replied with an eighth reason, which was that Tron had a better whitepaper since it was made through copying and pasting from other projects.

8. Better white paper writing capability (Ctrl+C + Ctrl+V much higher efficiency than keyboard typing new content)

— vitalik.eth (@VitalikButerin) April 6, 2018

Sun has also clashed with Buterin on what path Ethereum should take after its merger. According to Sun, the Proof-of-Work (PoW) mechanism should exist post-merge. Buterin, on the other hand, had harsh words for Sun and other people who wanted the continued existence of the Proof-of-Work (PoW) mechanism. He stated that they were mostly exchange owners trying to make more money.

3. Elon Musk Vs. Sam Bankman-Fried (SBF)

While SBF was dealing with the tragic crash of FTX, he was also suffering verbal attacks from the richest man in the world.

When news of the FTX crash broke and people realized just how much SBF donated to Democrat campaigns, lots of conspiracy theories began to fly around. And some of these theories were fanned by Mr. Musk himself.

Musk argued that SBF was a lot better at paying the media for favorable stories than at running his company. At the time, a rumor that SBF had significant investment in Twitter also began spreading. Musk immediately debunked them by saying SBF had no shares in Twitter as a private company.

Musk also scoffed at the idea that SBF had enough liquidity to invest in the purchase of Twitter. In leaked messages with Micheal Grimes, his banker, he seemingly found it incredulous that SBF had up to $3 billion in cash. Musk then went on to claim that when he met SBF he felt his “bullshit meter redlining.” Of course, SBF was in no position to give Musk a rebuttal. He had bigger fish to fry.

4. Vitalik Buterin Vs. Michael Saylor

Michael Saylor may not be building an Ethereum killer, but that didn’t stop Buterin from clashing with him. Saylor and Buterin are two of the most important people in crypto, and one could say they are rivals in the crypto-influencing space.

However, this doesn’t mean they have any love for one another. In July 2022, Saylor granted an interview where he called Ethereum unethical because it violated fundamental securities laws.

Noted cypherpunk Michael Saylor on why Ethereum is inherently unethical because its existence violates securities laws which have their basis in the 10 commandments:

(h/t @adjtewck)https://t.co/GzhTGnPfK8— Daniel “e1c04d9987a20652018” Goldman (parody) (@DZack23) July 30, 2022

Vitalik Buterin wasn’t willing to take that comment lying down, so he quoted Saylor and gave a scathing reply. He tweeted that Saylor was a Bitcoin maximalist who also turned out to be a total clown.

5. CZ Binance Vs. OKCoin

Today, CZ is known for building the behemoth called Binance. However, what people don’t know is that CZ used to be the CTO for OKCoin in 2014. That was one of CZ’s first jobs in cryptocurrency.

Interestingly, CZ didn’t leave his job at OKCoin amicably. At first, he tendered his resignation and said he was leaving to pursue other interests. However, things got dicey during a legal tussle that OKCoin had with Roger Ver, the CEO of Bitcoin.com.

Roger Ver and OKCoin had negotiated a payment agreement over service, and CZ had been a signatory to that agreement. However, things turned on their head when another agreement that CZ hadn’t signed emerged. CZ argued that by generating another agreement, OKCoin was seriously violating its contractual obligations.

In the end, CZ made very serious allegations against OKCoin. He claimed that the company used his physical signature to conduct multiple bank transfers from bank accounts. He also confirmed that OKCoin used bots to trade on their platform and that some of these bits were assigned to pump trading volume up.

On the Flipside

- For what it’s worth, these rivalries in crypto are often driven by opposition based on ideas, not on malice. As such, these rivalries hardly ever leave Twitter.

Why You Should Care

Sometimes, rivals can reveal deep problems with business models that crypto investors should pay attention to. The plagiarism claim that Vitalik Buterin made against Justin Sun, for example, may inform traders to be wary of Tron.